“Important is to execute the plan and make money long-term”

Having a good plan and a sound strategy is very important for every trader. But ultimately it can be useless if a trader is unable to follow his own rules and have a long-term goal. Even our new traders Martin, Eng Guan, Carl and Eylul know, that quick profits are not the way to long-term and consistent profits.

Trader Martin: “Patience is the key.”

What inspires you to pursue trading?

A couple of years ago I was in New York City on a vacation and while I went to see Wall Street and the golden bull. I saw also a lot of bankers and brokers who were in a rush coming and going in some of the biggest banks in the world. It was always interesting to me how the banks are making their money, so I believe that this kind of activity inspired me to dig in and find out how deep the rabbit hole goes.

What was easier than expected during the FTMO Challenge or Verification?

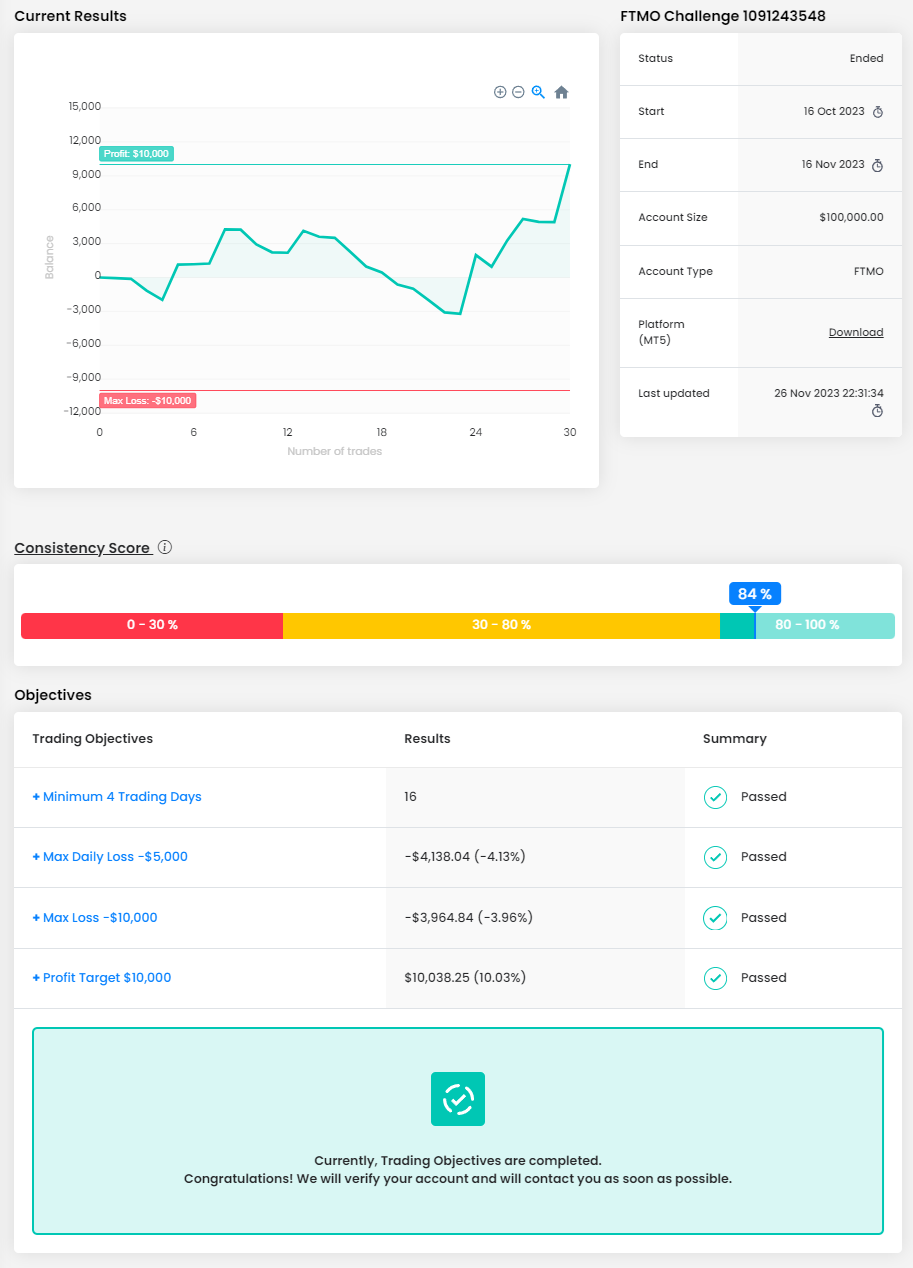

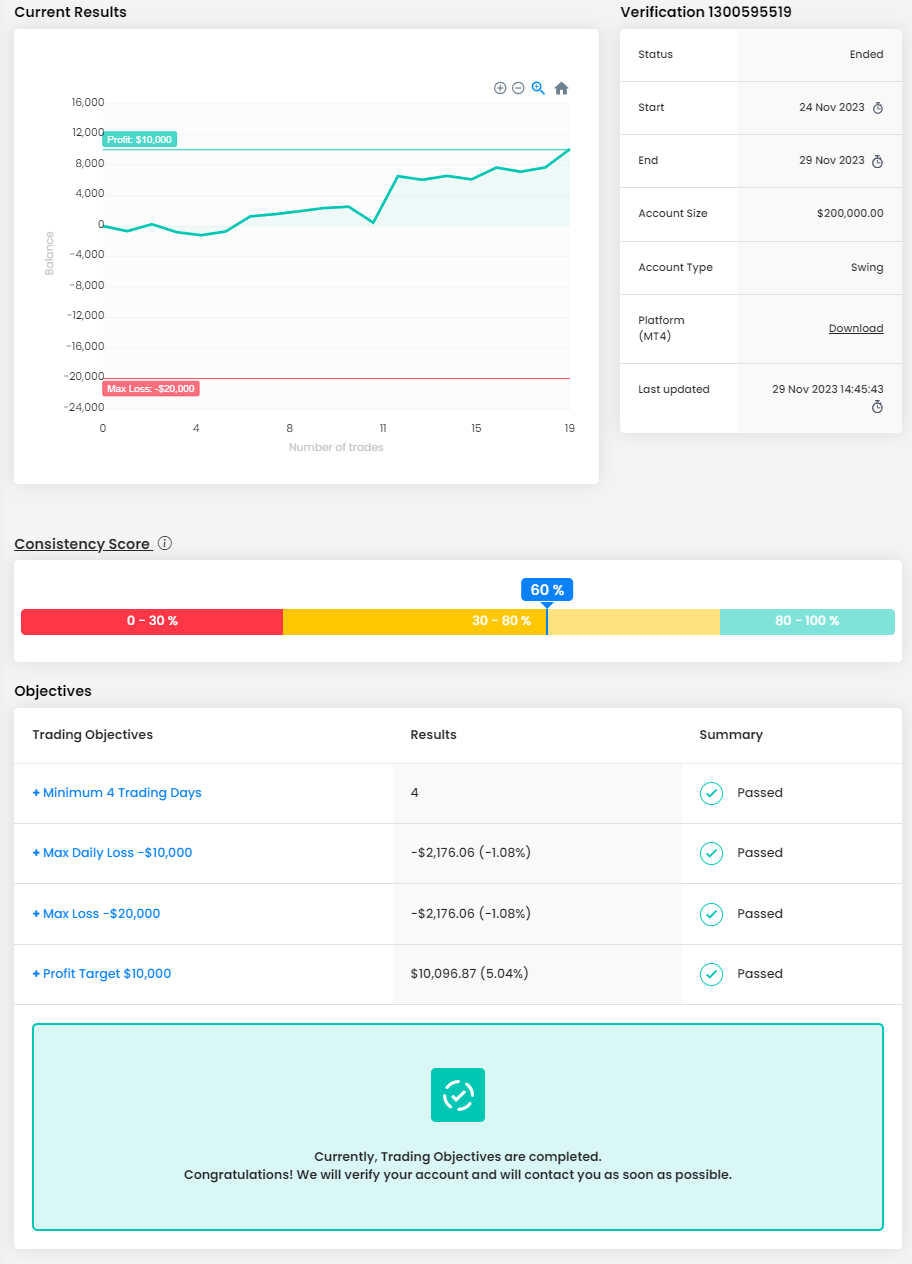

I can't really say, if one is easier than the other, of course you have just a profit target of 5% on the Verification, however, the psychology and fear really kicks in for some people, as far as I know. For me, with a proven edge and proper risk management everything is achievable, especially when companies nowadays get rid of the time period. It was really pressuring. I passed Phase 1 for 1 month, but it was really chill, not thinking about the time and whether the challenge was about to be failed, because of time. Phase 2 was done in 2 weeks, again NO PRESSURE.

How did you eliminate the factor of luck in your trading?

I never believed in luck in the first place. To answer the question, maybe I must say that our future is the reflection of our actions. Find the Strategy -> Backtest -> Forwardtest -> Live.

Has your psychology ever affected your trading plan?

I believe that 99% of the traders are going through that, but for me, it was really in the very early stages of my journey, when I had FOMO, I didn't know that the losses are part of the process, that every trader experiences drawdown and etc., but once you have found your strategy and backtested enough and found clarity and certainty in the results, knowing that in the long-term it works - there aren't any emotions included, when I sit in front of the charts. A loss - no big deal. A win - no big deal. Important is to execute the plan and make money long-term.

Describe your best trade.

Hmmmm, most of my trades are identical. Through backtesting during this year, I have a hit rate of 45% when I go 1:5RRR. I never thought that this was possible, but FXReplay is good enough software, so I trust it. I'm using an SMC-based strategy, so I really love to have a setup that has 7-8 confluences. London/NY open zone, Higher than average volume, liquidity swept by the creation of the supply/demand, imbalanced move, liquidity to target, imbalance to target, with the order flow, reaction of D/W/M volatility zones, with the lower timeframe swing range, etc.. I put my pending order, and the rest is history.

One piece of advice for people starting the FTMO Challenge now.

Patience is key. Quality over quantity.

Trader Eng Guan: “Always remember trading is not to earn the profit as quickly as possible.”

How has passing the FTMO Challenge and Verification changed your life?

Passing the FTMO Challenge and verification has given me a new perspective on how trading is possible. Even if you have a simple trading strategy. One of the most important aspects in trading is to have proper risk management. Without it, even with the best trading strategy can easily falter and cause the strategy to lose and lose your challenge.

Where have you learned about FTMO?

I have learned about FTMO from the website. When I started searching for growing a trading account by using a small capital. Through FTMO I found that I can spend a small fee, but I can earn a huge amount of profit.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most difficult fact is where I start to lose twice in a row during my training. This is where my psychology is being tested most. I start to question my strategy and whether it is still feasible to continue or not. However, with proper risk management and preference, I am able to overcome this challenge and yet able to achieve and pass the FTMO Challenge and Verification in the best possible ways.

Has your psychology ever affected your trading plan?

Definitely, it has affected my trading plan when I have lost more than twice in a row. This will always challenge and question myself on how to improve or how to break even quickly. I would say that the best advice I could give is to raise smaller when I start to lose my emotions and take my time to break even and to grow the account back.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, I can't wait to start another FTMO Challenge so that I can grow in an exponential way.

What would you like to say to other traders who are attempting the FTMO Challenge?

Do not worry about the training strategy and the profit loss ratio. It will come as long. You have correct risk management and keeping your emotions in check. Always remember trading is not to earn the profit as quickly as possible. It is a marathon, and it is to play the game how to stay in the game.

Trader Carl: “It is imperative to recognize that trading is not a get-rich-quick endeavor.”

How did you eliminate the factor of luck in your trading?

To mitigate potential risks associated with market volatility, I refrain from initiating new trades between 12:00 and 14:00 UK time, particularly during periods of significant news events such as FOMC and CPI updates. Consistently, I engage in a thorough analysis of my trading data to discern less successful periods, enabling me to refine and enhance my trading strategy.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Certainly, my future plans involve strategically expanding my capital. I aspire to participate in advanced programs, such as premium offerings, with the objective of scaling up my involvement in that domain.

Do you have a trading plan in place, and do you follow it strictly?

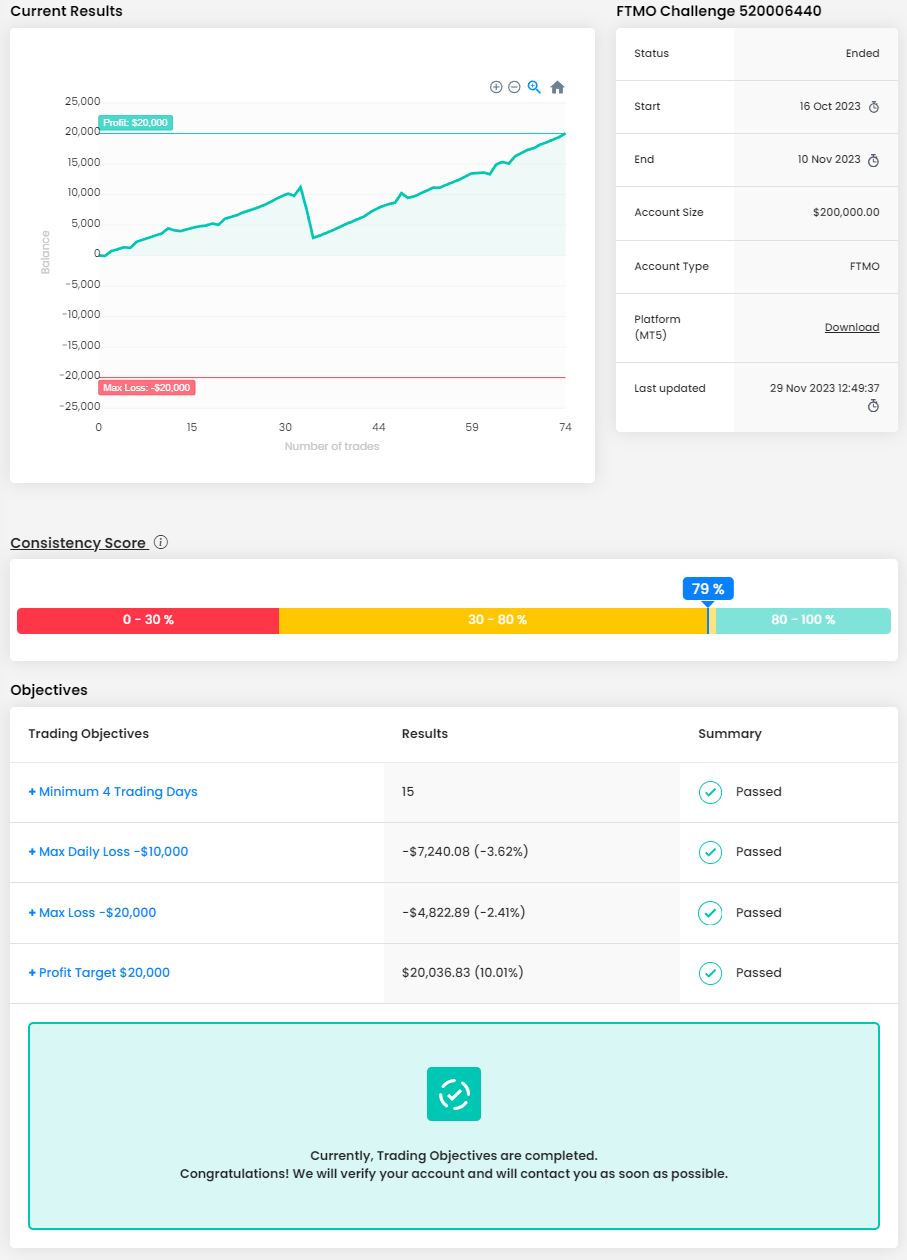

I am a trend-based trader who employs a systematic approach in identifying key components for trade entry. My analysis primarily centers on the 10-minute and 4-hour charts, seeking an average of 4 to 5 trades daily with an optimal price movement target ranging between 1 to 1.5 dollars before initiating a close. I have had multiple accounts with other prop firms where my strategy was not clear, and as a result, I failed. Having a Plan is critical to the success of trading with prop firms.

What was the hardest obstacle on your trading journey?

Experiencing a setback in the form of a financial loss can indeed have an impact on confidence, yet it is an integral aspect of the journey. It is imperative to manage losses, ensuring that they are not of a magnitude that jeopardizes the ability to recover. Importantly, the key lies in extracting valuable lessons from such setbacks. Cultivating a mindset that views losses as learning opportunities is fundamental to continuous improvement and future success in navigating the complexities of business endeavors.

What do you think is the most important characteristic/attribute to become a profitable trader?

Maintaining consistency in trading and avoiding impulsive revenge trading are paramount considerations in the financial markets. It is imperative to recognize that trading is not a get-rich-quick endeavor. Instead, a disciplined approach, characterized by a thorough understanding of a chosen strategy, is essential. It is not uncommon to witness individuals employing substantial lot sizes in pursuit of sizable profits, often driven by the misconception that trading guarantees swift financial gains. However, the prudent approach lies in identifying a strategy that aligns with one's risk tolerance and market understanding. Trading should only be executed when a well-defined opportunity emerges, and the trader possesses the confidence and conviction to act in accordance with their established plan. By adhering to a methodical and patient trading approach, traders can mitigate the risks associated with impulsivity and optimize the potential for consistent, sustainable returns over the long term.

One piece of advice for people starting the FTMO Challenge now.

Continual learning is imperative for success in trading. While perfection may not be immediate, it is essential to leverage resources such as Discord and actively engage in the community. Exercise patience, as proficiency in this field, is a gradual process that requires dedicated time and effort.

Trader Eylul: “Consistency and a patient approach will serve you well on this journey.”

What was easier than expected during the FTMO Challenge or Verification?

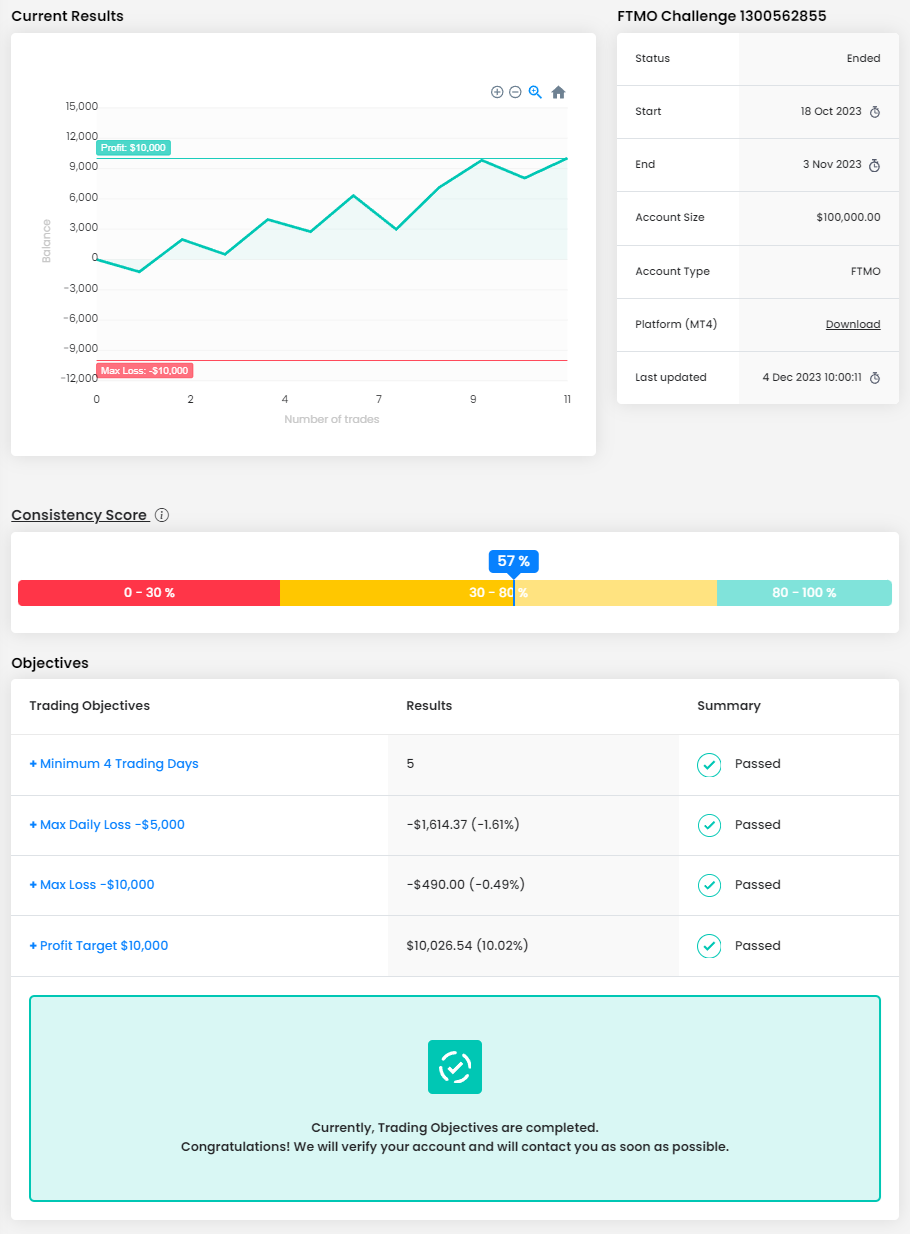

What surprised me during the FTMO Challenge was how smoothly I was able to incorporate their risk management rules into my trading approach. Having a solid foundation in risk management from my previous experience made it a seamless transition, allowing me to meet their guidelines without having to make major adjustments to my strategy.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most challenging aspect during the Challenge was managing emotions, especially when facing a drawdown. To overcome this, I implemented strict discipline, stuck to my trading plan, and regularly reviewed my performance to identify areas for improvement. This helped me stay focused and resilient during challenging market conditions.

What do you think is the most important characteristic/attribute to become a profitable trader?

Discipline is arguably the most crucial attribute for a profitable trader. Adhering to a well-defined trading plan, and managing emotions while staying consistent through various market conditions are crucial components of successful trading.

What was the hardest obstacle on your trading journey?

The most challenging obstacle on my trading journey was overcoming the initial impulse to chase profits. Learning to be patient, wait for optimal setups, and avoid impulsive decisions significantly improved my overall performance and risk management.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Absolutely, the FTMO Challenge has been a valuable experience.

What would you like to say to other traders that are attempting the FTMO Challenge?

My advice is to prioritize discipline and risk management. Stick to your trading plan, learn from each trade, and stay resilient through the ups and downs. Consistency and a patient approach will serve you well on this journey. Good luck :)

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.