“If you want to take trading seriously, you need to think long-term, not short-term”

We write about it at least once a month. Trading is not a sprint, it's a marathon. If you want to succeed in the long run, you have to think long-term. Short-term high returns may look tempting at first, but they probably won't bring you long-term success. What do our new FTMO Traders Malachi, Edward, Enrique, and Mynesha think about this?

Trader Malachi: “Trading really is a battle of yourself against yourself.”

How did loss limits affect your trading style?

It actually forced me to dig deeper into using proper risk management.

How would you rate your experience with FTMO?

Excellent so far. Every question I had, the support team answered quickly and efficiently. And it helped guide me through the process of becoming an FTMO Trader.

What inspires you to pursue trading?

Financial freedom, but not only that. It also inspired me to get to know myself better and improve myself overall. From impatience, greed, fear, discipline, etc. Trading really is a battle of yourself against yourself, and you'll definitely learn it. If not, you're going to go through the same pattern over and over again, till you break it and flourish.

What was the hardest obstacle on your trading journey?

During this Challenge, the Verification stage. Even though the profit target was less. I made a mistake instantly on the first day on the Verification and was down -4% (note* seriously be aware of upcoming high-impact news). But I made adjustments to include things to avoid in my strategy. Throughout the majority of the stage, I was in negative. From the fear of placing a trade, to being greedy, and breaking a rule. It wasn't till I really sat down and improved my strategy, really defining my edge that I was able to break through the negative drawdown to completing the Challenge. It's actually amazing that having a combination of an improved mindset and strategy you can apply can really do...

Do you have a trading plan in place, and do you follow it strictly?

Yes, I do, I kept it simple and to the point. It allows me to trade on the 1m timeframe and I don't have to sit at the computer. I can set my alerts to what I'm waiting for and go from there. My strategy overall is something I created by myself, that I can see near instantly with the combination falling into play. Also, the risk management part definitely kept me in the Challenge. I go for 1:5 RRR with a maximum drawdown of -2% a day. Also, maximum 2 trades a day to avoid over-trading. So, from one end of the spectrum, a day can be -2%. While on the other end, a day can potentially be +10%.

What is the number one piece of advice you would give to a new trader?

My number one advice is to seriously never give up! If you really want to take trading seriously, you need to think long-term and not short-term. Don't think how can I flip $100 to $100k? I'm just going to enter this trade because it's "obviously" going this direction, define your stop loss AND take profit. The list goes on and on. I believe you should definitely sit down, look at the charts, and determine what direction you want to go. (Do you want to sit at the computer for hours focused? Do you only want to trade on a higher timeframe? etc.) Then scale in, personally I only trade 1 pair. (Do you want to trade only 1 pair? 2-3? or a lot?). Continue to scale in, all these indicators, patterns, and price action are all tools for your strategy that you have to develop yourself. Really see how each tool can help you, and how it can be applied. And seriously, keep it simple. It doesn't have to be rocket science. It can literally be as simple as only entering a buy when such and such happens. That in combination with RRR, Daily Drawdown, etc will definitely help you achieve your goal. And the last point of advice, TAKE CARE OF YOURSELF! Trading is you against yourself. Don't beat yourself up, there will be winning trades and losing trades, it's all part of the process. Meditation, Reading, exercising, etc will definitely steer you in the right direction for your Trading career and life. You got this.

Trader Edward: “Tomorrow is another day.”

Describe your best trade.

I think my best trade during the FTMO Challenge was when I learned something new and was able to put it into practice by being patient and following the rules, leading to a winning trade. It wasn't about how much profit, instead it was about growth as a trader.

How did passing the FTMO Challenge and Verification change your life?

I'm hoping to eventually give up my day job and trade full-time, but first, it's about clearing debts and reducing the financial burden.

What do you think is the key to long-term success in trading?

Patience. Let the trades come to you. You don't have to trade every day, by taking only the trades that your strategy is confident in will make you successful over time.

What was more difficult than expected during your FTMO Challenge or Verification?

For me personally, it was trying to trade around my current job. I work 12hr shifts, nights and days, so it was difficult for me with the 30-day limit on the first part, I had to use the 14-day extension and still just about made it. The other part of that was the profit target, which adds another level of urgency. It put a lot of pressure on me to get winning trades on the days when I could get to my pc to trade.

How did you manage your emotions when you were in a losing trade?

Nobody likes to lose, but I would just tell myself that more trades will come along and that it's all part of trading. Tomorrow is another day.

One piece of advice for people starting the FTMO Challenge now.

I would say, make sure you have a good strategy. If it's a new strategy for you to test it first with the free 14-day trials provided by FTMO. Also, make sure you have the time to trade, some trading days will be slow, possibly with no trades depending on your strategy.

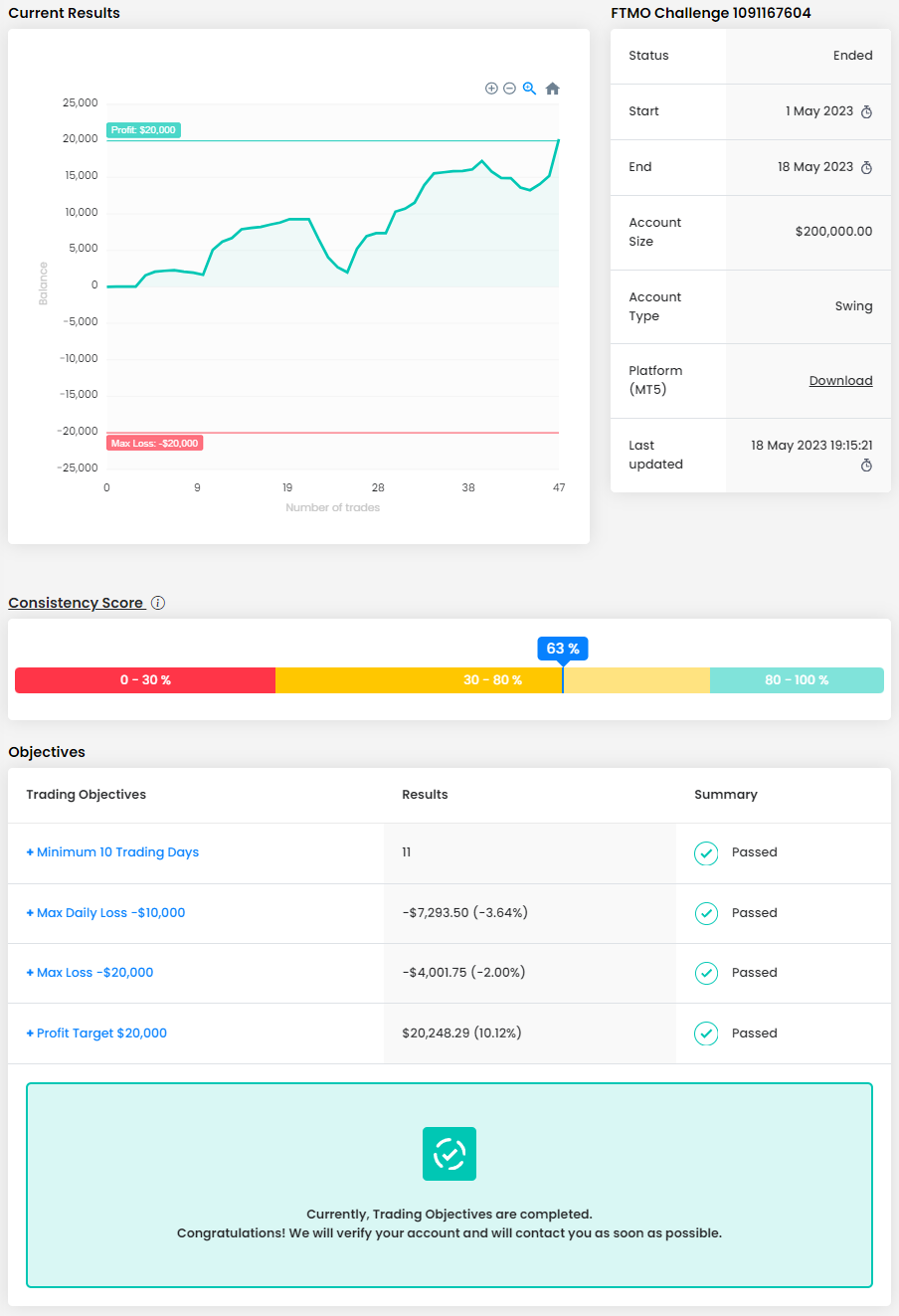

Trader Enrique: “FTMO could change my life, but that will depend solely on me.”

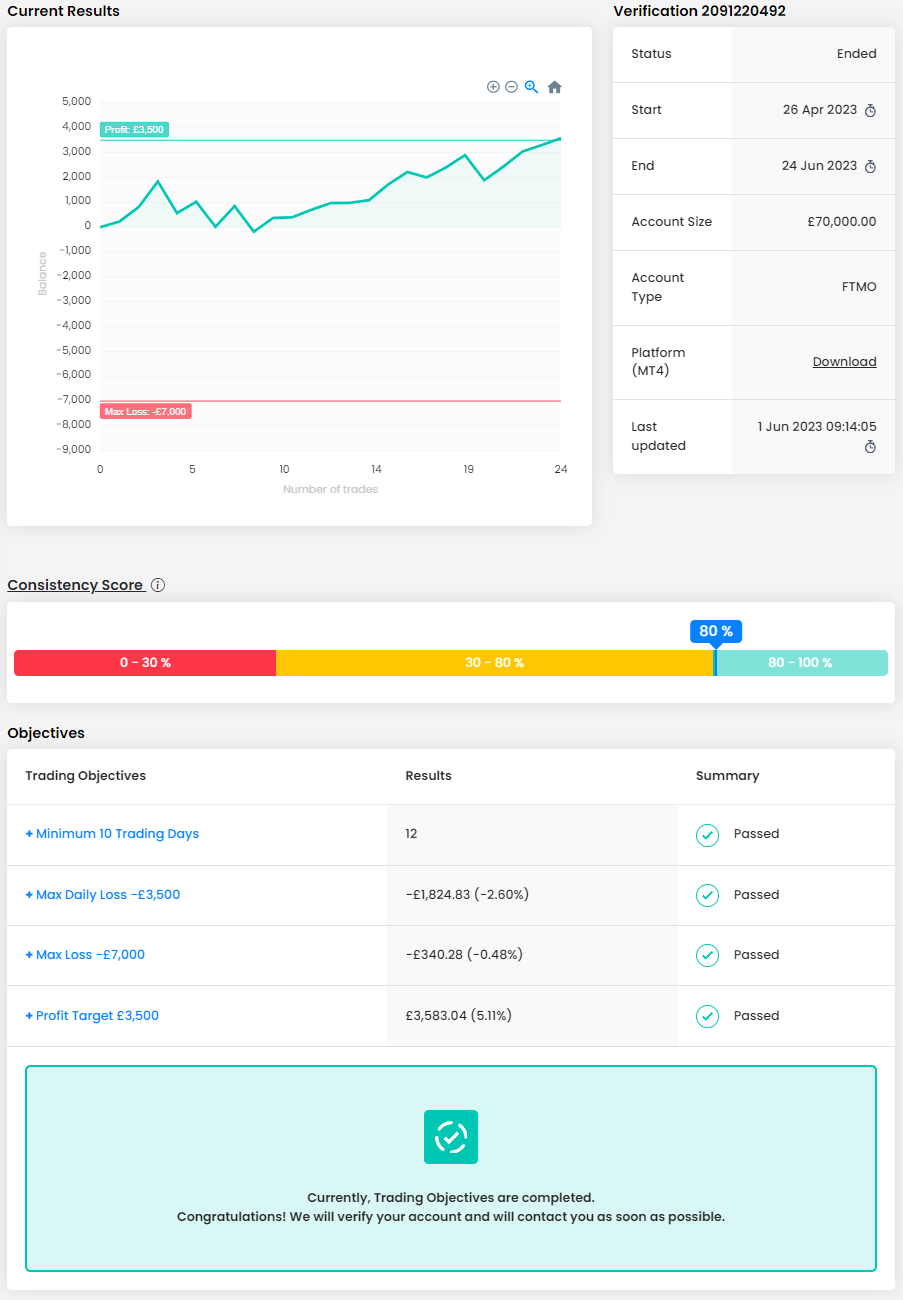

What was more difficult than expected during your FTMO Challenge or Verification?

The most challenging aspect of the FTMO Challenge phase was the deadline of 30 days, which somehow forces you to overtrade to meet the 10% objective.

What was easier than expected during the FTMO Challenge or Verification?

The limits of $10.000 (daily drawdown) and of $20.000 (maximum drawdown), allow you to trade with large lot sizes, which becomes very profitable when the market shows a strong and steady direction.

Do you have a trading plan in place, and do you follow it strictly?

I have a trading plan in place, which consists of determining the direction bias for the week, then entering the market near the top/bottom of the week, and exiting once a reasonable target has been met. This is my trading plan, which I have not followed to the letter during the FTMO Challenge phase, due to the time limit constraints to reach 10%.

How did passing the FTMO Challenge and Verification change your life?

So far, it has not changed my life. This is just the first step towards a new professional activity. If I am able to be consistent and rigorous with my trading plan, then it is my belief that FTMO could change my life, but that will depend solely on me.

What does your risk management plan look like?

First, I analyse the price behaviour during the current week to try to determine the market bias for the following week. If my analysis is correct, I would expect to be on the right side of the market around 70% of the time. This gives me the confidence to risk around 2% per trade, not by taking large lot sizes on every trade, but by setting a Stop Loss which is distant from the entry price, and which should not be reached. If I realize that I have mistaken the direction of the market, then I don't wait for the Stop Loss to be reached, as I normally would close my trade around 1/2 the distance. This translates into an expected risk of 1% in practice. If I lose more than 1,5% in total, then I cut my trade size in half in the next trade, until I am able to recover the latest capital that I had. And most important (which sometimes is hard to implement) is to avoid at all costs the temptation to do revenge trading after you have encountered one or more losses.

What would you like to say to other traders that are attempting an FTMO Challenge?

I would say, never try the Challenge until you have a clear understanding of 5 vital points, these are: are you a buyer or a seller (and WHY), when and at what price level should I enter a trade, when and at what price level should I exit a trade, how much capital in total should I risk at any giving time, and lastly, what to do (how to behave) once you encounter one or multiple losses.

Trader Mynesha: “Knowing the market can only move three things: increase, decrease, or consolidate has helped me concentrate and execute trades with little anxiety.”

Do you have a trading plan in place, and do you follow it strictly?

I do have a trading plan in place, and I follow it for entries in the market very strictly. I do not follow it as strictly for taking profit or closing trades. I also use the FTMO guidelines to maintain a healthy balance of drawdown and Daily and Maximum Losses.

How did you manage your emotions when you were in a losing trade?

By occupying myself with other items for the day to concentrate on and trusting my capability on what I've seen in the market. I balance what I see with news, releases, and market reports.

Has your psychology ever affected your trading plan?

Yes, three years ago when I first was introduced to investing, I had an unhealthy mindset. I thought every trade was supposed to get me rich, fast. After three years of studying, backtesting, and forming analysis, I realize that the market, while a tool for revenue generation is a symbolic representation of real life. It goes up, it goes down and it sits still. Knowing the market can only move three things: increase, decrease, or consolidate has helped me concentrate and execute trades with little anxiety.

How did loss limits affect your trading style?

It helped me perfect my entries into the market more precisely.

How would you rate your experience with FTMO?

I am becoming a more mature trader. Meaning I have developed much-needed patience- the kind required to day trade and wait for big market moves. I could not be more grateful to the folks at FTMO for providing the platform and opportunity. I appreciate so much how the metrics update in real-time. There is no way a patient professional trader can prove unsuccessful in FTMO Challenges, Verifications or FTMO Accounts, because of the real-time, updated metrics. I also appreciate simultaneously having more than one account open with the prospect of combining them to make greater future profits. May you all continue to transform the lives of so many people through this opportunity. It is a quality experience that helps traders feel prepared!

What is the number one piece of advice you would give to a new trader?

STAY with it. Don't play with it. This is an opportunity of a lifetime and prop investment firms are helping shrink the racial wealth gap across the globe.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.