How will the US presidential election affect financial markets?

The US presidential election is one of the world's most widely watched events, but this year is very specific in many ways and is attracting much more attention around the world than usual. How might the outcome of the US election affect financial markets?

The US is still one of the world's largest economies and is a power that has a fairly significant influence on financial markets (and not only financial markets) around the world. The presidential elections every four years are a very specific event that attracts the attention of all investors. This year, moreover, the campaign is extremely heated with emotion and the level of misinformation and attacks by both sides on their opponents is disproportionately high. At the same time, it is possible that the final results, as in the last election in 2020, will be known with a considerable delay.

In any case, how the election turns out is not in our hands, so we'll leave that to the voters and look more at how the election results might affect what happens in the financial markets and how it has looked in the past. At the same time, it is important to keep in mind that elections are not the only, or even a very strong, factor that has a long-term effect on what happens in financial markets. Overall, the influence of politics and elections is thought to be much stronger in emerging economies. Historical records and average results need to be taken with a grain of salt and put in the context of the times.

What can we expect

In addition to the election of the President himself, there will be other federal, state and local elections, as well as elections for the House of Representatives and the Senate. The House of Representatives elects 435 members every two years, and one-third of the Senators (34 this year) are elected every two years as well. It is important to remember that, although the President has a strong voice, the support of the Senate and the House of Representatives is also very important. This is because it is the latter that decides whether the laws and initiatives that presidential candidates are so fond of talking about before elections can be enforced. At present, the Republicans have a narrow majority in the House and the Democrats have a majority in the Senate, helped by the votes of independent senators and the possibility of Vice-President Harris making a decision in the event of a tie.

Of course, all states are up for election (with each having a different number of so-called electors), but given the US electoral system and historical and demographic trends, it is expected that the results in some states are "virtually certain" and the deciding factor will be the so-called "swing states" (Wisconsin, Michigan and Pennsylvania, North Carolina, Nevada, Arizona and Georgia), where both candidates can win. Together with the results of the Senate and House elections, several scenarios may then emerge which may have different effects on the direction of the US economy, as well as on investors' perceptions of the financial markets.

Blue or red wave?

Extreme cases where the candidate of the party that controls both houses of the US Congress wins the election are unlikely. A blue wave means that Kamala Harris will become president and the Democrats will control both the Senate and the House, while a red wave will mean that Donald Trump will become president and the Republicans will control both houses of Congress. However, it is much more likely that Congress will be divided or that the party whose candidate lost will have a majority in Congress. At the moment, the odds are more likely that the Senate could be won by the Republicans, and the Democrats are doing everything they can to win the House.

What about the markets?

Interestingly, although the candidates appear to be very different in many sectors of the economy and politics, in reality the differences between the two candidates in many areas are quite small. For example, on fiscal policy, both candidates will continue to increase government spending if they win, but there are differences on tax policy, where Trump, for example, promises to further cut taxes for businesses (from 21% to 20%), while Harris wants to raise corporate taxes to 28%. There are also relatively small differences on tariff policy, where a return to a free trade policy is not expected, and Trump would likely increase current tariffs, especially on trade with China. On the face of it, there are large differences in areas such as healthcare, immigration, foreign policy or the environment, but these topics do not have a large impact on markets. Thus, regulation may have a big impact on markets, with Trump in particular likely to bet on across-the-board deregulation in many sectors.

Thus, it is widely expected that Trump's victory in the election will have an immediate positive effect on stock markets, even if Congress is divided or the Democrats manage to control both houses of Congress. However, given how the stock markets have fared under President Biden, even the election of Harris might not necessarily lead to a sell-off, but the chances of a market decline are greater. From a sectoral perspective, the energy sector would be expected to benefit from a Trump victory and a Harris victory is unlikely to bring positive points for it, as would, for example, the healthcare sector. Given the stance on regulation, a Trump victory may also help the banking sector, for example. Also, the US dollar would probably be most helped by a Donald Trump victory, while the worst-case scenario would be the uncertainty associated with one party ruling Congress and the other ruling the White House.

What history tells us

It is generally believed that stock markets rise after elections, and it doesn't matter if the Democratic or Republican candidate wins. Because of the uncertainty in the markets before the election about what will happen after the election, increased volatility has occurred in the markets before the election itself, but after the election, the markets have generally risen one to two percent, which is plenty.

According to data from strategists at Fidelity, U.S. equities have posted an average gain of 9.1% in the year before the election (the 12-month period from the end of November to the end of November) since 1950, but that's not a big surprise given that U.S. equity markets have been rising for a long time. However, the figure below also shows that the dispersion of results is greatest compared to other years of the US presidential cycle, which supports the potential for uncertainty and volatility (although this year volatility has not been much of a factor).

Source: Fidelity

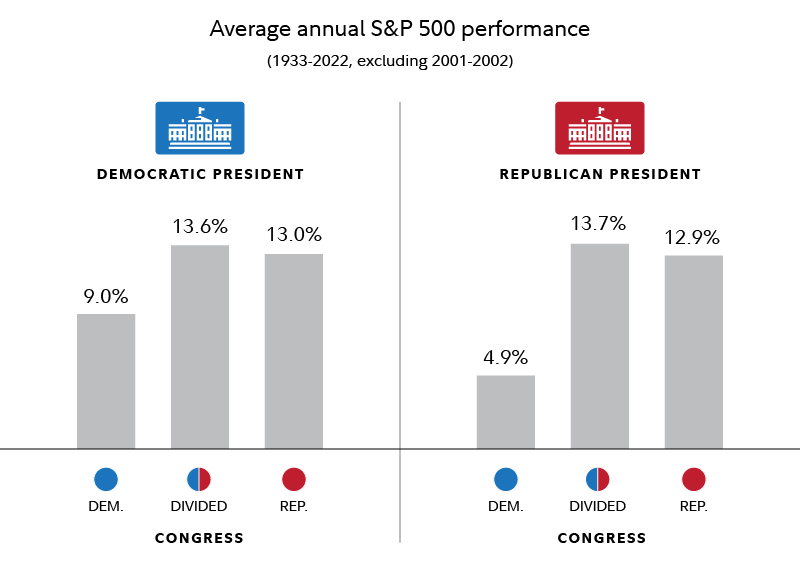

The next chart from Fidelity then shows what we mentioned, that the markets themselves don't care who is president, they do similarly under Republicans and Democrats. Rather surprisingly, stocks have done best when Congress has been divided.

Source: Fidelity

Historically, in the years following an election, stocks have done much better when a president from the same party has been re-elected. This is probably related to the fact that there are no major changes in the economy or politics, making market and economic developments more predictable.

Source: Duncan Financial Group

What to take from all this information? Equity investors (regardless of whether it is an election year) should focus on long-term goals and not worry about market timing based on election results. Markets may experience volatility, but it should not be a barrier to long-term returns. Short-term traders, on the other hand, can take advantage of volatility in the markets, but should adjust their exit strategy or money management and their Stop Losses to avoid losing their trading account unnecessarily in the pursuit of quick profits. Trade safely.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?