“Have your ducks in a row”

Before you want to make money in forex, you will need to sort out and prioritize your goals and be consistent and disciplined enough. A methodical approach and constant education is the foundation of successful trading and today our new traders Akousa, Lando, Brandon and Manie know it too.

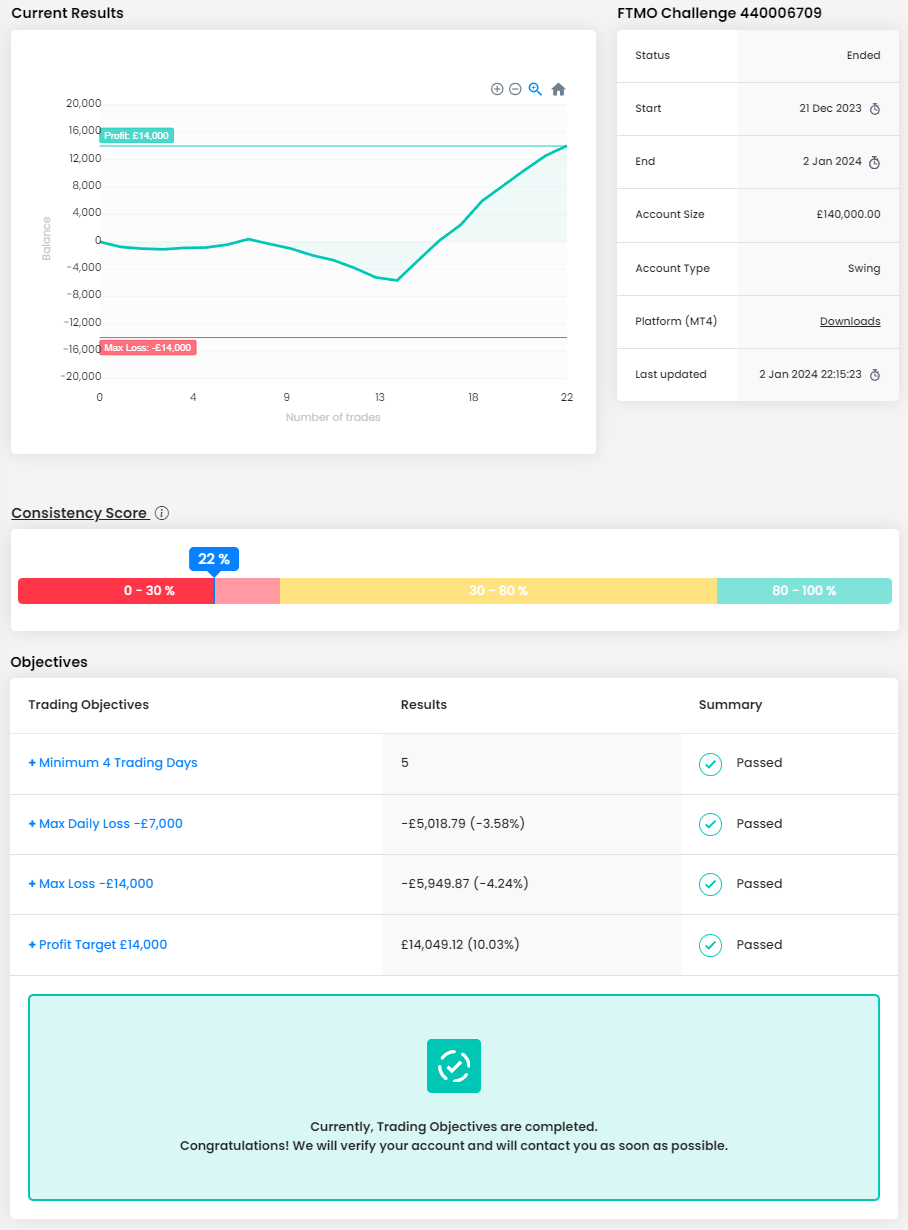

Trader Akosua: “One thing I have learnt on this trading journey is accepting losses.”

What was the most difficult during your FTMO Challenge or Verification, and how did you overcome it?

I did not actually find the Challenge or Verification stages too difficult, mainly due to the fact that I stuck firmly to my risk management plan.

How did you manage your emotions when you were in a losing trade?

One thing I have learnt on this trading journey is accepting losses. Given I stuck rigidly to my risk management plan, any losses that I made during this period were not ‘painful’. By sticking with the plan, I found any losses that I made were within the realm of what I was happy to lose. This kept my emotions in check.

What do you think is the key for long term success in trading?

Long term success in trading depends heavily on the management of risk. After trading for a number of years, I realised that managing the risk is what gives you longevity and preserves your capital. In my early trading days, I thought knowing which direction the prices were going was the most important thing. But I realised along the way that there are other aspects of the trade that are also very important. For example, getting better entry positions, managing the risk, knowing when to take profit.

Where have you learnt about FTMO?

I learnt about FTMO through word of mouth. A friend of mine thought it was an investment opportunity. When I researched the company, I realised it was actually a prop firm, and it looked like something I could do given I had some trading experience.

Has your psychology ever affected your trading plan?

In the early days, my psychology was all over the place. Although I never wanted to give up completely, it could be extremely painful and stressful. Then I read a really good book about the psychology of trading, I felt like that was the last piece of the puzzle. This book really underpinned the importance of my risk management system. It was then I realised that rigid risk management will eliminate negative trading psychology.

What would you like to say to other traders that are attempting the FTMO Challenge?

If I was a trading teacher, I would probably teach risk management as the first module ha-ha…. If you are serious about trading long term, this is probably the most important aspect of the challenge. Don’t give up, manage your risk, take your time and be persistent. You will be great, you will make it!!!

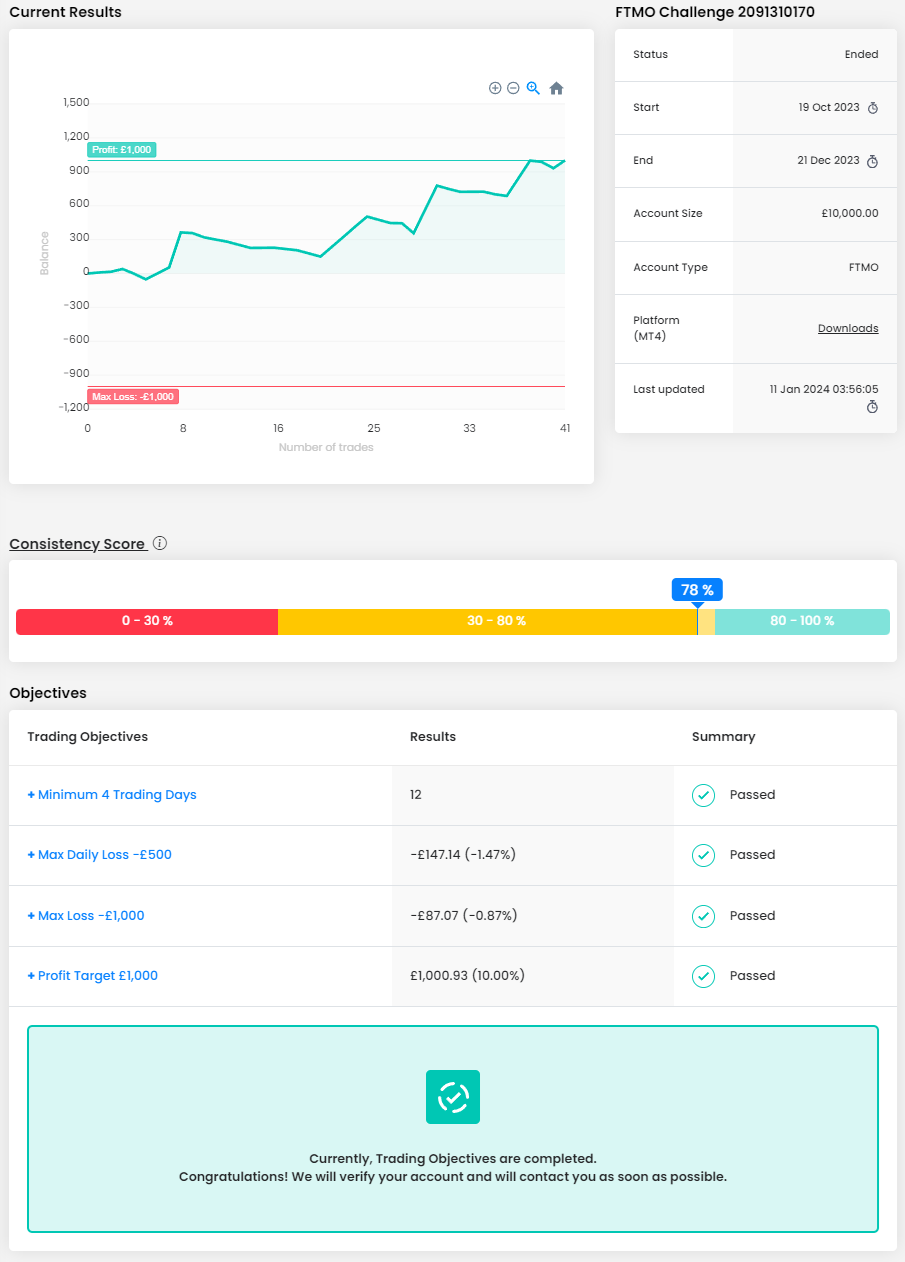

Trader Lando: “Stay focused on risk management.”

What inspires you to pursue trading?

I am inspired to pursue trading because it is a truly unlimited way to gain and grow your wealth. No limits in terms of hours that you can put in and money that you can make at any hour of the day wherever you choose to be. If you want to make more money, however, you do not need to put in a lot more time every day, but give things more time as the longer and more consistent you are the more you will eventually make. While if you say give your job more time you may start out at one pay grade and 10/15/20 years later you may only be making 10-20% more than where you started, if even that much in many cases.

How has passing the FTMO Challenge and Verification changed your life?

It has changed my life because with the income I will be able to generate I will be able to fully pursue my other entrepreneurial ambitions without having to lose time by committing to a job that would not have given me the opportunity the money FTMO can and will bring in.

Where have you learnt about FTMO?

I first learned about FTMO in 2018 when seeking out ways to have more capital or maybe work for a trading company online, but at that time it was not very popular, so I did not do further investigations into it. I then reconsidered doing so in 2020 after hearing of others success with the platform through social media.

Do you have a trading plan in place, and are you strictly following it?

Yes. I have a simple trading plan that I follow strictly that is mainly based around risk management, fundamentals and highly technical as well with the intentions to fully integrate sentimental analysis in a big way once I have fully compiled a research study that I have been working on.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes. I plan on doing more challenges to increase the money that I have with FTMO to get to the max challenge allocation level, and then slowly but surely get to the $2 million mark.

What is the number one advice you would give to a new trader?

My number one advice to a new trader would be to stay focused on risk management. No matter how good or even how bad you are, once you have good risk management and can keep an account alive, you will never go broke in trading. You will fund accounts less, do less challenges after even having a funded account already and have more peace of mind because the less you lose, the less you have to make to cover your losses as well. The gains are great, but if you can limit your losses, your account can only go up instead of down. With all of that said, still find a way to focus on trading to win and not trading to not lose.

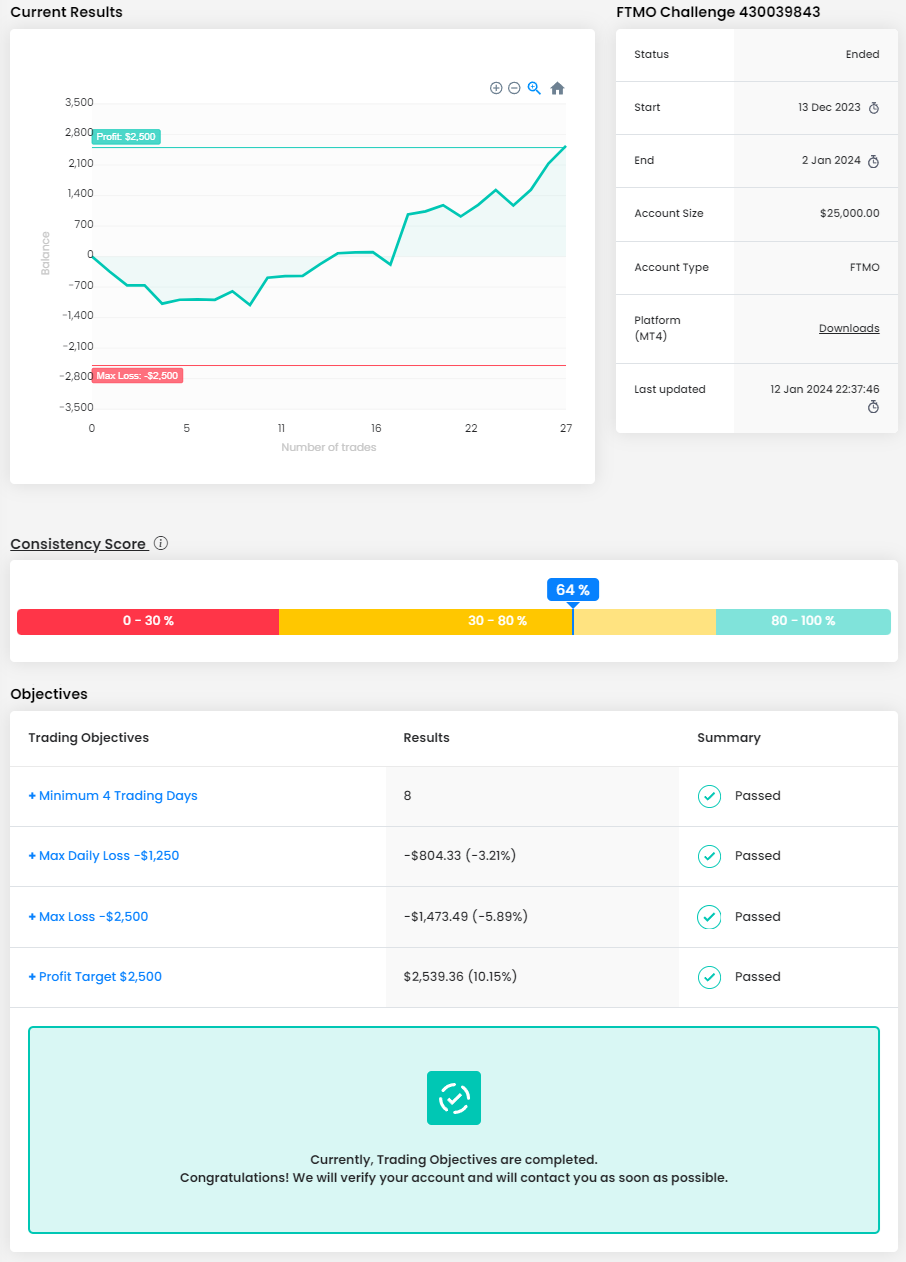

Trader Brandon: “Continue to work on yourself and master this skill, it will pay off in the long run.”

What inspires you to pursue trading?

The ability to obtain financial freedom and work anywhere in the world, as well as a steady source of passive income that would enable me to make money even in my sleep.

What was the hardest obstacle on your trading journey?

The hardest obstacle on my journey was managing my emotions and being consistent. I knew my strategy worked perfectly, and my setups were valid, often my entries would have little to no drawdown, however due to the lack of self-control I had over my emotions, it would cause me to abandon my trading plan to trade out of emotion, leading to many losses and many blown accounts.

How did loss limits affect your trading style?

It forced me to take a conservative approach with my risk, as losing 5% in a day or 10% total would mean the breach of the loss limit, and the termination of the FTMO challenge. Therefore, I would try to only risk a maximum of 1-2% on every trade, as well as only taking high quality setups, reducing the total overall number of trades taken.

Has your psychology ever affected your trading plan?

Absolutely, psychology is arguably the most important aspect in trading as it can influence you to trade outside of your plan. Emotions such as fear and greed are severely detrimental to your trading plan, as it can cause you to overleverage or take low quality setups. I (and every other trader I'm sure) have taken unnecessary losses due to "revenge" trading, or FOMO (fear of missing out) on a trade. A great trader follows their trading plan strictly and does not allow emotion to sway them, no matter if they are in drawdown or floating in profits.

Where have you learnt about FTMO?

I learned about FTMO in 2019, around the time I started trading. FTMO was one of the first, and most renowned prop firms in the industry, and was well-known for being a great starting place for experienced traders to gain capital as well as improve their trading skills.

One piece of advice for people starting the FTMO Challenge now.

My piece of advice to other traders who are ready to take the challenge is to master your psychology and emotions first. It does not matter how good your strategy is, if you cannot follow your trading plan, you will not be consistent in the markets. I failed many times to get to this point, but I never gave up. Continue to work on yourself and master this skill, it will pay off in the long run.

Trader Manie: “I eliminated luck by reducing my level of discretion with every trade.”

What do you think is the most important characteristic/attribute to become a profitable trader?

Consistency. As a trader, once I made sure to focus on consistency has made me disciplined, meticulous with my work, and profitable.

What do you think is the key for long term success in trading?

The key for long term success aside from consistency is accepting the reality of the industry that you work in. Once you take that into consideration, you can truly have the patience to play the long game in trading with your education, growth, and success. I didn't care if I succeeded in 1 year or 15 years. I love the craft of trading and the industry, and I was prepared to put in the work to get there. That mindset made me successful.

How did you eliminate the factor of luck in your trading?

I eliminated luck by reducing my level of discretion with every trade. Staying away from opinion-based trading and more focused on what my trade plan says to do. Making sure to have a solid trade plan that I can do step by step also made a big difference.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Absolutely! I hope to one day grow with this company and hit Max allocation and maybe even work at a trading desk someday!

How did loss limits affect your trading style?

It was great for my trading style! It helped to reign me and be more conservative, consistent, and exact with my trading. It also helped me make my risk management parameters into an exact science.

One piece of advice for people starting the FTMO Challenge now.

Have your ducks in a row. You should be tracking yourself and studying your data like you're a school subject. Don't give up and make it part of your lifestyle in your routine. Trading for me feels like brushing my teeth. Find your groove and be methodical and strict about your consistency, and you'll get there.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.