FTMO Traders discuss their trading

Cut out the noise on social media and learn about random distribution. That's what our new FTMO Traders say in their interviews. Be inspired by their trading and the FTMO journey.

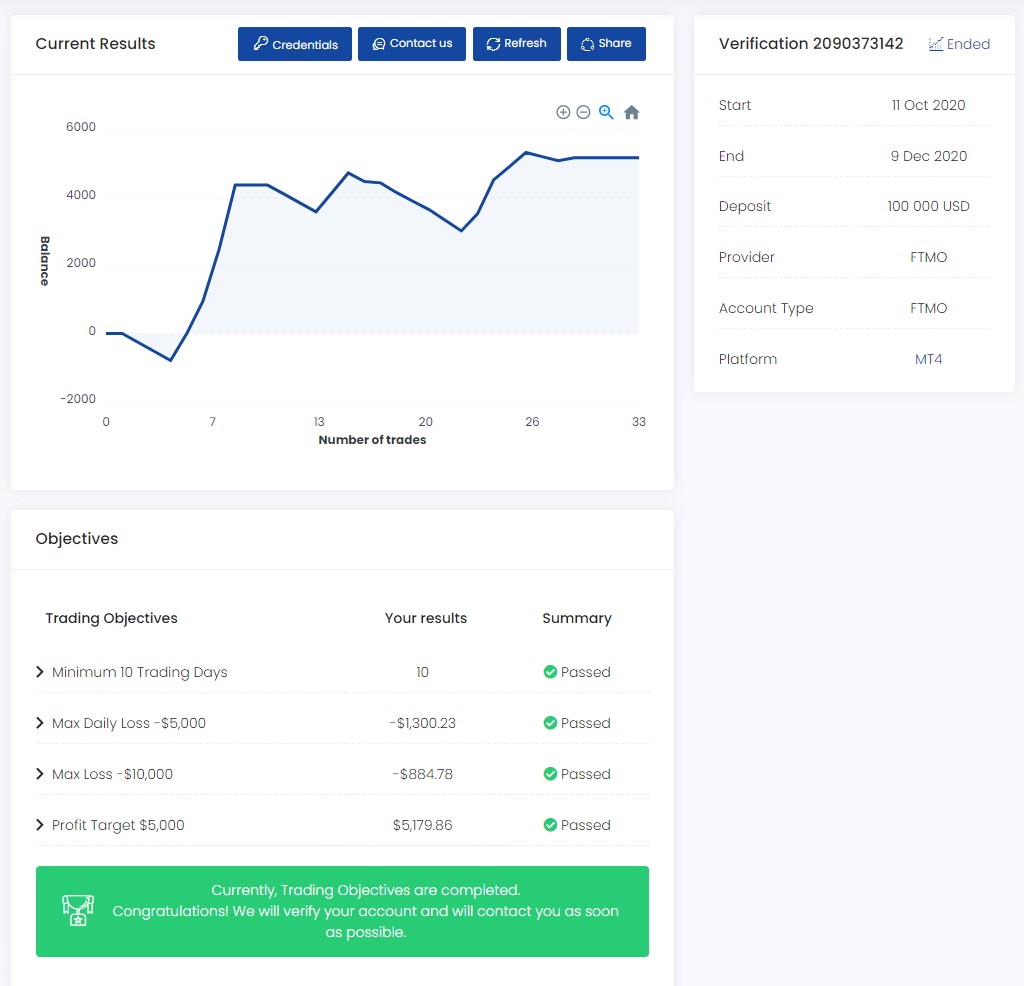

Trader Yasin - there will always be opportunities in the market

How did you manage your emotions when you were in a losing trade?

My emotions were intact when I was in a losing trade because my r:r was good, also I did not risk more than 0.25% per trade. I would not get emotional or let the bad trade get to me. I would be patient and look for the next opportunity because 1 good scenario was all I needed to get my losses back and go into profit.

Do you plan to take another FTMO Challenge to manage even bigger capital?

My plan is to take this first account and build some capital with it and once I do that I will reinvest it into another challenge. The aim for me is to go for the three accounts of 100k.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I do have a trading plan, I follow it strictly because I know every time I go off the plan my trades are not good and i worry too much about the trades. If i take the trades using my trading plan I am more confident.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

I would say the FTMO Challenge because the first 2 weeks of FTMO Challenge I was ill in that period so I was unable to trade, this made it harder for me but I knew if I stuck to my plan and just been patient for the correct setups I can accomplish it.

How did Maximum loss limits affect your trading style?

I don't think it affected my trading style because in my plan. My risk was 0.25% per trade and i wouldn't take more then 4-5 trades per day. The maximum loss limits didnt affect me as much as i though it would.

One piece of advice for people starting the FTMO Challenge now.

Trust your plan and be patient, there will always be opportunities in the market.

Trader Paweł - think about the quality of decisions you make

Do you have a trading plan in place, and do you follow it strictly?

I do and I follow it.

What do you think is the key for long term success in trading?

Managing risk so you can survive any drawdown.

Understanding that once you have a positive expectancy strategy in place achieving success is taking another trade.

I would suggest not thinking about the outcome of any single trade as winners or a loser.

Rather think about the quality of decisions you make. If it's a high-quality decision, that's all good, no matter the result of the trade.

If for some reason it's a bad decision then learn from that and improve your edge.

True edge plays out when you take many trades and you are able to survive any drawdown that may happen.

It's like tossing a coin that is biased towards your bet. You can lose any single toss but in the long run, you win. And winning, in the long run, is the only possible way to win in trading.

How would you rate your experience with FTMO?

Very good.

How does your risk management plan look like?

For the challenge, it has been 1% of the initial capital per trade.

For the FTMO account, I'll first build a buffer to make sure I can survive a drawdown of 19R, and then I'll be trading 1% of initial capital. Drawdown that big should never happen with my strategy, but I prefer to be defensive and be sure I can stay in the game no matter what.

How did you eliminate the factor of luck in your trading?

You can't do it for any single trade, but you can do it over large sample size. I put in the work: - I prepare my trading plan every morning - I end each day doing an overview of what happened in the market, how it was trading, judge quality of my decision, log trades and lessons learned - I focus on a single market at a time (DAX), and two markets in total (DAX and SPX) - I go through the charts and my journal every weekend to refresh what I had learned during the week - I set a goal for each session which most often is eliminating a mistake (like taking profit too soon) or getting better at something (like staying focused longer) - I make sure I recover well. Except for occasionally watching a movie, I'm trying to stay away from screens for any non-work-related reasons. I play sports and take care of nutrition.

What would you like to say to other traders that are attempting the FTMO Challenge?

Be sure that you have a profitable strategy and take the bet that you can execute it during the Challenge.

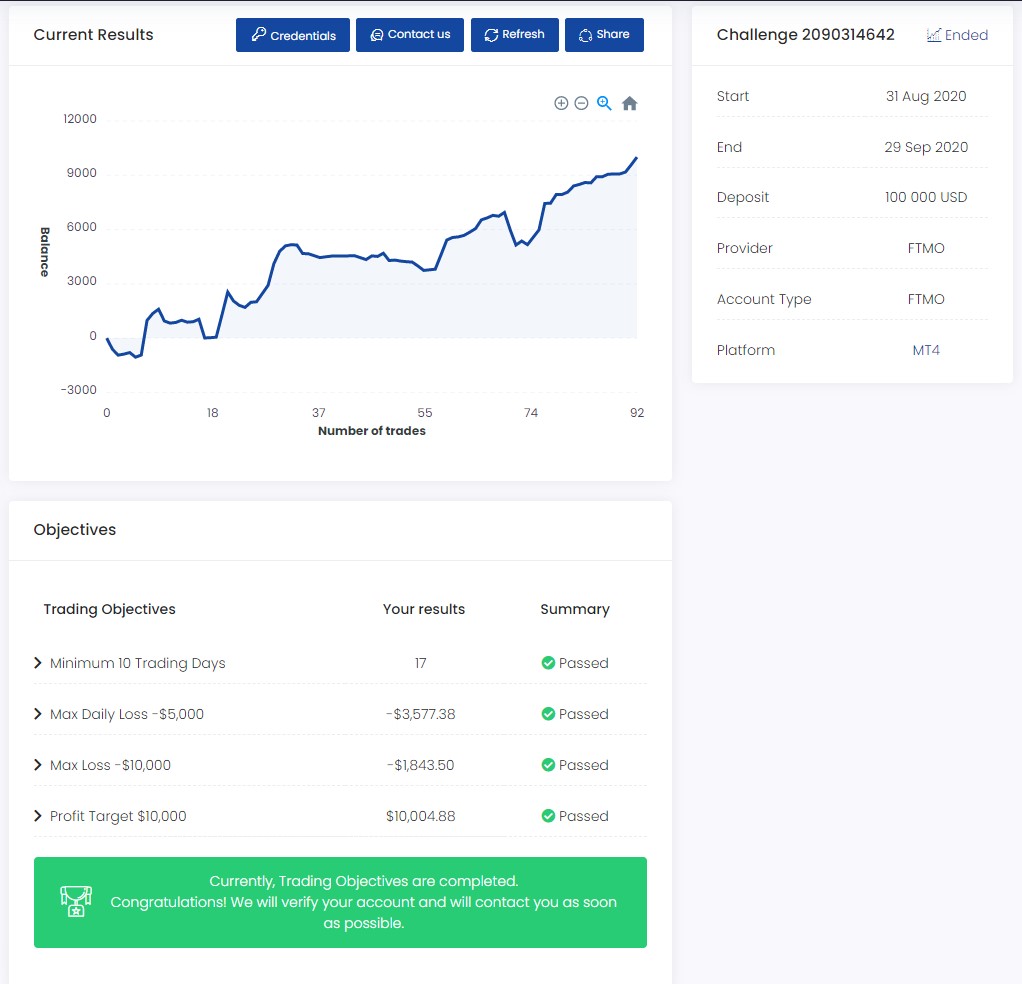

Trader Brian - cut out the noise on social media

How would you rate your experience with FTMO?

I've had a pretty good overall experience with FTMO's platform and their customer support. My performance on the challenge and verification stages came with some bumps in the road, but with perseverance and discipline, I was finally able to pass! My first attempt started the same week of the global shutdowns in March due to covid19 and that challenge attempt didn't go as planned to say the least. Never the less, after a few more attempts and with the market volatility calming down in some capacity throughout the summer, I was finally able to have my breakthrough. Customer support has been stellar throughout my whole process and they are on point in responding first thing the next business day. Great experience for me so far and highly recommended for all traders looking to have some additional capital!

Do you have a trading plan in place, and do you follow it strictly?

I have been able to develop a pretty strong trading plan for myself that is tailored to me and my time zone here on the west coast of the U.S. I work on keeping my position sizing consistent and limiting the amount of risk in play at one time. I have been able to dial in the particular times of the New York/London session that have given me consistency and been able to have a routine to where I'm still able to enjoy the rest of my day and organize other non-trading activities. In detail, I wake up early during the week to gauge the sentiment from the previous sessions and analyze the futures numbers before the New York open to get an overall feel. I already have pairs in mind from my weekend prep and previous day prep so I know what I'm looking to trade. From there, I simply use a 20 EMA, reversion to mean analysis, some core patterns for context, and pivot points where price has seen lots of reactions.

Where have you learnt about FTMO?

I heard about FTMO through multiple trading podcasts.

Has your psychology ever affected your trading plan?

Oh yeah psychology is always in play every trading day, but dialing down the specific times of the trading day and realizing that I don't have to trade all sessions to be profitable has helped minimize the negative psychological effects. Another big action I took that has helped me tremendously was unfollowing the majority of trading pages on all social media platforms. That exposure over time became a nuisance to my own way I saw and traded the market. Granted, they had their time and place at the beginning of my trading career, but overtime it started to turn into noise rather than useful information.

How does your risk management plan look like?

I'm strict on maintaining consistent position sizing for all positions. More than not, I'll close all positions before the end of the trading day here in the U.S. to avoid any sudden breaking news or events during the Tokyo and early London sessions. This particular action has helped with me to carry on with the rest of my day stress free and be able to have a daily life balance. If I hit a daily loss in the 1.5-2% range then I'll cut it off for the day. To top it off, I don't trade more than 2 pairs at a time to limit my exposure.

One piece of advice for people starting the FTMO Challenge now.

Never give up, find a balance between trading and regular life activities, cut out the noise on social media, maintain strict risk management guidelines, find pairs that work the best to the times of the trading session that work best for yourself, and plainly just believe in yourself.

Trader Diego - Learn about random distribution

What was more difficult than expected during your FTMO Challenge or Verification?

Not trying to rush the process. I know it's a common one, but also the most dangerous one. It is something you should be watching out for.

How did you manage your emotions when you were in a losing trade?

For me every trade was the same, a loss or win both come down to a positive return in the long-term. I do not get disturbed by losing, if you truly accept every loss is also the moment your trading will explode. The positive RR outweighs the possible losing one can encounter.

How would you rate your experience with FTMO?

10/10 for sure, the excellence in their communication is seriously the best.

Describe your best trade.

I do not have the best, great or good trades. I see trading as a boring machine in which I must be the controller and only take trades to get the most out of the strategy and let the dices roll out. The odds are on my side and the only thing I can do is do my best to take every trade.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

As I said above, the most dangerous thing is rushing your process. Problem: Rushing. Solution: Being aware of how long it takes to reach it if you cannot control your ego. And working on it, by learning the random distribution of trades in trading. To be completely honest, I failed 5 times before this one, all trading the same plan but every time I rushed it -> overtrading -> trading trades, not in my plan -> blow account.

What is the number one advice you would give to a new trader?

1: Make a trading plan which is positive for over 500 trades.

2: Write a simple and mechanical trading plan.

3: Learn about random distribution.

4: Trade your plan and track your trades if you actually traded the plan.

Trader Carlos - I always risk 1% of the account per trade

What was more difficult than expected during your FTMO Challenge or Verification?

Psychology, maintain the same risk-benefit in operations when I am drawdown.

How did you eliminate the factor of luck in your trading?

Reading books about the best, learning from those who have experience in the markets. being a statesman, putting the odds in my favor, and taking advantage of them. establish patterns in my ways of operating, and follow the rules of my patterns. Profit in trading is not lucky, it is achieved by obtaining positive results balancing the risk and benefit, putting the odds in your favor.

How did you manage your emotions when you were in a losing trade?

Remembering my mistakes in the past, accepting that negative results are normal and necessary in market operations. Understand that for some to win, others have to lose. The most patient, constant, and who follows the rules will obtain positive results in the long term.

Describe your best trade.

In 2018, I really liked the cryptocurrency xrp, because in 9 months it moved between a range of 500 pips and it took approximately 1 month to go up and down. I studied it a lot because I had followed that pattern 4 times and after 5 or 6 months I waited for it at 0.29500, I set my alarm and hoped that reached that point, and coincides with a price action with the BTC at a support point, since it was highly correlated, I decided to execute a purchase with a ratio of 1:11 to 0.36000, it was a very euphoric moment, and gratifying after have been waiting for 1 month.

How does your risk management plan look like?

I generally use a calculator I always risk 1% of the account per trade, a maximum of 2 operations at a time, and 3 per day at most. I look for minimum ratios 1: 2 to 1: 5, I already like intraday operations

What would you like to say to other traders that are attempting the FTMO Challenge?

respect their trading rules and don't risk more than 1% of your account per trade

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.