Don't take risks at the end of the trading period

In the next part of our series on successful FTMO Traders, we will look at a trader who focused on one selected instrument, which may seem like the ideal approach in the long run. However, he took unnecessary risks at the end of the trading period, which really didn't pay off.

Some traders are comfortable with trading multiple instruments within an asset class (equities, indices, commodities, forex), some may benefit from diversification between different types of investment instruments, and others may focus solely on one instrument.

For many traders, the latter approach is the ideal way to perfectly master a given market and thus become a specialist in trading that instrument. The advantage of this approach is that the trader is not distracted by following numerous markets. On the other hand, it is true that more instruments can offer the trader more opportunities. Each approach has its advantages and disadvantages, so it depends on what suits the trader.

Our trader is obviously comfortable with the approach of trading only one instrument, and in his case it is the most popular among FTMO Traders, i.e. gold (XAUUSD). As you can see from the balance curve, the trader had a great start, then his progression stalled for a few days, only to pick up nicely in the second half of the period, and eventually give away some of his profits a bit unnecessarily.

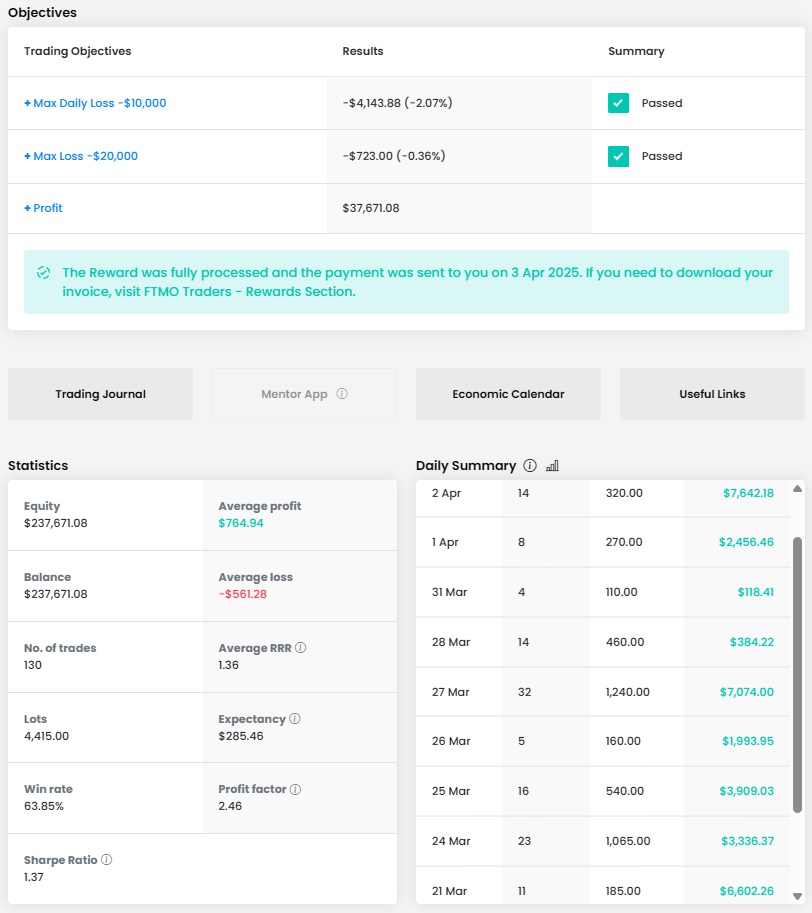

The total return of nearly $12,000 is very good. While that doesn't look too staggering in a $200,000 account, what's more important is the ability to make similar returns over the long term. A large account gives the trader the opportunity to earn relatively large returns, although in percentage terms they may not be large numbers.

The trader had no problem with the loss limits, so it is clear that he does not take unnecessary risks and thanks to the good consistency of his trades he is able to easily reach a profit of over $10,000. His problem, however, is the vice of many traders who want to achieve a higher return at any cost and sometimes fail to do so at the end of the trading period. And because they want to make up for these unnecessary losses, they open more and more trades and in the worst case, they may still exceed one of the loss limits at the end of the period and make trading unnecessarily complicated. Our trader avoided this black scenario, but we cannot praise him for it.

The trader's statistics are not bad at all, the average RRR above 2 is very good and the win rate of around 50% is not bad either. Unfortunately, if it wasn't for the last two days it could have been much better, especially in terms of trade win rate. In total, the trader executed 29 trades in eight days for a total size of 169 lots.

Considering the trader's style, this is not that many trades, with the trader opening 6 lots each time (except for the first 1 lot). This can be advantageous when the trader is a scalper and does not have time to deal with a different position size on each trade. On the other hand, it can be restrictive when the trader needs to set a wider Stop Loss, which may be too large in money terms at the given size.

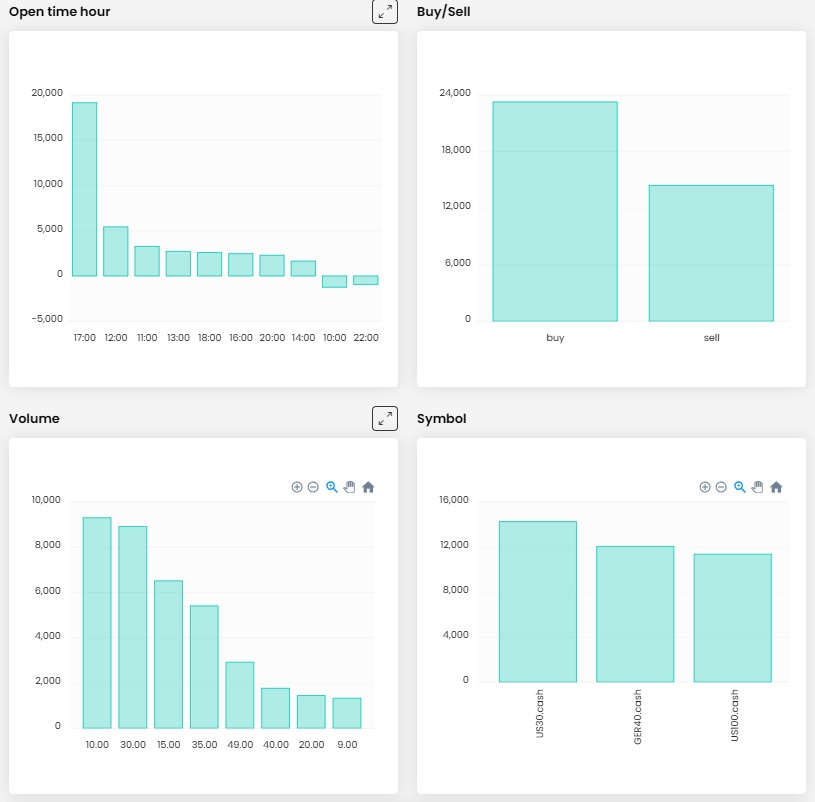

It is clear from the journal that this is an intraday trader who scalps frequently, which was preached especially at the end of the trading period. However, as we have already mentioned, the trader did not do well in the last two days and had nine losing trades during the course of them, which is a real pity.

The trader usually held the trades for a few minutes, only rarely did his trades last more than an hour. We can praise him for setting a Stop Loss for each position, he also did not deal with Profits that often, which is quite common in scalping.

As we have already mentioned, the trader traded only one instrument, which was gold, and with the exception of the first trade he opened positions of the same size of 6 lots. The difference in results between buy and sell positions is interesting. Given that gold saw both a significant rise and a fairly strong correction during the period the trader was trading, this is probably a psychological problem for the trader who simply prefers to open long positions.

Although the trader was more focused on opening long positions, his most profitable trade was a short position, on which he earned over $5,000. We don't know if it was the lack of long signals, but the trader opened a short position just before the markets opened in Europe on a consolidation following a downtrend and managed to hit a fairly significant price drop, with gold losing over ten dollars within half an hour. We can commend the well set Take Profit and the fact that the trader did not exit the trade prematurely but waited until his TP.

In the second picture, we then see two trades that the trader made shortly after each other. The first one ended in a loss and is an example of how the same size position on each trade can be a limitation for the trader. Had the trader opened a smaller position, he could have set a wider SL and his trade could have ended in profit, but in the end he realised a loss of over $2,000. We can then commend the fact that the trader closed his trade on a clearly set SL and did not allow the loss to be too large.

The trader then opened the next trade after a short consolidation, the entry was very good and he ended up in profit. In retrospect, we can argue that the trader could have been more patient and waited for a better exit, but the trade still ended with a profit of over $3,500, which is not bad at all.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?