"Don't get attached to the charts or the monetary value"

Many traders, especially in their early days of trading, feel that the more time they spend looking at charts, the sooner they will find the holy grail that will bring them quick and big profits to secure them for life. However, the reality is different, and trading is not just about charts and indicators, but rather about patience and psychological resilience. And what do our new FTMO Traders think about this?

Trader Rishaad: "I always knew it was not as easy as some people make it out to be."

What inspires you to pursue trading?

My journey as a trader started around 6 years ago. What drew me to trading was the idea of being able to work on my own terms, freedom of time and space. I quickly fell in love with the markets. However, I always knew it was not as easy as some people make it out to be and it would take a serious amount of time and dedication. I always felt I could become the best at anything I felt passionate about and this was no exception.

What was easier than expected during the FTMO Challenge or Verification?

Reaching the target long before the deadline. Timing is everything.

What was the hardest obstacle on your trading journey?

Overtrading. It took me a few challenges, and even a blown funded account to learn the hard way. Lowering my risk and setting clear rules, such as stopping trading after 2 losses in a day, helped me.

What do you think is the key for long-term success in trading?

I think everyone will have a different answer depending on their personality. For me, it’s having a long-term approach and goals, it allows me to not over-risk or get attached to like one trade. Also, having healthy living habits in general. I start my morning away from the charts, it helps to get my mindset clear and get me in my zone. I always start my mornings stretching and working out, then I have breakfast, after that I will look at the charts.

How did you manage your emotions when you were in a losing trade?

I journal every trade that I take, I feel it’s very important at the end of the day to analyze your trades. I also back test the week that passed and review the trades that I’ve taken. Doing this allows me to gather enough data to not let losing trades affect me negatively. I don’t trade during the night for the benefit of getting good sleep and also because of the widening spreads during early hours of the morning. Again, just healthy living habits in general.

What would you like to say to other traders that are attempting the FTMO Challenge?

Take it 1 step at a time. Don’t get attached to the charts or the monetary value. Focus more on the process and on enjoying it, being in a positive mood. You will go through many ups and downs, if you persist you will be successful.

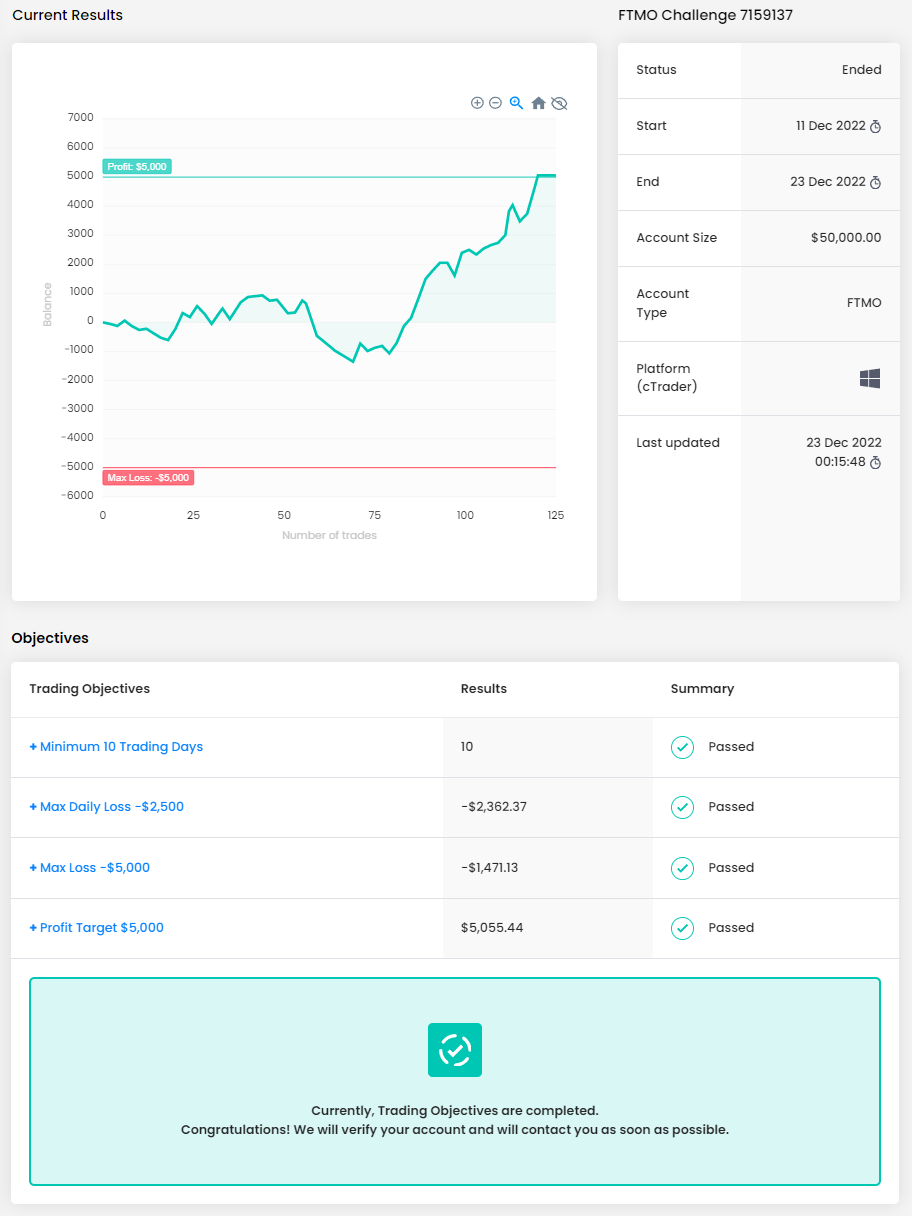

Trader Sherelle: "As new traders, we tend to place more value in a miracle strategy or indicator."

Do you plan to take another FTMO Challenge to manage an even bigger capital?

Yes, of course.

What do you think is the most important characteristic/attribute to become a profitable trader?

For me, it's someone who is able to stay calm under pressure or practice excellent trading psychology. Unfortunately, it is something that is often overlooked. As new traders, we tend to place more value in that miracle strategy or indicator but throughout my journey, it was only when I learned to manage my emotions, be disciplined, and maintain a calm and objective mindset in the market that I was able to become profitable.

Describe your best trade.

I honestly can't remember the specific trade, but it was the first trade that I placed using my new strategy. Even though the trade itself or resulting profit wasn't that noteworthy (especially since it was on a demo account), I still think of it as the best because it was the first trade I placed using a strategy that specifically was for me. Before I had wasted so much time on strategies that worked only for others, but with this one, I had finally created a strategy that best suited - my personality, my strengths, my weaknesses; that best suited me.

How did you manage your emotions when you were in a losing trade?

I simply walk away and recite some mantras like "there will always be another trade" or "I picked a high-probability setup and managed it to the best of my ability, so I did my job and did it well." The market can sometimes rattle us and cause us to forget those truths so in moments like those I recite them to ground myself.

Has your psychology ever affected your trading plan?

They work hand in hand. My psychology encourages me to only take high-probability setups that follow my plan to the letter. No compromises. My trading plan would be nothing without good psychology to support it.

What would you like to say to other traders that are attempting the FTMO Challenge?

Take your time and remain calm. Keeping a clear and calm mind is essential. Do whatever works for you - meditation, yoga, listen to music or podcasts, exercise etc. In the midst of the evaluation, try to maintain good trading psychology and if you feel it is beginning to suffer, take a break and step away from the markets.

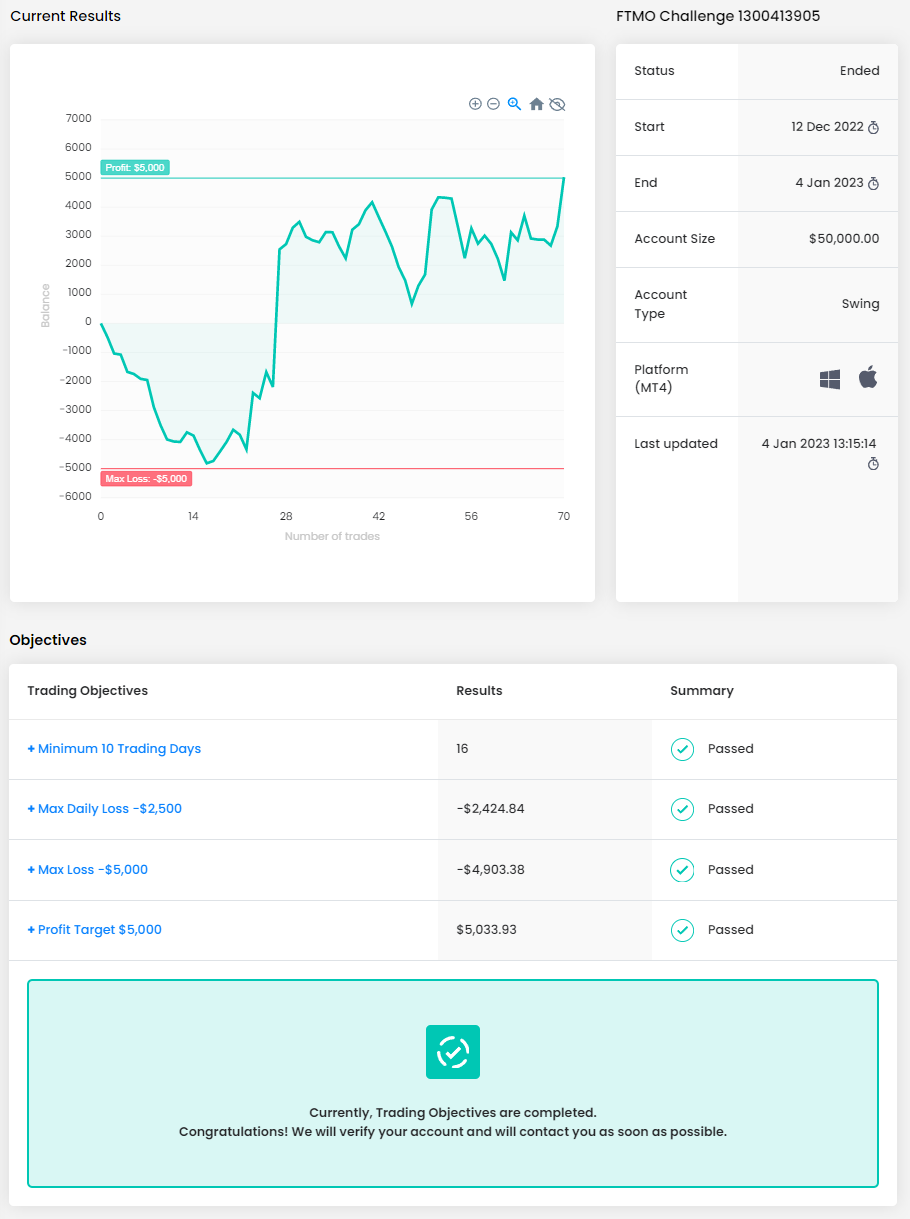

Trader Victor Patrick: "It's important to know when to take a step back and to stop trading."

How did you manage your emotions when you were in a losing trade?

It's important to know when to take a step back and to stop trading. I also keep on reminding myself that it's better to lose a small amount rather than a larger amount through emotional trading, and that a smaller loss can easily be repaired rather than a bigger loss.

Has your psychology ever affected your trading plan?

My biggest psychological barrier to trading is when being in a losing trade, to keep on over trading even if there aren't clear signs from my trading plan in just hopes of covering up the losses. I've learned the hard way, as mentioned earlier, that again it's better to lose small than to lose big going against your plan.

What do you think is the key for long-term success in trading?

The key is to consistently follow your plan, and to keep on journaling what went right and what went wrong with a certain trade. I even review charts of trades I didn't take and see how it would play out, just so I can get a feel for the patterns and conditions to refine my trading plan.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have a trading plan and do as much as I can to strictly adhere to it. My problems arise when I don't stick to my trading plan - by entering trades that don't confirm my strategies or by overtrading when I have a losing trade. I've learned the hard way of the value of sticking to a trading plan.

What was easier than expected during the FTMO Challenge or Verification?

I think that the technical analysis aspect of finding good opportunities make up less than half of the challenges faced when trading, while more than half consist of one's trading psychology. One has to be in a proper state of mind, and not aggravated in any way with their losses (which are part of trading) and just learn to love the process and not the rewards.

What is the number one advice you would give to a new trader?

Practice, practice, practice. It's one thing to just read about trading skills such as technical analysis and trading psychology, but another thing to be experiencing these in the field. Even after passing the FTMO Evaluation, I still feel that there is so much more to learn, and that practicing, and journaling are one's best weapons when one is new to trading.

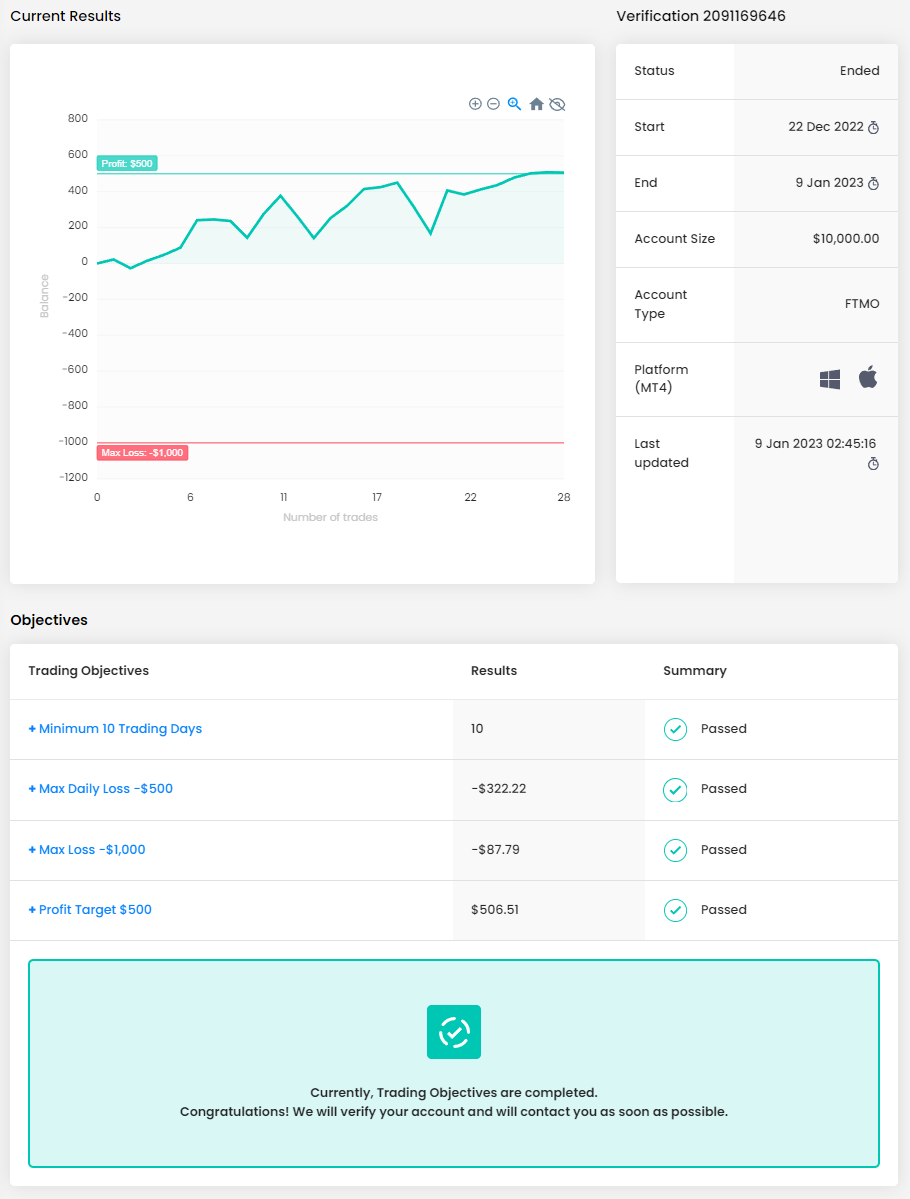

Trader Janine: "Don’t try to force yourself to be fast."

What do you think is the key for long-term success in trading?

For me, the key is to trade consistently. It is OK to take a few days „trading pause” once in a while but always continue trading to improve yourself. Check out new methods in a demo account and after a while include them in your real Trading account. Never stop learning and improving yourself.

What was easier than expected during the FTMO Challenge or Verification?

I just had to remind myself that I have 30 days to complete each step of the Challenge which is a long time if you really trade every day.

What was more difficult than expected during your FTMO Challenge or Verification?

I had the most struggle with my mindset which then influenced my trading outcomes. Learning to overcome, for example, frustration.

What inspires you to pursue trading?

Trading is very interesting, and it is a big area where you can always learn and improve. I don’t think it is ever over to learn more about trading itself. I do want to make myself more financially independent.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

By stopping myself and by telling myself that being successful needs time. I had to learn to focus on doing it right over a longer period of time instead of trying to hurry and risk everything.

What would you like to say to other traders that are attempting the FTMO Challenge?

I did not succeed the first time! I was too eager to succeed fast. Take your time. As I mentioned before, you have 30 days. Take those 30 days, use this time, and don’t try to force yourself to be fast. And also: never quit!

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.