Do you want to trade? It's simple, but it's not easy

Trading is very simple, but not easy at all. If that statement doesn’t make sense to you, you’ve probably heard of trading but don’t have much experience with it. Trading is really simple, but the path to success in this business requires a lot of time and effort. It’s up to you how you approach it and if you are willing to do something for your success.

Unfortunately, most people who try their luck in this industry started trading without dedicating their time to studying and therefore lost all their money right at the beginning. As in any other industry, the basis of success in trading is an honest study of the basics, supported by the gradual acquisition of experience and the development of your skills and abilities.

What is Trading?

The word ‘trading’ can have a fairly broad meaning, but essentially, it is the buying and selling of various financial assets to make a profit based on fluctuations in the prices of those assets. You can trade virtually any financial asset that has a financial value, and as a trader, you can then speculate on the rise or fall of that value. At the same time, you may have a myriad of financial assets at your disposal.

What Trading Involves?

Trading is about understanding and integrating several key areas. True mastery requires many hours of hard work. It is a very immersive activity that is a cycle of skill development, mental preparation and application of acquired knowledge. It also involves analysing results, looking for room for improvement, and correcting possible mistakes and shortcomings. If you want to become an active trader, it will be a never-ending process of learning and improving your skills with one goal, and that is consistency in attitude, in preparation, in daily routine and ideally, of course, in profitable trades.

Investing vs Trading

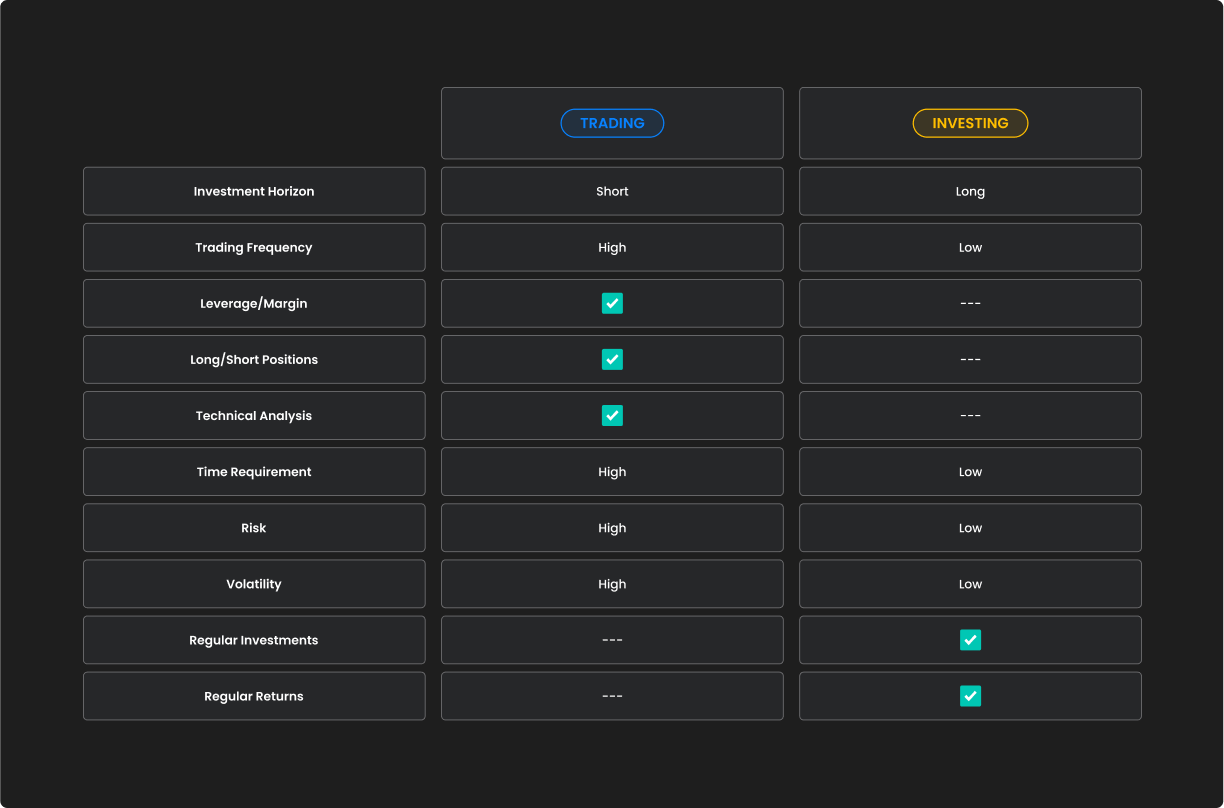

Many people confuse trading with investing, but there are some basic differences. The difference between trading and investing is, among other things, how you make a profit and whether or not you become the owner of the asset.

The investor’s goal is to purchase a financial asset at a favourable price with the expectation of its appreciation in the long term. They anticipate that the market price will increase over time, allowing them to profit from the price difference when they sell the asset at a higher price. Additionally, investors may earn regular returns from owning the asset itself. For example, shareholders may receive dividends (if the company distributes them) and can participate in company governance through voting rights associated with their shares. Bondholders, on the other hand, receive regular annual interest payments in the form of coupons.

Traders, on the other hand, seek to make a profit through speculation, usually in the short to medium term. Due to their higher volatility, currency pairs and derivatives are suitable for these short-term trades. In these, the trader does not own the asset and can trade in either direction (long/short) without problems.

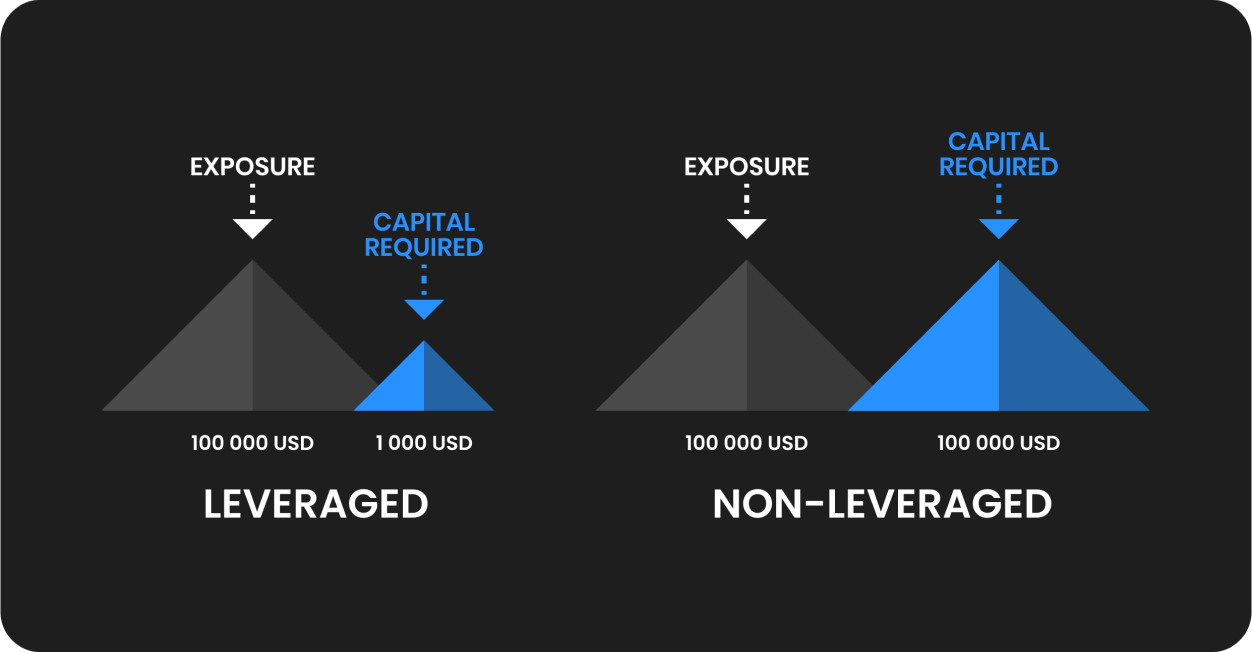

Another advantage of these instruments, which is mainly used by retail traders, is the use of leverage. Leverage allows you to open large positions with very little equity thanks to borrowed capital. Borrowed capital thus multiplies asset price movements and increases potential profits. At the same time, however, it is important to remember that higher potential profits are also associated with higher potential losses.

In the example below, you can see how much money you would need if you were to open a trade of 1 lot (base unit) on the EURUSD currency pair. Without leverage, you would need $100,000, with 100:1 leverage you would only need $1,000.

Who Can Become a Trader?

Anyone can become a trader. According to FTMO data, traders come from diverse backgrounds—regardless of education, nationality, location, family wealth, or gender. One of the appealing aspects of markets is their non-discriminatory nature; outcomes are determined solely by one’s attitude and ability.

Most people think that only someone who knows macroeconomics and microeconomics, excels in mathematics and is great at chess can become a trader. The reality is that you need slightly different qualities and skills to become a successful trader. As we have already mentioned, a willingness to learn new things is essential. The very important qualities of any trader should be perseverance and mental toughness, discipline, humility and an open mind.

Persistence is one of the key qualities of a trader. It is common to have good and bad periods, even when your results are already consistent and long-lasting. You can’t trade without losses, and the claim by some “trading gurus” that their success rate is close to 100% is unrealistic hogwash. Getting used to the fact that as a trader, you will sometimes have to endure a series of five or ten losing trades in a row will not be easy. It will require a very large dose of patience, perseverance and humility.

We must not forget discipline in all its forms. That is why there are so many successful traders among athletes who have been taught discipline from a young age and take it for granted. You probably know yourself that without a disciplined approach you cannot become a top expert in any field, and trading is of course no exception. Discipline is certainly not a 100% guarantee for long-term success, but it is a prerequisite without which you will never climb out of mediocrity. Discipline will help you avoid the phase where you constantly change your approach and strategy because you feel that “it’s not working”.

Unfortunately, humility is lacking in many traders who fail to be profitable in the long run, but always look for mistakes in someone else. The results of a trader are influenced by a myriad of factors over which he or she cannot have 100% control. Such an environment creates room for error. A good trader must be aware of this and should be able to admit his mistakes to himself and ideally always learn from them. A humble trader doesn’t feel that he knows everything, doesn’t overestimate his abilities, and is also able to keep his emotions in check.

Curiosity and the willingness to learn new things are then closely related to all of the above. Indeed, when a trader has enough humility, he or she realises that success in trading requires constant learning, improving one’s skills and knowledge. A trader can then be persistent enough, but without enthusiasm and interest in the subject, even this persistence quickly fades, because if something is done just for the money, it will not work in the long run.

Expected Earnings of Traders

Most traders only become interested in education after they have lost their first money in the markets or, in the worst case, lost all the capital in their trading account. This is a valuable (and often very expensive) lesson that needs to be remembered well.

Most traders lose money in the beginning; that’s a hard fact. The 90/90/90 rule states that 90% of traders will lose 90% of their invested capital within 90 days. You may have seen campaigns by various influencers claiming to make thousands of dollars a day from exotic beaches with just a few minutes of work. These ideas have nothing to do with serious trading. Having excessively high expectations is a recipe for long-term failure. A trader who expects immediate and substantial earnings from trading will sooner or later experience disappointment and frustration. This isn’t to say you should set small, easily achievable goals; rather, you need to be realistic.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?