“Do not chase the trade if it's not there”

The ability to wait for the right moment to enter the market and stop yourself from executing a position at any price is one of the skills of successful traders that not everyone learns. Patience has also led our new FTMO Traders, Nasir, Keano, Rutik and Densley to success.

Trader Nasir: "You can say trading is my passion and daily working habits"

What was more difficult than expected during your FTMO Challenge or Verification?

Some of the things that were more difficult than expected for me include managing emotions during drawdowns, sticking to a trading plan consistently, and adjusting to the rules and restrictions of the Challenge.

What do you think is the most important characteristic/attribute to become a profitable trader?

There are many important characteristics and attributes that can contribute to becoming a profitable trader, but some of the most commonly cited ones include discipline, patience, risk management skills, a strong work ethic, and the ability to remain objective and unemotional when making trading decisions.

What was easier than expected during the FTMO Challenge or Verification?

I have found that the rules and restrictions of the FTMO Challenge actually made it easier to stay disciplined and focused on the trading plan, as there was a clear set of guidelines to follow. Additionally, I also have found that the FTMO Challenge helped me to develop a stronger sense of risk management and to better understand my own trading psychology.

What inspires you to pursue trading?

Different traders are inspired by different things, but some of the main reasons why I pursue trading include the potential for financial independence, the intellectual challenge of analyzing markets and making profitable trades, and the ability to work from anywhere in the world with an internet connection. You can say trading is my passion and daily working habits.

How would you rate your experience with FTMO?

The FTMO program was a great way for me to test my trading skills and gain valuable experience. The Challenge was tough but fair, and I appreciated the feedback I received on my trading performance. The risk management guidelines helped me to become a more disciplined trader, and I was able to develop a profitable trading plan as a result. Overall, I had a very positive experience with FTMO and would recommend it to anyone looking to take their trading to the next level.

What is the number one advice you would give to a new trader?

One of the most important pieces of advice for new traders is to focus on developing a solid trading plan and sticking to it consistently. This plan should include specific entry and exit criteria, risk management guidelines, and a clear understanding of your trading goals and objectives.

Trader Keano: "The most difficult part was sitting and waiting for setups."

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, my goal is to reach the max allocation allowed!

How did you manage your emotions when you were in a losing trade?

At first my stomach would burn, and I would just completely lose it. Now after losing so many times, I kind of don't feel it anymore, I just have faith in my capabilities to rectify my losing trades.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most difficult part was sitting and waiting for setups. When I started this last FTMO Challenge, I made sure that all my study work and backtesting was done beforehand. By doing that the days felt very long, and I got impatient a lot of times as I was just sitting and waiting for setups, I countered it by just staying active and exploring other hobbies in my down time such as tennis and content creation.

Describe your best trade.

My best trade can only be explained by calling it a feeling. My setups all follow the same logic, but there came a time a couple of months ago when I just started feeling very sure of my executions and I just didn't feel lost in the market anymore. So, my best trade would be when I got that feeling.

How did you eliminate the factor of luck in your trading?

I made sure to do all the work required. I spent the last year and a half just backtesting and forward testing with proper risk management. I made myself used to a model that repeats and now luck has absolutely nothing to do with my trading.

One piece of advice for people starting the FTMO Challenge now.

Follow your trading plan EXACTLY, it’s so tempting to just try and finish your FTMO Challenge in one or two trades, but believe me that will hurt you more than anything.

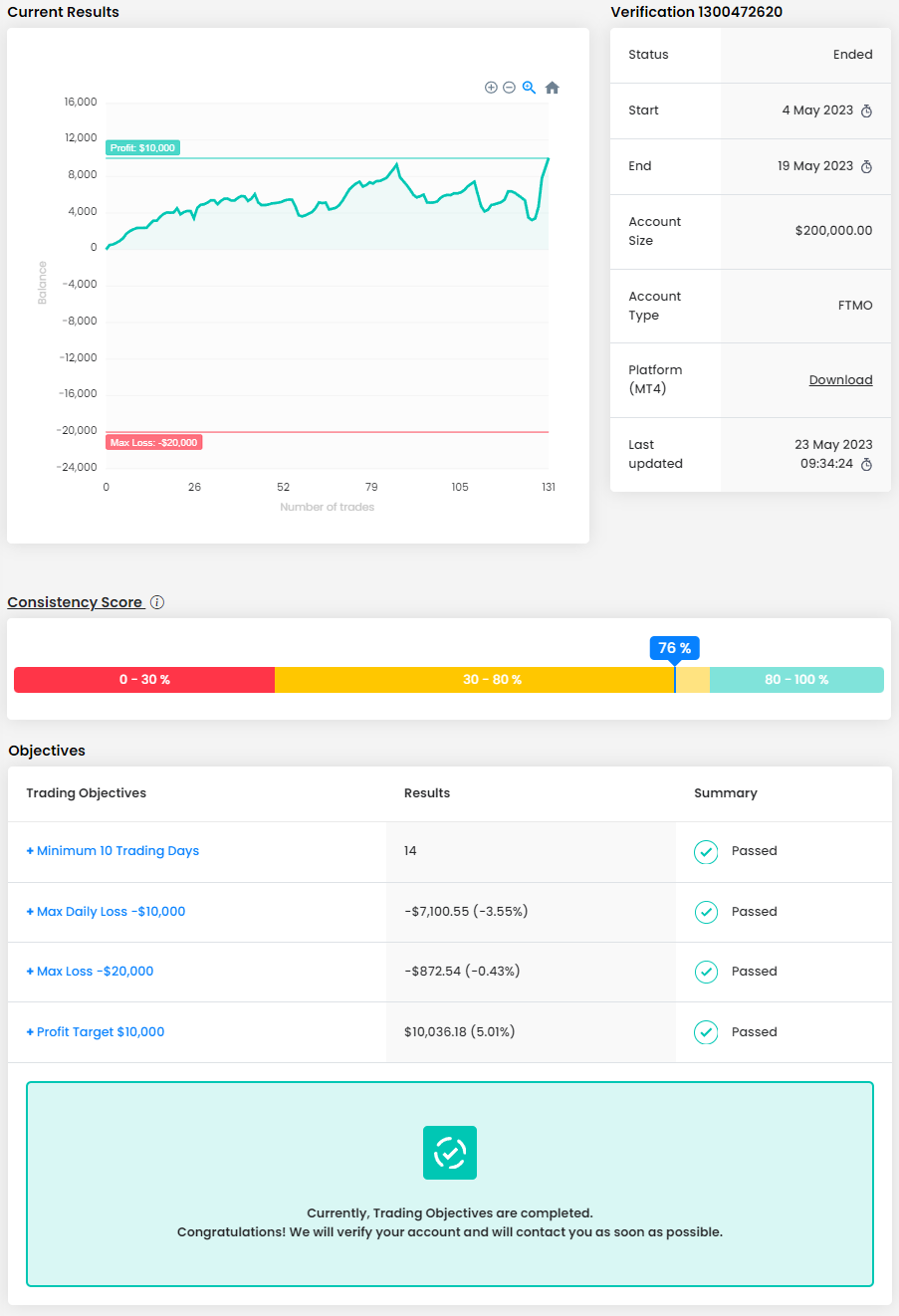

Trader Rutik: "Don't fall under the pressure that you need to take trades."

How did you manage your emotions when you were in a losing trade?

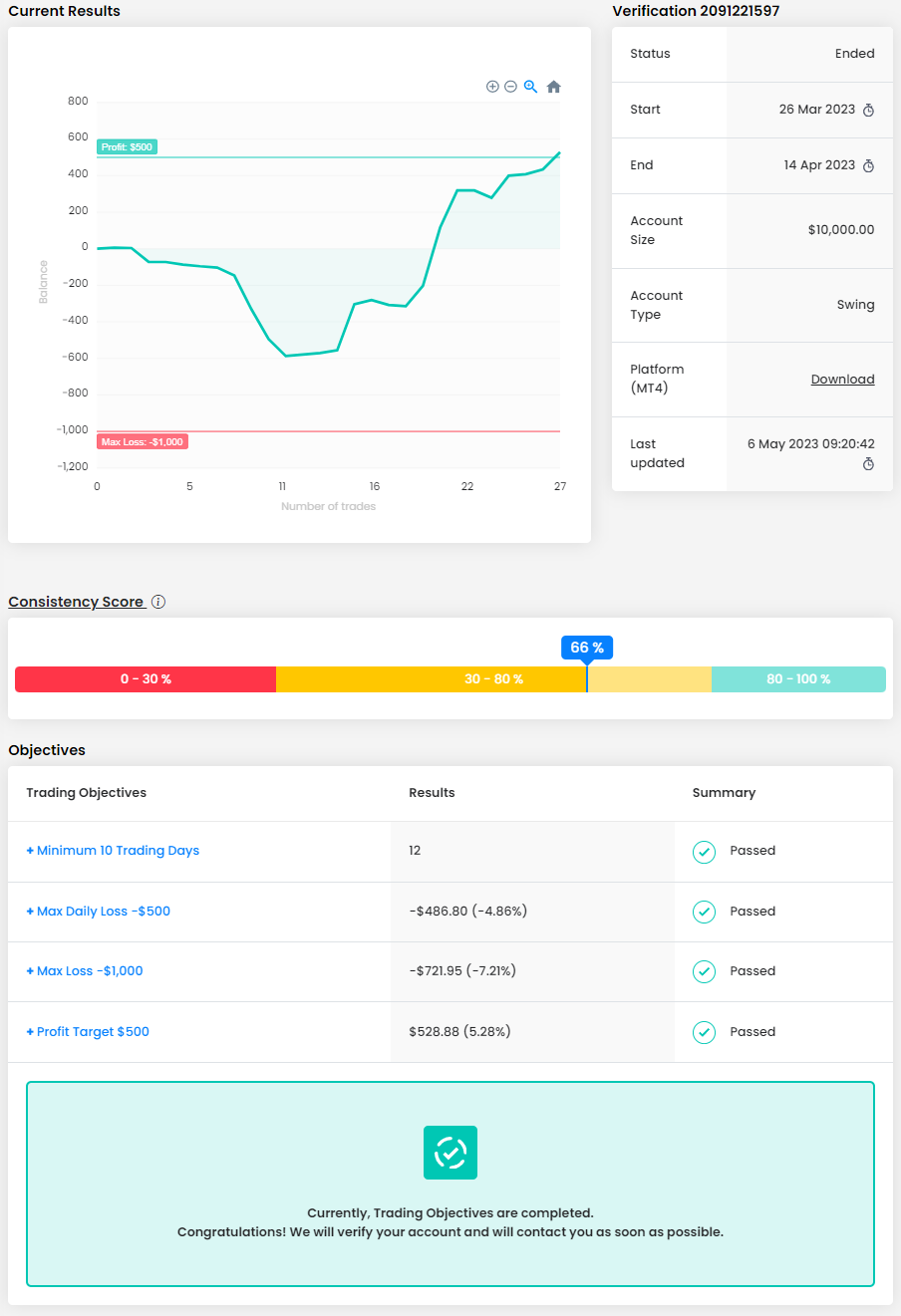

When going down into my drawdown on Stage 2 of the Verification stage, I felt that coming back wouldn't be too hard if I just took a break and came back. I started trading on the second stage right after I passed the first one and I instantly went into drawdown within the first 4 days with 2 trades that I held. Unfortunately, I closed both of them in losses but later went to full profit but after holding for multiple days and the Max Daily Loss being so close, I decided to close those trades at a loss. This led me to be in a drawdown. I was about 6% in drawdown, and I knew that if I just waited and waited for clear stepus that I could come back. So, I did. I waited about a week and changed and took my first trades back this week. I knew this week would be volatile due to Fed minutes, CPI data, and other economic reports so I knew this was my chance to hit winning trades to get back above my starting balance and hit that 5%.

Has your psychology ever affected your trading plan?

In all honesty, my psychology has not been affected with my trading plans even while being under drawdown on the Verification stage. The main thing about this Challenge is not hitting the Profit Target of 10% or 5%, but it’s to not lose your fee cost that I paid to take the FTMO Challenge. I knew that if I fail that I can take the Challenge again, again, and again. This was around $160 for me, and it was something I was willing to lose if it came to it. Knowing that, I understood the requirements to move onto the next phase without anything affecting my psyche.

What was more difficult than expected during your FTMO Challenge or Verification?

In paper the FTMO Challenge should be more difficult because you need a 10% Profit Target compared to the Verification Profit Target of 5%. But this was not the case for me, I found it more difficult on the verification phase compared to the FTMO Challenge phase. The reason was being impatient. Once those first few trades I took brought me down into drawdown territory I knew I needed to just wait for the trade to come to me.

Do you have a trading plan in place, and do you follow it strictly?

I do have a trading plan in place. Before taking the FTMO Challenge, I have been using this strategy for a long time now, constantly gaining on my account, monthly. The strategy allows me to take trades with sniper entries for a better risk to reward allowing me to not be in a trade for too long. The one time I didn't follow the strategy led me to drawdown. This was a great learning point because I was feeling the rush after the first phase and passing.

How did loss limits affect your trading style?

The Maximum Loss limits affect my trading style because I figured it would be realized losses and not unrealized losses. I didn't know this, but this did have an effect on the position size because I didn't want to come close to my Maximum Loss or even my Daily Loss.

One piece of advice for people starting the FTMO Challenge now.

The one piece of advice I would give to new people starting the FTMO Challenge and for future self when taking the Challenge again would be not to rush. If you have a consistent trading strategy and you backtested it and it works, then don't fall under the pressure that you need to take trades. The trading clock doesn't start when you purchase the Challenge, instead it starts when you make and input your first order. I would tell someone or future self to wait for days of volatility to begin trading. In addition, do not chase the trade if it's not there. Take the trades that come to you because those will be the winners.

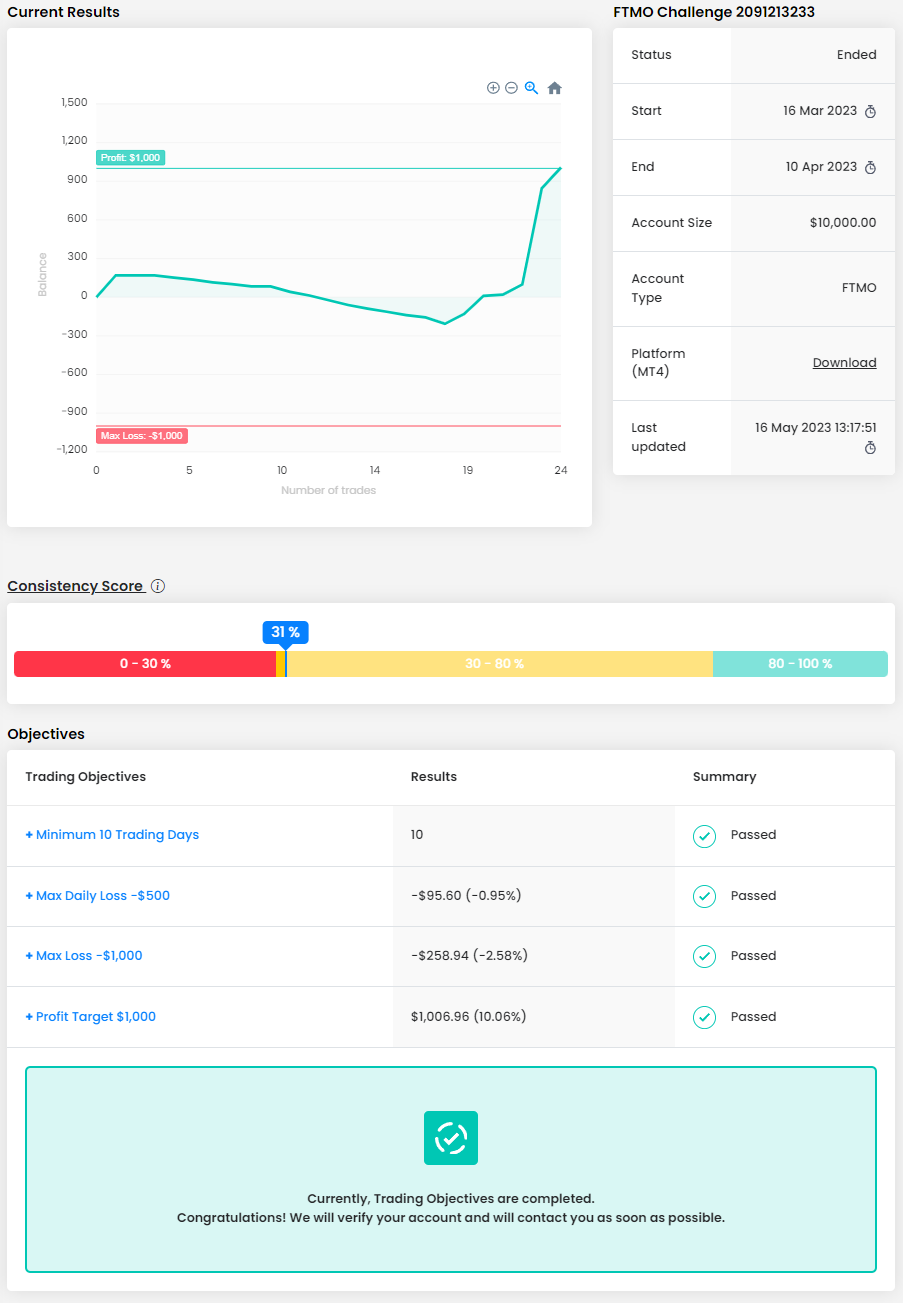

Trader Densley: "Trading is a source of inspiration for me"

How has passing the Challenge and Verification changed your life?

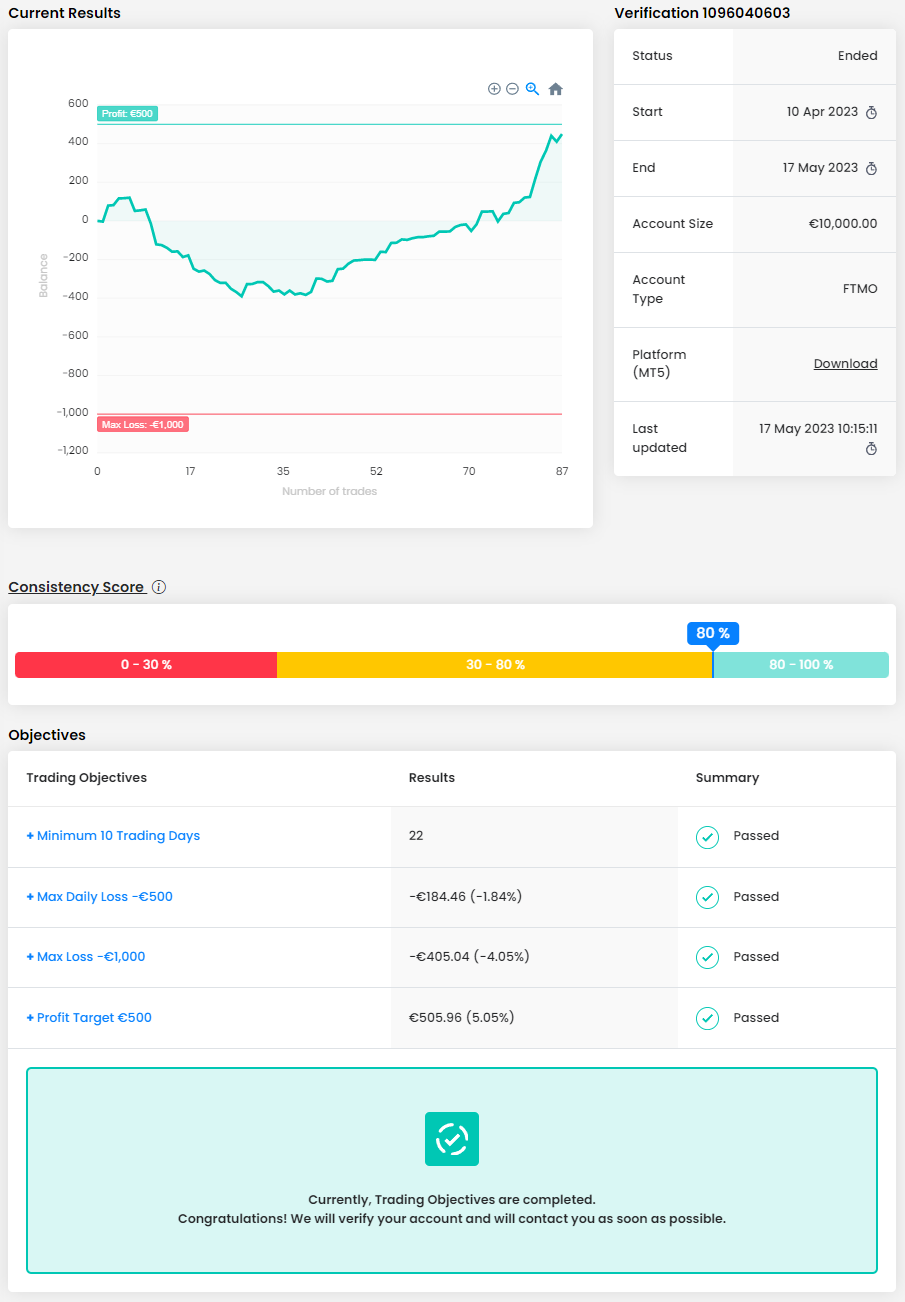

Trading for FTMO taught me invaluable lessons about consistency, discipline, and self-belief. As I embarked on the Challenge, I began to understand the essence of trading, it requires dedication and adherence to a set of principles. Succeeding in this endeavour allowed me to recognize my potential as a competent trader. However, it was the subsequent Verification process that truly bolstered my confidence and solidified my self-perception as a trader. The validation I received felt akin to earning a degree, symbolizing my growth and proficiency in the field.

What does your risk management plan look like?

I will set clear stop-loss orders for each trade, between 1% or less limiting potential losses. I will never risk more than a percentage of my capital on any single trade. Additionally, I will regularly review and adjust my risk management strategy to ensure its effectiveness in minimizing potential losses.

What inspires you to pursue trading?

Trading is a source of inspiration for me as it not only addresses the financial aspects of life but also holds the potential to become a secondary income stream. This additional income would grant me the freedom to travel, spend quality time with my loved ones, and relish the joys of life to the fullest.

Has your psychology ever affected your trading plan?

Undoubtedly, trading had a profound impact on me. Initially, doubts plagued my trades, but as I progressed, I learned the significance of faith and trust in my trading rules. This shift in mindset significantly improved my psychological resilience and bolstered my confidence in decision-making.

Describe your best trade.

Among my trading experiences, I consider the trade that propelled me to pass phase 2 Verification as my best. It was meticulously planned, with a comprehensive strategy in place. Patiently awaiting the opportune moment, I executed the trade flawlessly, aligning with my expectations and solidifying my proficiency as a trader. It felt nice being on the right side of the market.

What is the number one advice you would give to a new trader?

Please have patience & keep it simple!

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.