“Consistency and patience are more powerful than any indicator or signal service”

Indicators and tools that offer trading signals may seem like the ideal solution for many novice traders looking to make big money in forex trading. In reality, however, they are merely a crutch that, in most cases, does not work and often has a negative effect. The sooner traders realize this, the sooner they can join the ranks of our successful FTMO Traders.

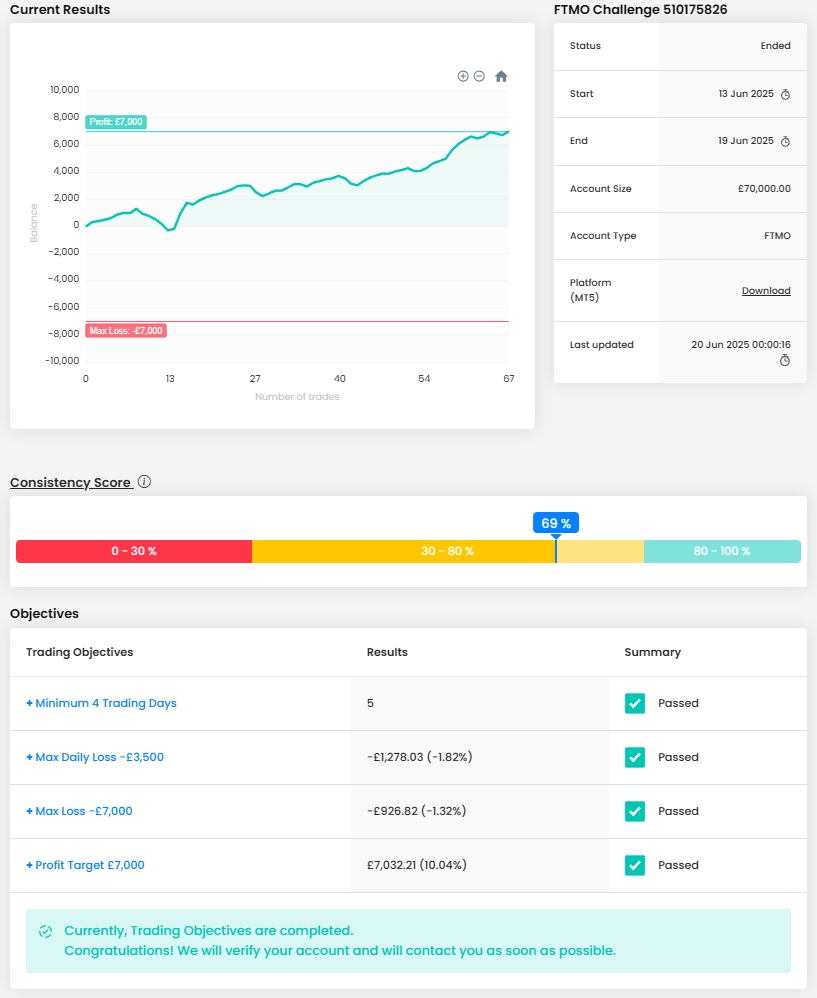

Trader Adam Xiao Jun: “Stay disciplined and stick to your strategy.”

What was the hardest obstacle on your trading journey?

Initially, maintaining discipline and waiting for the correct setup to come to play as opposed to entering after a few confluences. This accompanied by others has made my psychology and emotions much stronger and better.

How does passing the FTMO Challenge and Verification change your life?

Changed my life in a way that taught me learning how to trade was not a waste of time. I improved and learned to get to where I am, and I will continue to improve as long as I put the hard work in.

What inspires you to pursue trading?

My love for economics and financial markets. Trillions worth of pounds flow throughout the world and it is extremely interesting to me that we are all able to trade the same markets as one another in this zero-sum game.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have a strategy, and I follow it very strictly.

Describe your best trade.

Not necessarily my largest trade but my best trade catching a 4:1 RRR on EURUSD. This was taken after a 15-minute opening range breakout was created upon Asia open. I could see that price was failing to break above the zone on the 5 minutes. Scaling down to the 1 minute we saw a sweep of the candle that failed to break above and a bearish move to the downside. After confirmation with a market structure shift, I entered with a relative Stop Loss and within 30 minutes the Take Profit was hit. Price action was clean, and all the confluences added up.

One piece of advice for people starting the FTMO Challenge now.

Stay disciplined and stick to your strategy. Do not chase losses and don’t overleverage and risk jeopardizing that daily drawdown because that affects mentality the most.

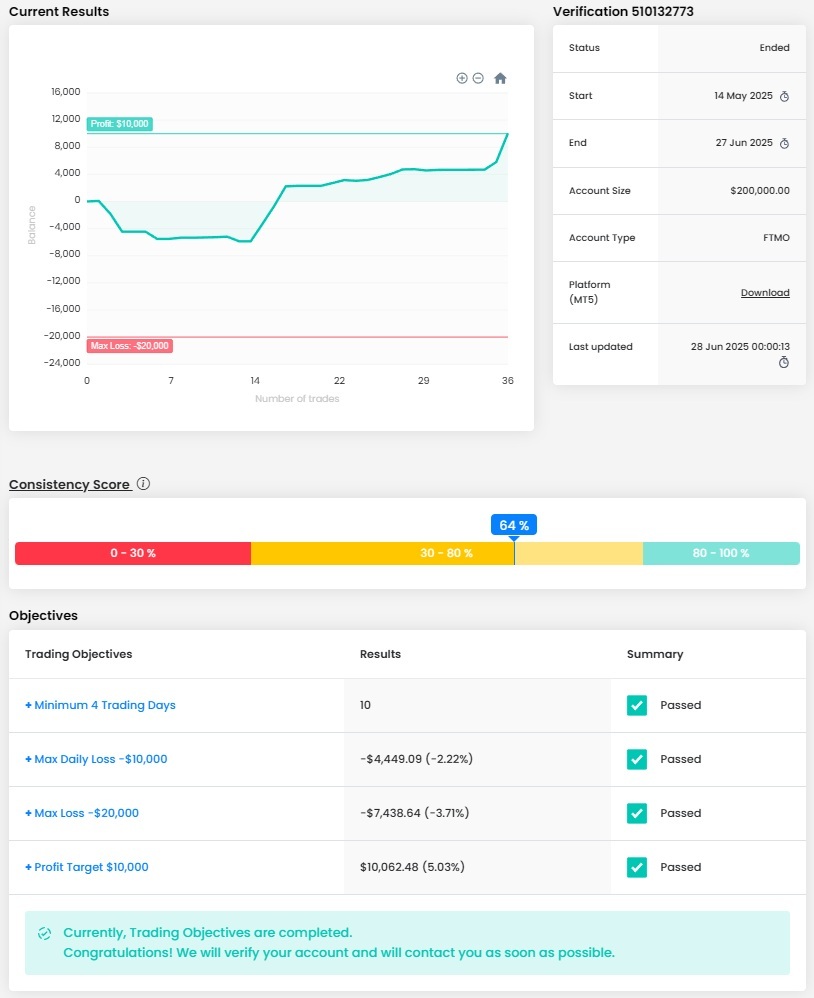

Trader Adnan: “My consistency comes from following the plan, not chasing the market.”

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes.

Where have you learnt about FTMO?

I learnt about FTMO on your website.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have a detailed trading plan based on Smart Money Concepts and strict risk management. I follow it with discipline, including entry/exit rules, risk-per-trade limits, and psychological boundaries. My consistency comes from following the plan, not chasing the market.

What was the hardest obstacle on your trading journey?

The hardest obstacle was overcoming emotional trading and sticking to discipline during drawdown phases. Learning to trust my strategy even when results were not immediate was a major psychological breakthrough for me.

What inspires you to pursue trading?

Freedom — both financial and personal. Trading allows me to control my time, challenge myself intellectually, and grow without limits. I’m inspired by the idea that I can earn independently from anywhere in the world.

What is the number one advice you would give to a new trader?

Focus on mastering one strategy and risk management before anything else. Don’t rush the process — consistency and patience are more powerful than any indicator or signal service.

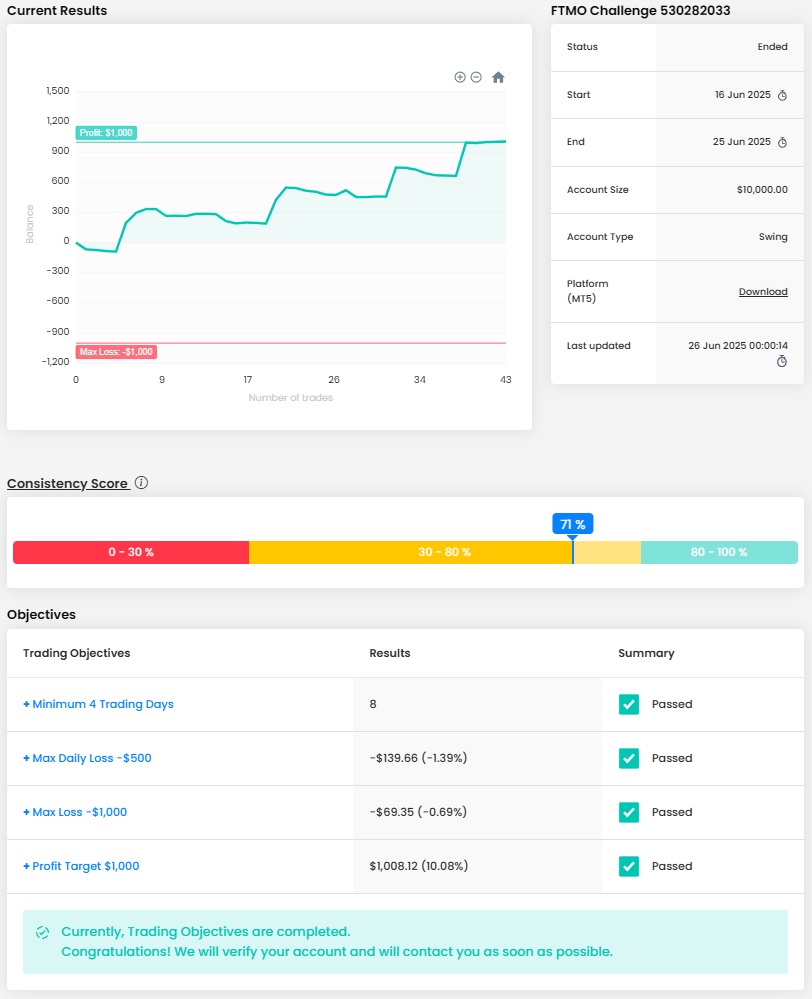

Trader Volodymyr: “The market rewards discipline and patience.”

How does passing the FTMO Challenge and Verification changed your life?

Passing the FTMO Challenge and Verification was a game changer. It not only validated my trading strategy but also gave me the confidence and capital to trade professionally. It’s allowed me to pursue financial independence and focus on trading full-time.

What was the hardest obstacle on your trading journey?

The hardest part was managing emotions during drawdowns. I had to learn discipline, patience, and how to stick to my plan even when things didn’t go my way. Overcoming that was key to my progress.

Describe your best trade.

My best trade was a swing position on USDCAD during a major market correction. I held the position for three days, respected my reward-to-risk ratio, and ended up hitting a 5:1 RRR. It was a perfect example of planning, patience, and execution.

What does your risk management plan look like?

I risk a maximum of 0.66% per trade, with strict daily and weekly drawdown limits. I use Stop Losses on every trade and never chase losses. Position sizing is based on volatility, and I avoid overleveraging.

How would you rate your experience with FTMO?

10/10. The platform is professional, the rules are fair, and the support team is responsive. FTMO has given me the opportunity to trade with substantial capital and grow as a disciplined, confident trader.

What is the number one advice you would give to a new trader?

Focus on consistency over profits. Master risk management, journal every trade, and treat trading like a business. The market rewards discipline and patience—chasing shortcuts usually leads to setbacks.

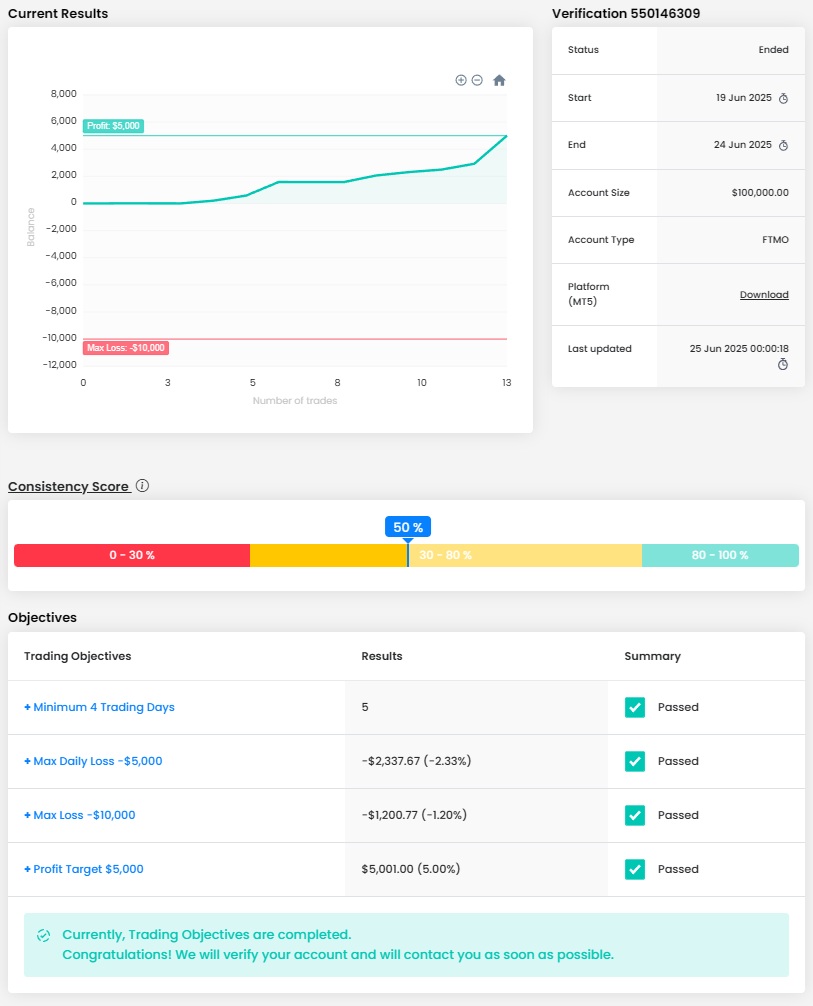

Trader Abdelwahab Omar Abdelwahab Ahmed: “The most difficult part was staying patient during periods of low market volatility”

What do you think is the key for long term success in trading?

Consistency, risk management, and emotional discipline are the foundations of long-term success in trading. Having a well-tested strategy, sticking to a trading plan, and continuously learning from both wins and losses is what sustains growth over time.

How did you eliminate the factor of luck in your trading?

By relying on a rules-based trading system, thorough backtesting, and strict risk management, I’ve minimized randomness in my results. I also maintain a detailed trading journal to track patterns and performance, which helps me refine my strategy based on data, not chance.

How would you rate your experience with FTMO?

Excellent. FTMO provides a professional environment and clear structure for traders to prove themselves. The support, tools, and challenges have helped me grow as a trader and stay disciplined. It’s a great platform for serious traders who treat this as a business.

How did you manage your emotions when you were in a losing trade?

I managed my emotions by sticking to my risk management rules and reminding myself that losses are a normal part of trading. I took breaks when needed, focused on the bigger picture, and reviewed my trades objectively to avoid emotional decisions.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most difficult part was staying patient during periods of low market volatility when opportunities were limited. I overcame this by avoiding overtrading, waiting for high-quality setups, and trusting my strategy instead of forcing trades.

One piece of advice for people starting the FTMO Challenge now.

Stay disciplined and focus on process over profits. Stick to your plan, control your risk, and don’t let emotions dictate your decisions. Remember, consistency and patience are key to passing the FTMO Challenge successfully.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.