A successful bet against US tariffs and the US dollar

As part of our series on successful FTMO Traders, we will once again look at a trader who speculates on the movement of the dollar through multiple currency pairs. In this case, it is a successful bet on the decline of the dollar.

In late October, we wrote in our series about a trader who speculated on the movement of the US dollar through three currency pairs, increasing the return potential of his trades due to the high positive correlation of these currency pairs. Our trader today also uses two of the three pairs of the previous trader in his trading, which are also among the most traded currency pairs on Forex - EURUSD and GBPUSD.

And like the previous case, our trader today did not use these highly correlated pairs to hedge, but rather to expand his options and speculate on the movements of the US dollar. More specifically, to speculate on a decline in the US dollar.

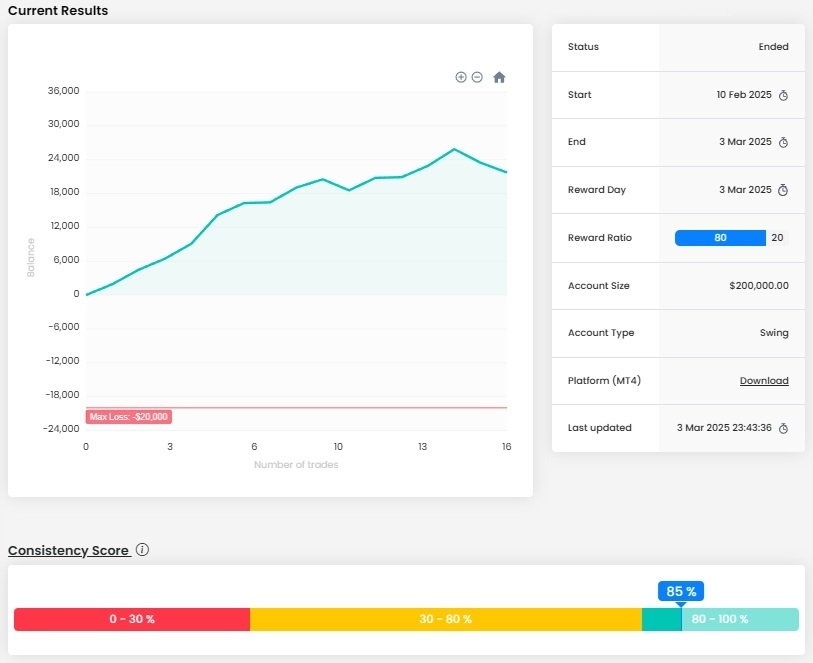

Looking at the balance curve, it is evident that this approach paid off from the beginning of the trading period until the end of the trading period, when he made two unsuccessful trades on the last day. Although these last two trades were a bit unnecessary and rushed, the trader eventually made a very nice profit and maintained a very high consistency of his trades.

A total gain of $21,722 on an account size of $200,000 means a profit of over 10%, which is very good. Although on the last day of trading the trader lost over $4,100 and his maximum loss that day was over $4,500, in percentage terms it was only 2.27%, which is a long way from the Maximum Daily Loss limit, or Maximum Loss, which is also very good.

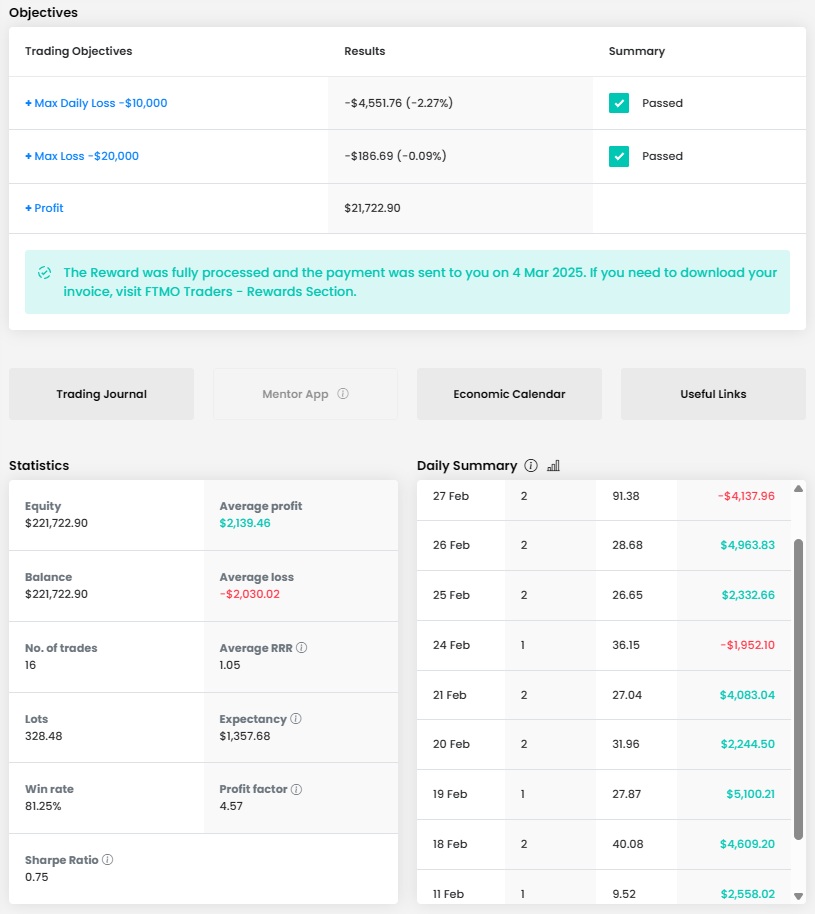

The trader executed 16 trades totalling 328.48 lots over the course of ten trading days, representing one to two trades per day and 20.53 lots per position. In fact, the trader opened positions of 10 to 20 lots, in some cases opening two positions at a time. This is not a small number, but with the size of the account, it is still acceptable if the trader sets his Stop Losses so that he does not risk too large a percentage of his account per trade. The average RRR of 1.05 is not very high, but given the trader's success rate (81.25%) it was obviously enough for a very good result.

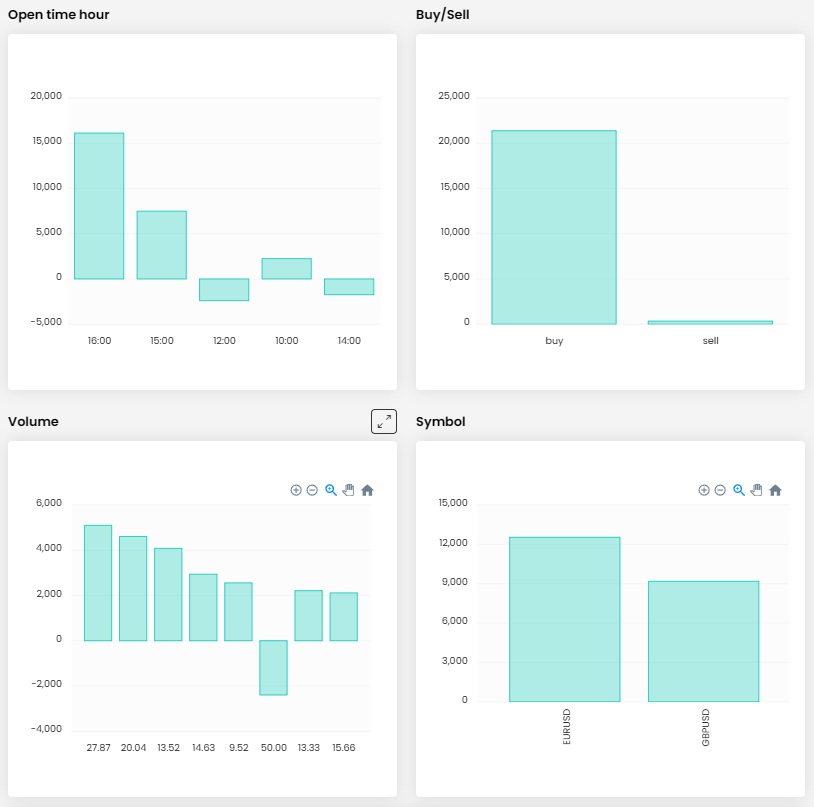

It is clear from the trader's journal that here again we have an intraday trader with scalping tendencies. So he keeps positions open for a few hours at most, which is perfectly fine and logical given the volatility of the currency pairs in question combined with the position sizes and good money management.

Again, we must commend the use of Stop Losses on all positions and in this case the trader even always entered a Take Profit, which is a bit of a bonus.

Interestingly, most of the positions that the trader opened were long, only the first two and the last two were short. The success rate of long and short positions also looks like this, and it was the last two positions, which were very unnecessary in our opinion, that were short, which influenced this disparity.

It is also interesting to note that the trader made virtually all of his profit on long positions, but the strong uptrend that the GBPUSD and EURUSD pairs are in (especially true for the latter) only started on the last day of our trader's trading period. As mentioned, the trader traded only EURUSD and GBPUSD pairs, which was also matched by the trading hours when he opened his positions.

As always, we also look at selected trades. The first will be the most profitable trade that the trader opened on the GBPUSD pair. The trade was opened at a time when there was no imminent danger of macroeconomic news being published and the trader was clearly going against the movement of the main trend that day.

Whether this is a good thing or not we probably won't judge, as we don't presume to evaluate the trader's entry or exit strategy, but the exit looks very good and the final result of over $5,100 is very good.

We evaluate the second trade or trades negatively because they are the last trades mentioned in the trading period. However, the problem is not the entries that look like the trader made them on a bounce from the resistance that formed on the EURUSD pair that day. The problem is the position sizes, as these were larger than average and thus did not allow the trader to set the stop loss at a more reasonable level. Thus, in both cases the trader lost completely unnecessarily, because as you can see, the market movement eventually hit well, but unfortunately it occurred only after the trader realized two unnecessary losses. The end result from both trades is thus a loss of over $4,100. Given his overall profit, the trader may not have been completely unhappy, but such an unnecessary loss at the end of the trading period really makes no sense. Trade safely!

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.