A good trading plan will save you time

Traders who have enough experience and are able to stick to their strategy and trading plan do not need hundreds of trades to achieve good results. If a trader can avoid the common mistakes made by inexperienced traders, he or she can make a good profit in a few days. In the next part of our series on successful traders, we will have a look at two such traders.

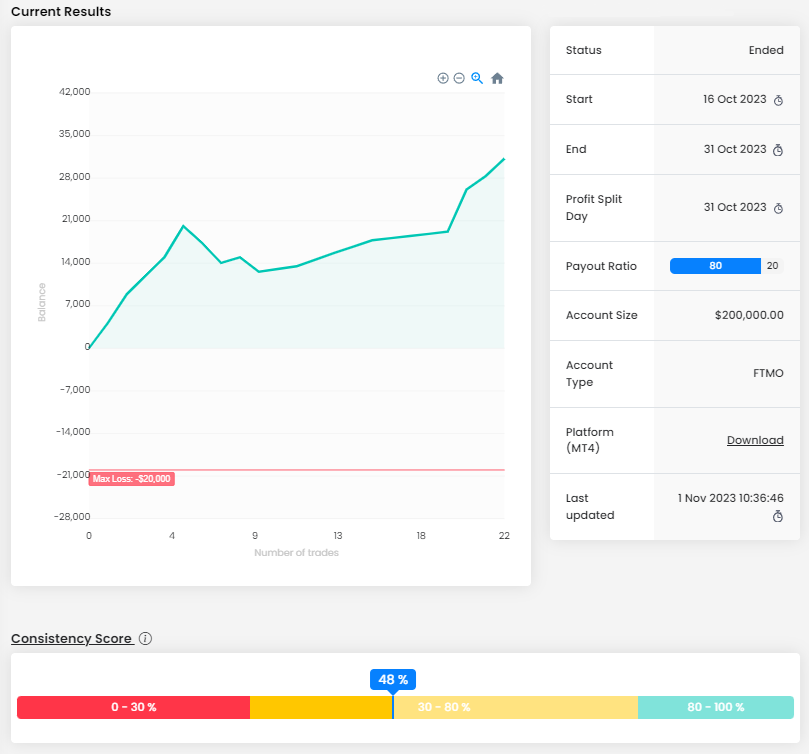

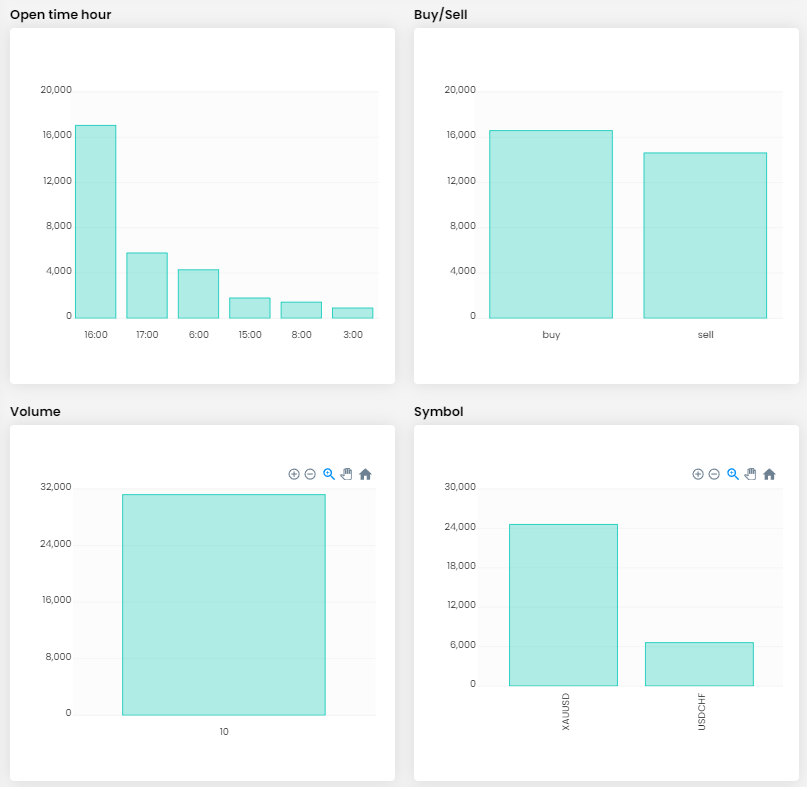

The first trader is very close to scalping in his trading style. His balance curve has been in the green right from the start, and although he has had one series of losing trades, it hasn't changed the fact that he has made a very significant profit.

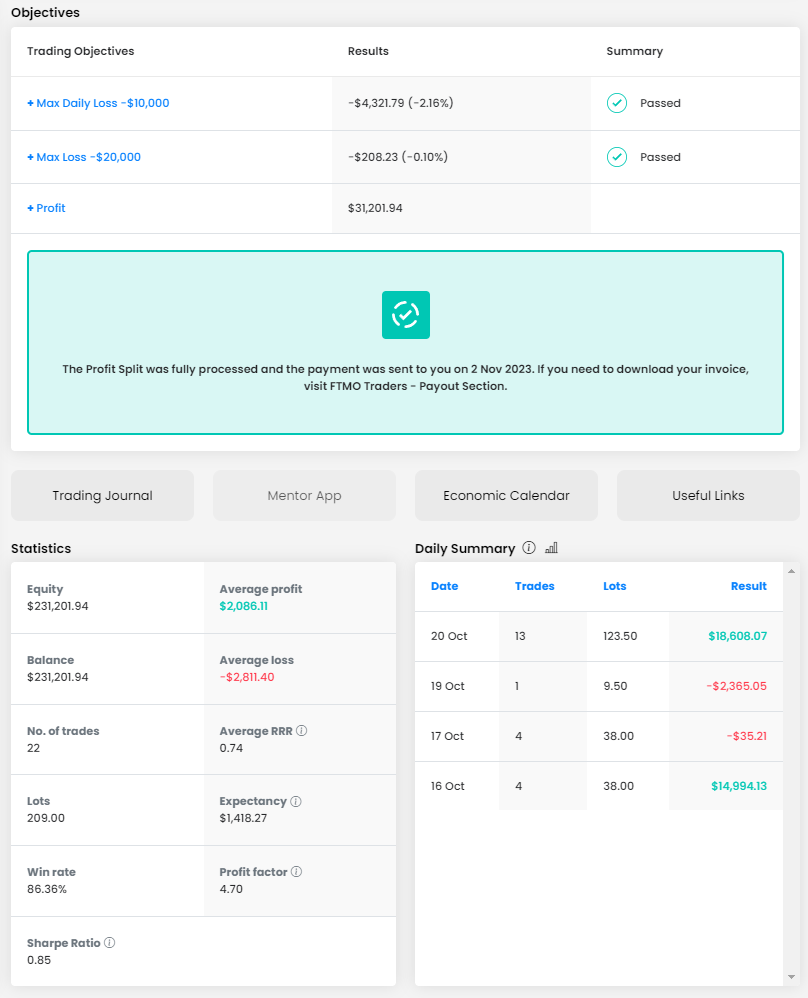

A return of over $31,000 with an account size of $200,000 is very good. The trader, despite a rather risky trading style, had no problem with the loss limits and the largest daily loss of 2.16% is perfectly fine. The average RRR is not high (0.74), but the trader made up for it with a very high win rate (86.36%). In the long run, you cannot rely on such numbers, but for this case it was quite sufficient.

Interestingly, the trader made all his profit in just four days of active trading, and did not trade again after reaching the mentioned return. What the exact reason is, we cannot know, but if it was a voluntary and deliberate approach, we appreciate that the trader was not unnecessarily "greedy", did not continue trading, and rather collected his profit. In the four days mentioned, the trader executed 22 trades with a total size of 209 lots. This amounts to 9.5 lots per position, which was also the size of all his positions.

A typical scalper might be expected to have a larger number of trades per day, but the trader was only really active on the last day when he entered the most positions. The trader's diary reveals, that he traded only at specific time intervals during his active trading periods. This is a rather intensive method, and it is not surprising that it is not possible to trade all day in this way.

On the third trading day, the trader opened only one position, which ended in a loss, and then he did not open any further trades. Again, this is only a guess, but if the trader stopped trading after a losing trade in order not to lose more money unnecessarily due to possible mistakes resulting from a mental state (FOMO, revenge trading), we must commend him for his approach. Not everyone is able to stop trading after a loss and not risk more money. On other days, the trader still started with a profit.

The trader does not place Stop Losses and Take Profits, for which he does not get praise from us, but on the other hand we have to admit that with his active trading it is understandable. Often, after closing one position, he opens another one in the opposite direction. Although this is a rather risky approach, it also means that he is watching the trades live and therefore uses the so-called mental stop loss. And although it works in the case of this trader, we do not recommend this method of closing positions. On a more positive note, even when using this method of closing positions, the maximum loss per trade was around 1.5%, which is quite okay.

The trader opened positions mainly in Gold (XAUUSD), but one day he also traded the currency pair USDCHF. Buy and sell positions are quite balanced, which is normal with his active trading style. He opened most of his trades between 16 and 17 hours of the platform, which also showed in the result.

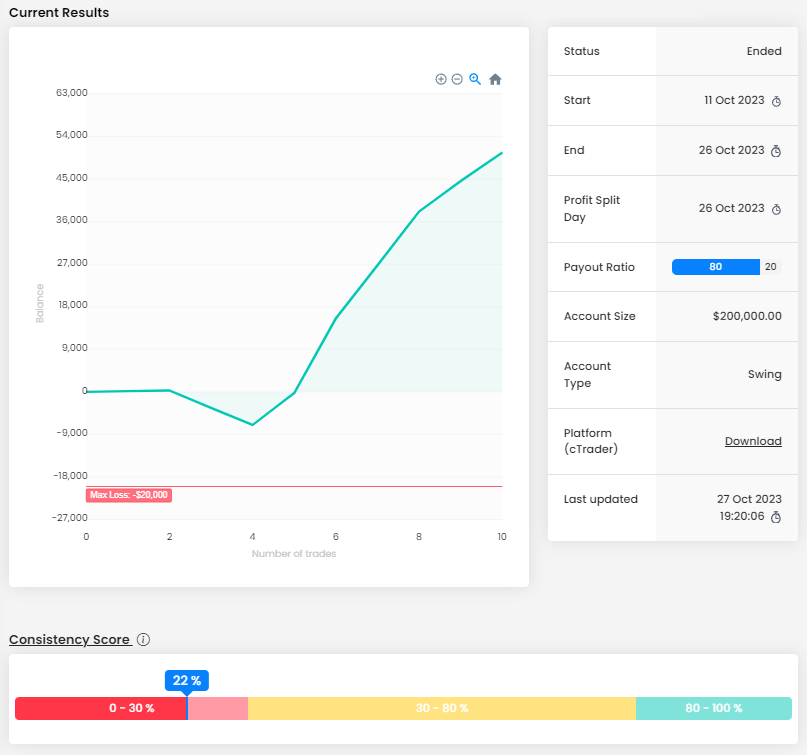

The second trader took a completely different approach as it is more of a swing strategy, but his result is also great. Unlike the first trader, he got into the red numbers at the beginning of the trading period, but the second part of the balance curve is genuinely impressive.

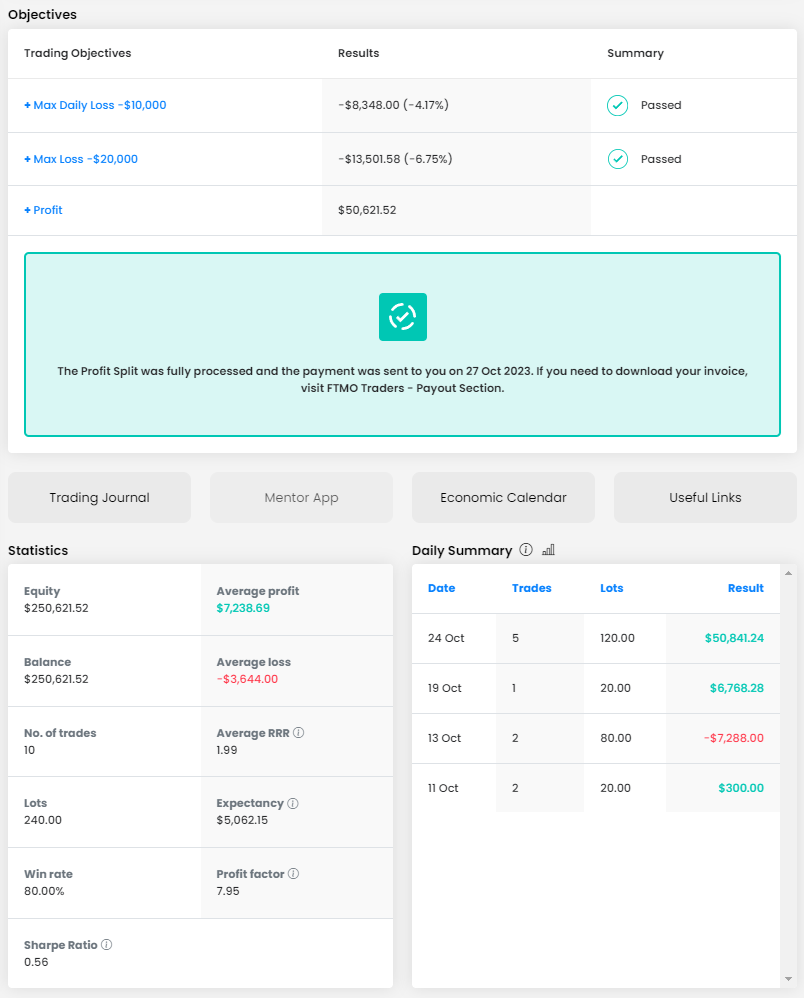

A total return of over $50,000 on a $200,000 account is indeed great, but unlike the first case, this trader was much closer to the Maximum Daily Loss limit (-4.17%). In this case, the trader achieved a much better RRR (1.99), while his success rate was still pretty high (80%), which is what made the trader achieve such a great result.

He only needed ten trades with a total size of 240 lots, which is an average of 24 lots per trade. The maximum position size was 80 lots, which is quite a high number, but with an account size of $200,000 it is still acceptable.

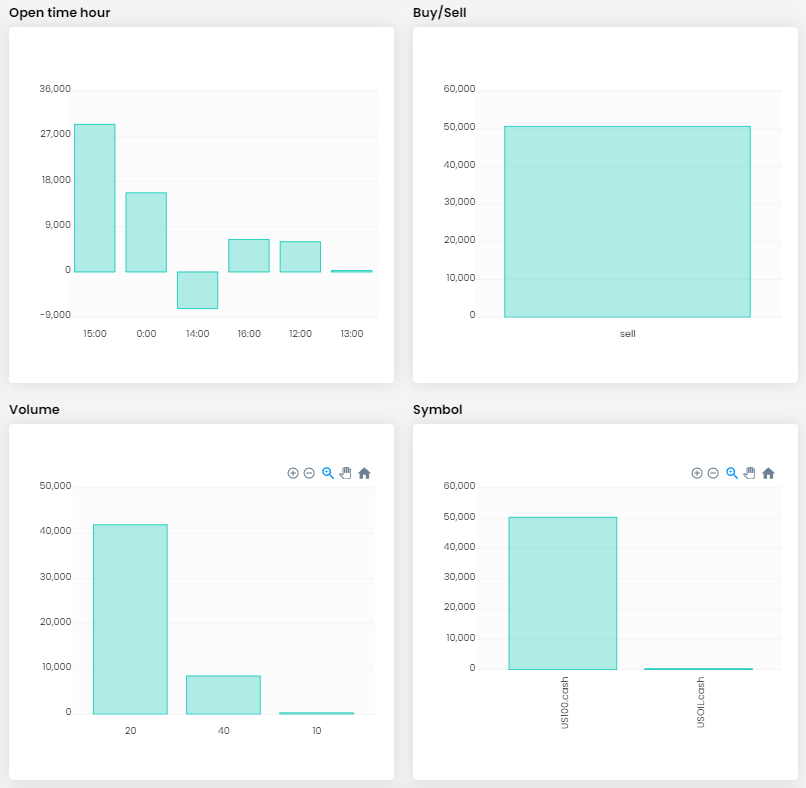

The diary shows that the trader opened only short positions, but looking at his other accounts, we can conclude that it was a coincidence, because at other times the trader had no problems with long positions. In this case, it was only to take advantage of the downtrend in US stocks. The trader held his positions for several days due to the multi-day decline in the US stock markets, and it paid off.

In this case, the figure of four trading days is a little misleading, as the trader held some of his positions for over ten days. In any case, we must commend the trader for the fact that when he had positions open, he opened only a few more positions in profit and did not open too many positions unnecessarily.

As already mentioned, the trader opened most of his positions on US stocks, specifically on the Nasdaq 100 technology index. At the beginning of the trading period, he tried two short-term positions on WTI oil (USOil.cash), but he then focused only on the stock index.

Today's two successful traders are a very good example of how, when following reasonably set rules, a trader does not need hundreds of trades and weeks of sitting in front of a trading platform to make significant returns. And it can be done with both, long-term trades and scalping.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.