Editorial note: All responses are 100% organic and received from our new FTMO Traders during the contract signing process. All responders agreed to have their feedback published and all their answers are not being edited by FTMO, hence they can include grammatical mistakes or typos.

"A good trade is a good trade regardless of the results"

Every forex trader tries to maximize his profits and limit his losses, but you can't trade with profits alone. However, even a losing trade does not necessarily mean that there is something wrong with your strategy as trading is a game of probabilities. A very important point made by our new FTMO Trader Michael that every trader should realize as soon as possible. He, Brian, Benard, Kioja and Thomas are the new FTMO Traders willing to share their knowledge among others.

Trader Brian: “Use adequate risk management whatever your strategy is.”

What was easier than expected during FTMO Challenge or Verification?

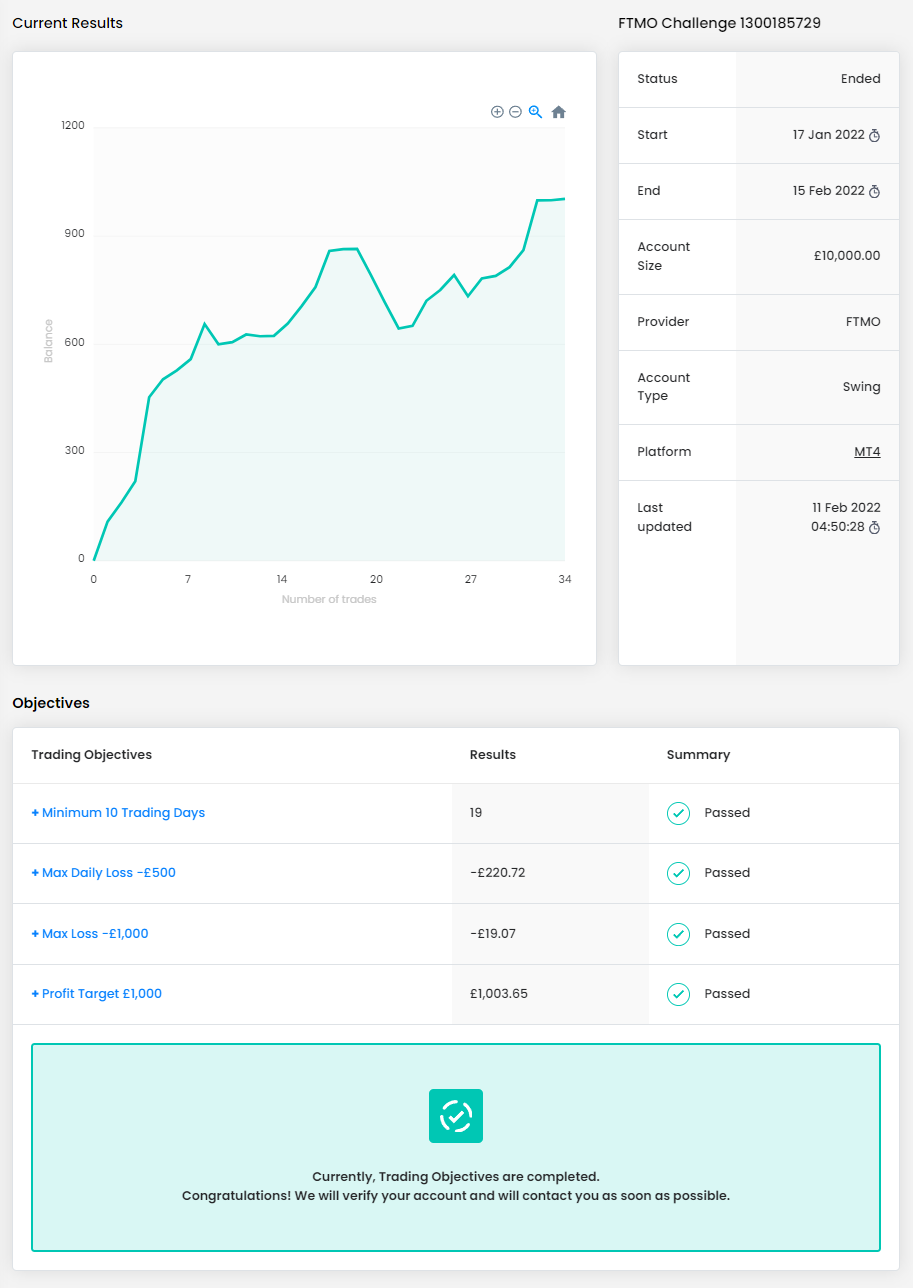

Reaching my profit target during verification was a lot easier than expected as I hit it after only 8 trading days.

What was the hardest obstacle on your trading journey?

Managing my mentality during the challenge and verification, I had to keep my emotions in check to remain calm when trades were moving opposite to my TP goal to trust that they would move in the correct direction which prevented me from closing trades early when they were in loss.

How did loss limits affect your trading style?

The maximum loss suited my trading style of using my risk management of risking 1% of my account per trade using lot size to control this. The maximum loss draw down did mean I had to limit the number of trades I could enter at one time until I could lock in a profit to each one.

What was more difficult than expected during your FTMO Challenge or Verification?

During the FTMO challenge I came close to the 30-day limit and had to prevent myself from panicking and opening trades that were too big in my quest to complete the challenge, I was able to prevent this and was rewarded with passing the challenge with 2 days to spare.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

I have been using a swing account to carry trades over and twice I had trades which during the switch from one day to another pushed beyond and closed after my Stop Loss and resulted in bigger losses than expected. I managed this by checking my trades 30 minutes before the market close time and deciding whether to close the trade or remove the stop loss depending on how the trade was shaping up.

One piece of advice for people starting their FTMO Challenge now.

Ensure you use adequate risk management whatever your strategy to ensure any losses you make are recoverable from.

Trader Benard: “Losing 10% of the account shows how you are not ready to manage big capital.”

What do you think is the key to long-term success in trading?

Long term success in trading is characterized in three aspects, risk management, discipline and not giving up. However good your strategy is, with poor risk management you can't go far with trading, the market will always try to kick you out no matter how good you are in sniper entries, but with proper risk management, you can survive. Discipline, every trader must be disciplined to get good results, without that, you will always leave you will always eat pieces and leave the real bread. Never giving up, no matter how many accounts blown, never give up, there is no best opportunity to financial freedom other than trading.

How did you eliminate the factor of luck in your trading?

I eliminated the factor of luck by going with big boys, for example, getting my entries on big timeframe, avoiding noise associated with small timeframes.

What was more difficult than expected during your FTMO Challenge or Verification?

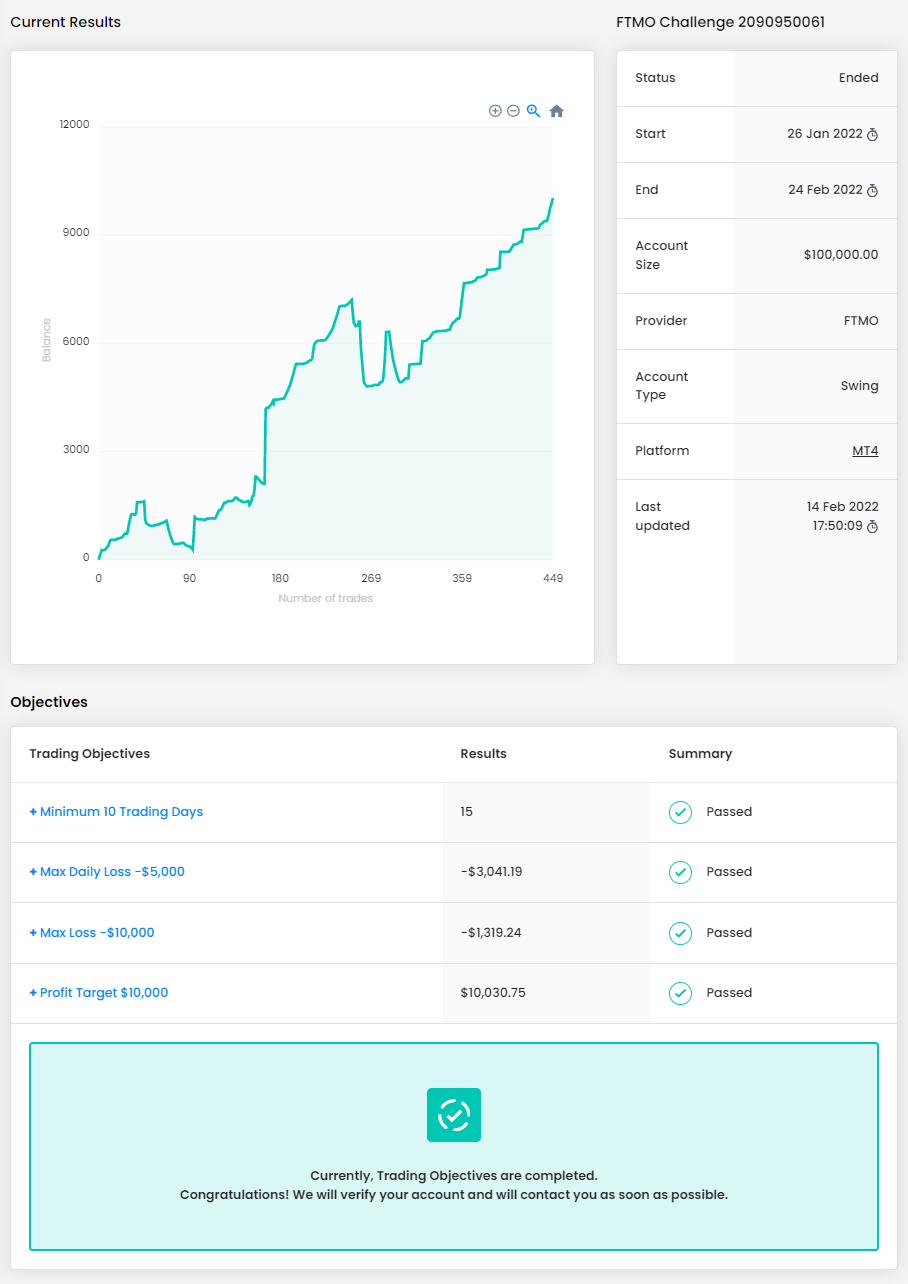

Here I can say challenge stage is harder than I expected, making 10% target brings in gambling mentalities, like increasing lot size etc. With verification it was as sweet as eating a cake, two months to make 5% is real fair.

How did loss limits affect your trading style?

Maximum loss didn't affect me, in this case, losing 10% of the account shows how you are really not ready to manage big capital, protecting capital is more important during the challenge.

What was easier than expected during your FTMO Challenge or Verification?

Verification was easier than I expected, in fact I was able to catch big moves within the shortest time possible.

What is the number one piece of advice you would give to a new trader?

Never give up, every strategy wins if you apply proper risk management, here I mean small lots, big lots will not take you anywhere other than punishing your pocket.

Trader Michael: “As traders, we are playing a game of probabilities, and it is impossible to win every trade.”

How has passing the FTMO Challenge and Verification changed your life?

Passing the challenge has definitely changed my life. It has shown my family that I am a serious trader and now have the potential to earn a living doing what I love.

Do you have a trading plan in place, and do you follow it strictly?

Yes. Every trader must have a trading plan and I follow that strictly every day.

What was more difficult than expected during your FTMO Challenge or Verification?

The challenge stage is definitely the most difficult as earning 10% in 30 days is challenging. The new 14-day extension was a huge help as I was at 8% at my 30 days and was able to pass the 10% on my 33rd day so the extension was game changing for me.

How did you manage your emotions when you were in a losing trade?

At first dealing with losing trades was tough because I took it personally. But as I became a more experienced trader, I have learned to separate my ego from my trades. A good trade is a good trade regardless of the results and as traders we are playing a game of probabilities and it is impossible to win every trade.

What do you think is the most important characteristic/attribute to become a profitable trader?

Staying disciplined with your trading plan and chipping away every day.

What would you like to say to other traders that are attempting their FTMO Challenge?

I think risk management is the most difficult part of the FTMO challenge overall because it has such strict loss limit rules. Create a trading plan that ensures your risk management stays within the loss limits and make sure you can lose multiple days without losing the challenge.

Trader Kioja: “If I lose 2% in a day, I will stop trading and come back the next day.”

How did you eliminate the factor of luck in your trading?

By finding my edge. I trade a setup that works for me every day and don’t stray from it. Outside of live market hours, I backtest to find other setups that I can see consistently.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, I would like to manage 400k+ in capital.

Describe your best trade.

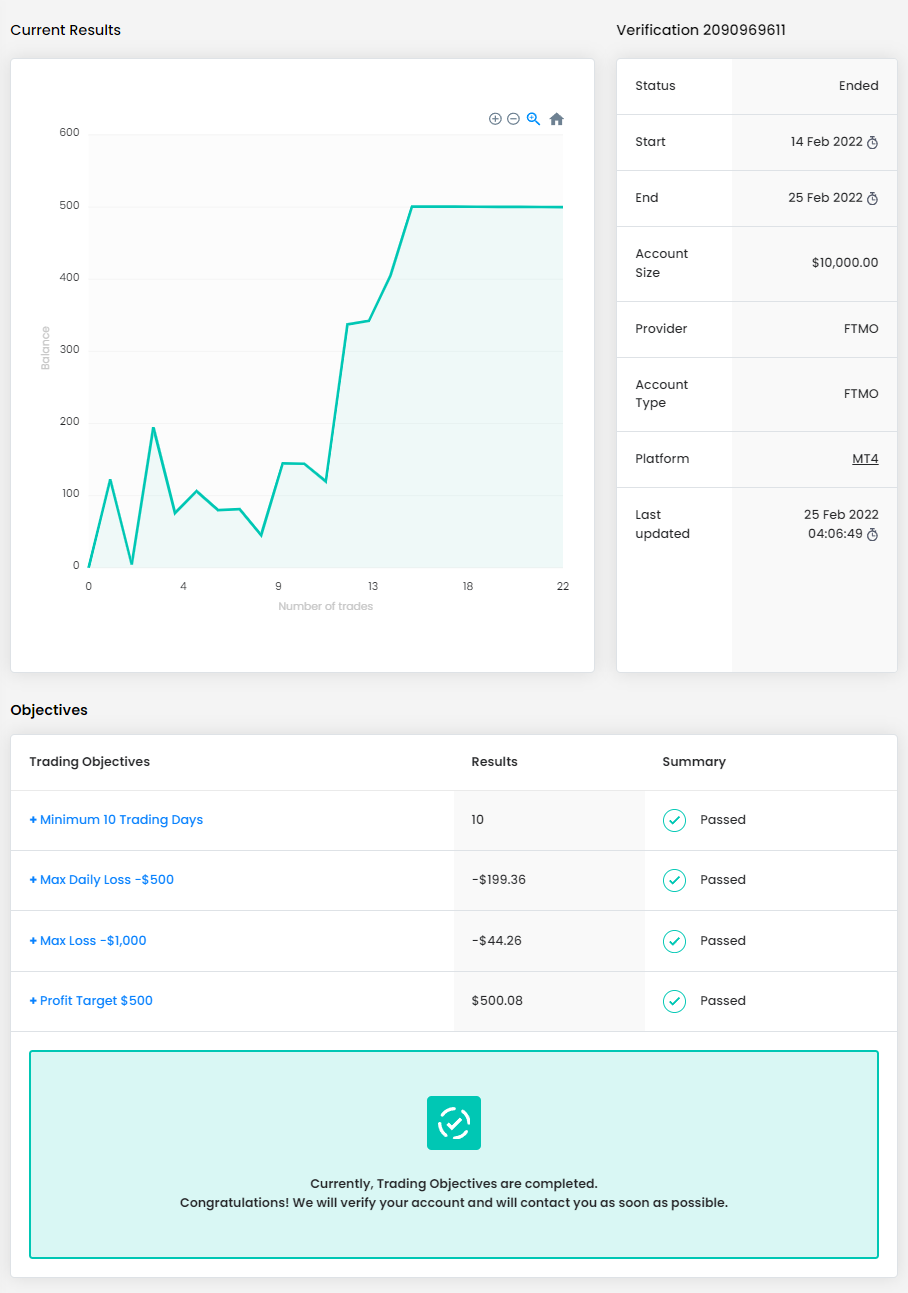

I can’t remember any one trade, but I can say what a perfect trade looks like to me. A perfect trade is when price leaves an area of Supply/Demand while trending, then bounces and pulls all the way back to give me a nice entry on a tap to ride the trend continuation. If I can get a tight stop loss with it, that’s the chef’s kiss. Consistently taking that setup is what allowed me to pass the challenge.

What does your risk management plan look like?

I typically risk 0.5% to 1% a trade and take 1:3RRR trades. If I decide to trail, I’ll lock in my 3R and follow price with my stop loss. If I lose 2% in a day, I will stop trading and come back the next day.

What was the hardest obstacle on your trading journey?

Figuring out a strategy that works for me. I didn’t realize that following tons of people and using their strategies wasn’t the way to profitability. I only found consistency once I took all the knowledge I’ve gained over the years and hit the charts to figure out what my own eyes were seeing.

One piece of advice for people starting their FTMO Challenge now.

Wait until you find your edge before starting the challenge. You want to make sure your psychology is 100% under control and that you have some form of consistency.

Trader Thomas: "Learn to leave your emotions behind!"

How did loss limits affect your trading style?

I managed the risk accordingly to the FTMO criteria by keeping my trades at a maximum risk of 0.5% percent. Once a boundary is set one needs to be disciplined and work within those boundaries. I think, it’s great to have these limits in place because you are always aware of how to manage your risk.

Describe your best trade.

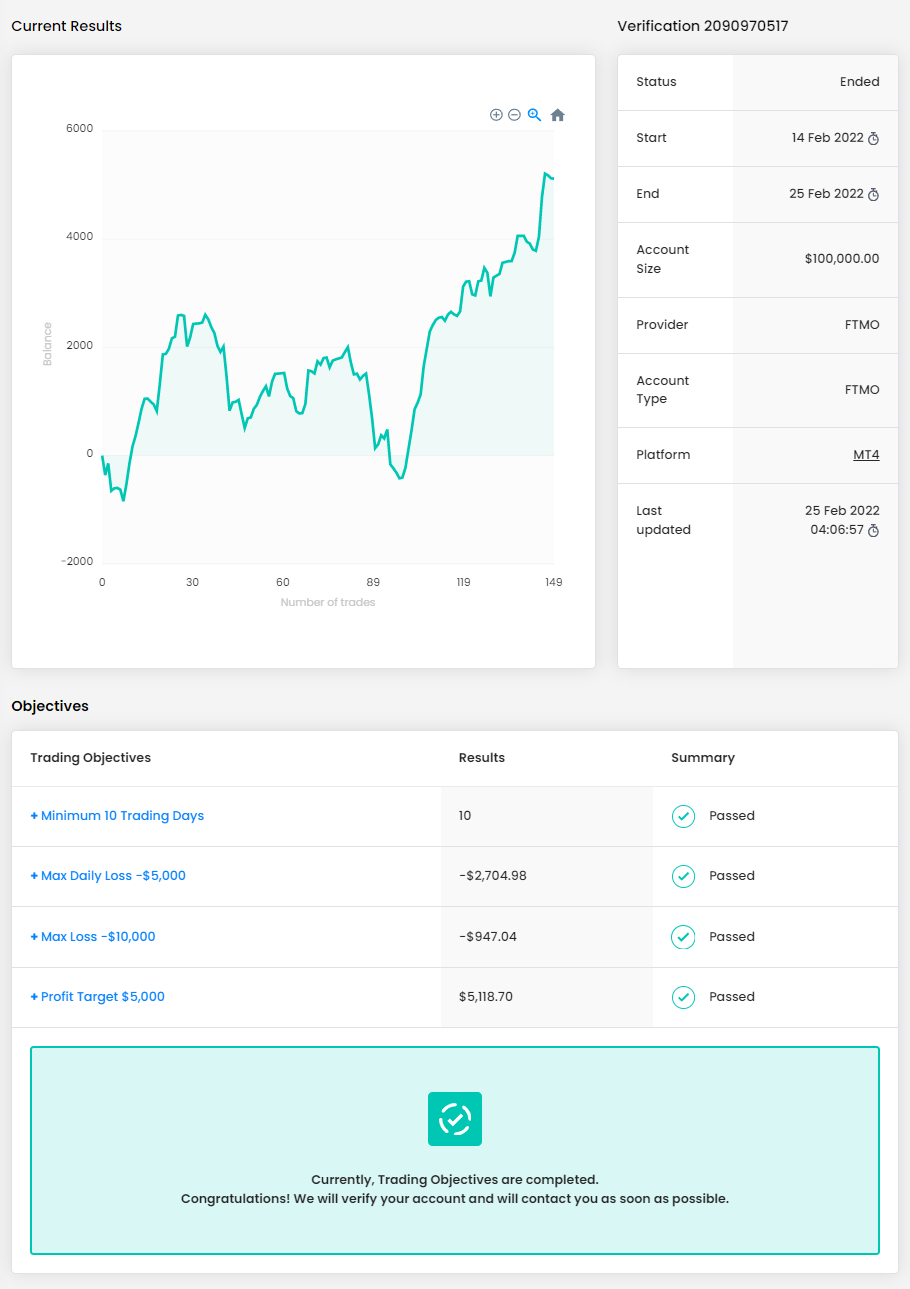

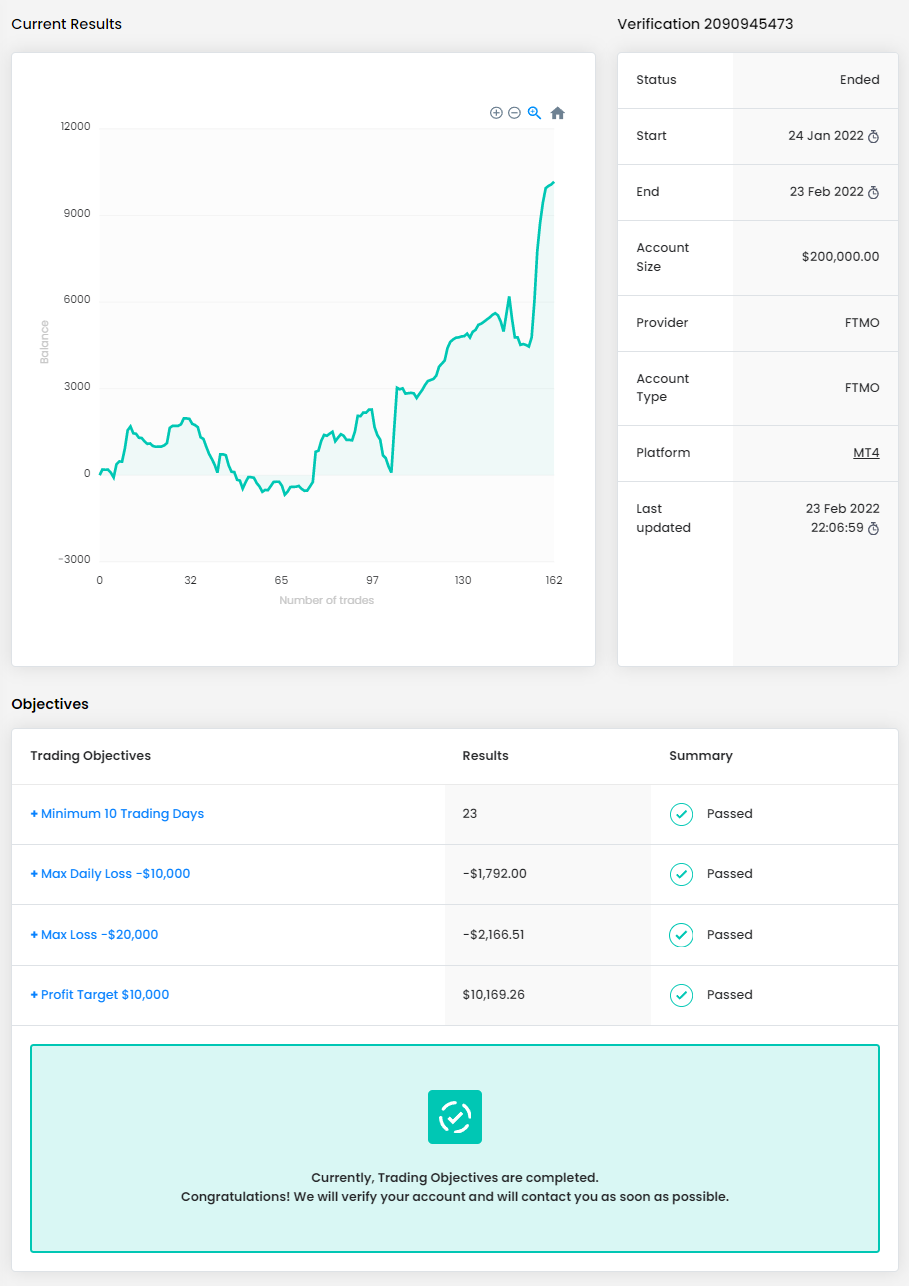

I have two actually, one of the most phenomenal trades I took in the verification process was GBPJPY sell on the 23/02/22 which played out perfectly to my analysis and gave very little drawdown. The other trade was GBPUSD sell taken on the 23/02/22. They pretty much played out identically and gave a great RRR respectively. These trades met all of my criteria and were just beautiful to execute.

How did you manage your emotions when you were in a losing trade?

When I execute a trade, I know that I have analyzed the charts to the best of my ability. Having a stop loss in place along with effective risk management there is no need to get emotional about losing a trade. It's a part of the process. You can't win every trade, but the law of probability should pay in your favor.

What was the hardest obstacle on your trading journey?

Managing my emotions I think was the hardest obstacle in my trading journey and also overtrading really complicated things. I believe by having strict risk management practices in place I now only trade when my setups form & trade without emotion.

How would you rate your experience with FTMO?

I think the experience has been great, failing the first challenges made me more determined to develop a better trading strategy, skill set and pay more attention to risk management.

What is the number one piece of advice you would give to a new trader?

Find a strategy that works for you, always use a stop loss and effective risk management & never revenge trade. Learn to leave your emotions behind!

__________

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.