A 19% profit on stocks in two weeks? Why not?

In the next part of our series on successful FTMO Traders, we'll have a look at a trader who made almost 20% in two weeks by trading stock indices. Does that seem incredible to you? Then read on.

Stock investors have faced significant losses in recent weeks, but trading stock indexes doesn't have to be a losing game. Success lies in timing: knowing when to enter and when to exit the markets can make all the difference. Yes, it's true that predicting the kind of market washout we saw at the end of last week is quite difficult. On the other hand, Donald Trump's imposition of nonsensical tariffs was not unexpected; the tariffs were announced well in advance. Rather, the problem was that nobody expected them to be on such a scale, and the reaction from investors may have been too strong.

However, this does not change the fact that our trader managed to make almost 20% over two weeks by trading stock indices. The balance curve clearly shows that he has been in profit since the beginning of the trading period and despite a relatively large number of losing trades he had no problem consistently increasing his profit.

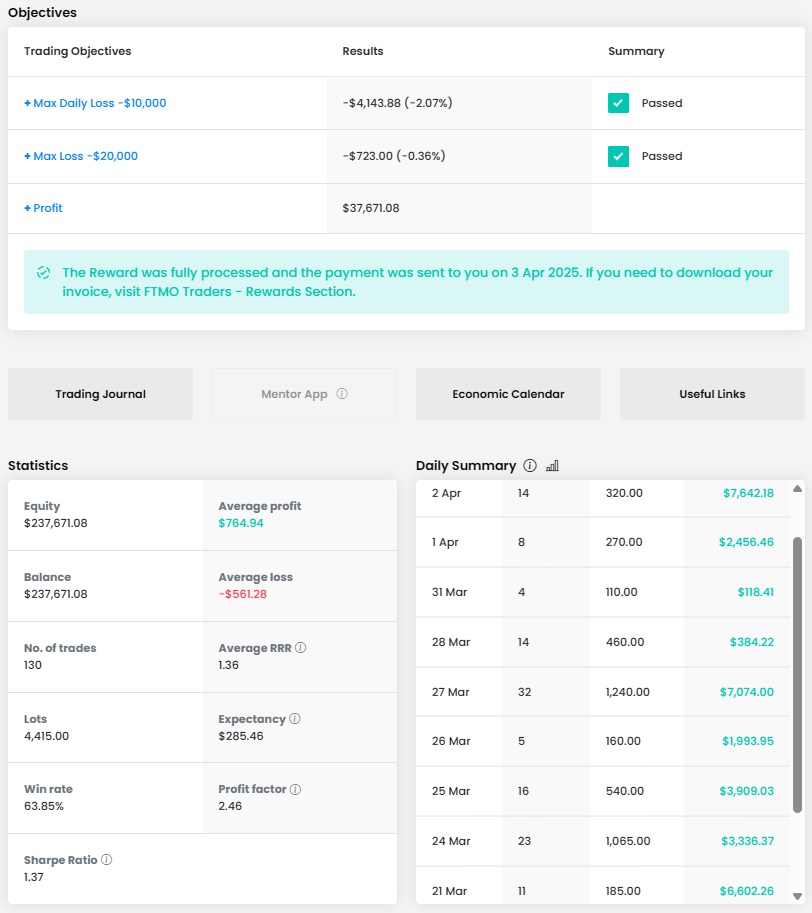

A total profit of $37,671.08 is awesome in any account, even with a $200,000 account that's a profit of nearly 19%. Who wouldn't want that in eleven trading days, right? That this was probably no coincidence is also proven by the statistics on the Maximum Loss Limits, which the trader was very far from.

The combination of the average RRR (1.36) and the success rate of trades (63.85%) is pretty much right, and if a trader handles it well from a psychological point of view, he practically won. Thanks to this, the trader was able to record a positive result in all his trading days.

Our trader executed 130 trades in the trading period with a total volume of 4,415 lots, which is a lot at first glance. So on average, one position had a little over 33 lots, which is a lot, but for the US stock indices it's pretty good, still far from the maximum possible position.

In some cases, the trader opened larger positions that were already close to the maximum we are able to accept (it also depends on the Stop Loss, which fortunately our trader set quite reasonably). Of course, we don't like to see this, and we warn traders in such cases that we are not willing to accept such behaviour in the long term. There is no need to exceed a reasonable level of risk to get a good result, and our recommendation in this regard is quite clear.

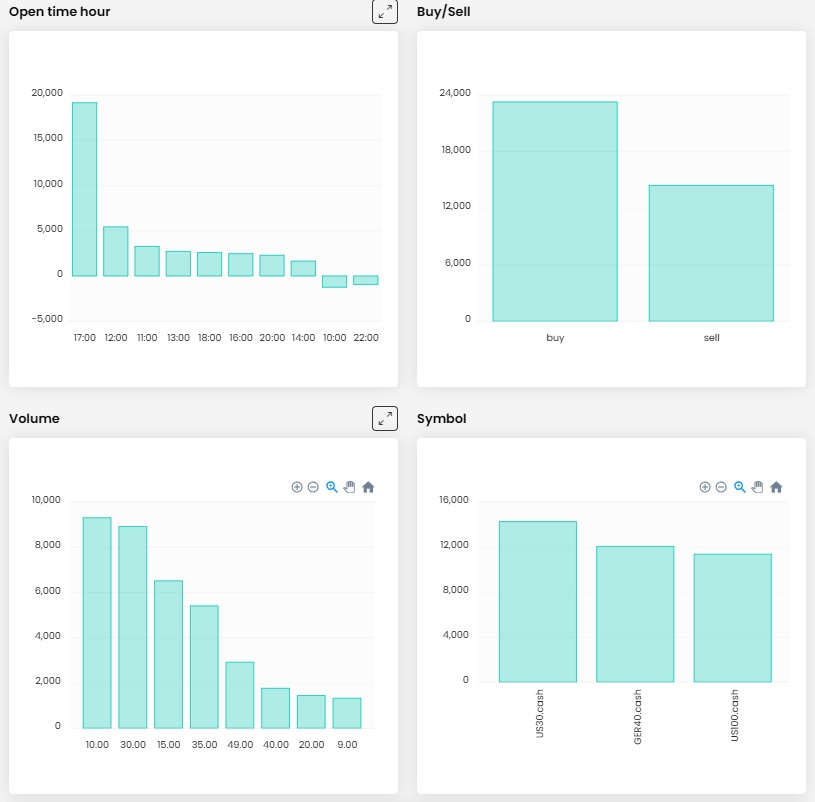

The journal again makes it clear that he is a short-term trader and scalper. He keeps his trades open for a few dozen minutes at most, sometimes less than a minute. Such trading requires a lot of attention and is not only time consuming but mentally demanding. As can be seen, the trader does not open unnecessarily large positions at the end of the trading period, but on the other hand, he divides them into multiple trades.

At the same time, he tried to keep the losses to a minimum, which is useful at the end of the period, because it is unnecessary to lose a lot of money just for the sake of chasing more profits. Unfortunately, we often see traders behave exactly the opposite at the end of a trading period and it also often happens that they completely unnecessarily break the Maximum Daily Loss rule, even though their overall profit is very high.

The trader traded only three instruments, namely two US indices (DJIA - US30.cash and Nasdaq 100 - US100.cash) and then also the German DAX (GER40.cash). Although he traded at a time when the markets had no clear direction and were more likely to storm ahead of Trump's tariffs, he was able to profit on both long and short positions. In short, scalping can be quite successful during periods when markets fluctuate up and down.

Since the trader traded both European and American stocks, he could open trades practically throughout the day, which he did. However, he was most successful after the opening of the US exchanges, which is when the market is most liquid and volatility also plays in scalping's favour.

We also look at the trader's most successful trade. These are two positions that the trader entered shortly after each other when the price of the DJIA stock index bounced off the short-term trend line. The first position was opened after the line was broken, so it was a somewhat risky trade, and it was also a smaller position. The second position was opened by the trader after the bounce, it had three times the volume and here the trader was explicitly counting on the price to continue upwards.

As you can see, the trader's trade was successful, both positions ended in profit, the first with a profit of $1,480 and the second with a profit of $3,360. It is a bit of a shame that the second position was not held by the trader until the Take Profit was reached, which was a few points higher, but as mentioned, it was the end of the trading period and the total profit of over $4,800 is still very nice. Trade safely!

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?