Trading Week Ahead: Markets Brace for Fed Signals and NFP Amid Shutdown

Markets face a data storm this week as FOMC Minutes, Nonfarm Payrolls and the Unemployment Rate take the spotlight. With the US government already in shutdown mode, key data releases may be delayed or limited. In this fog of uncertainty, traders should prepare for sharp moves across FX, bonds and equities as markets react to every available signal.

• FOMC Minutes

This week’s release of the Fed’s latest meeting minutes gains added importance as markets seek clarity amid a potential data blackout. With fewer macro prints available due to the shutdown threat, any dovish tilt in the Fed’s tone could weigh on the dollar and Treasury yields while lifting risk assets. Conversely, a reaffirmed hawkish stance may reinforce bets on prolonged higher rates, boosting the greenback and pressuring equities.

• Nonfarm Payrolls

Friday’s NFP report (previous: 22K, forecast: 51K) arrives at a time of elevated political tension. A potential U.S. government shutdown could amplify market sensitivity to economic data. A solid increase in employment would likely strengthen the dollar and push rate-cut expectations further out, while a disappointing result could revive risk appetite and put pressure on the greenback.

• Unemployment Rate

While often overlooked compared to payroll data, the unemployment rate could still move markets, especially if other economic reports face shutdown-related delays. Analysts expect the rate to hold steady at 4.3%, matching the previous figure. A higher reading would point to softening labour market conditions and could push the Fed closer to rate cuts. A lower print would likely support the view that rates need to stay elevated for longer.

| Date | Time | Instrument | Event |

|---|---|---|---|

| Monday, Oct. 6 | 7:00 PM |  EUR EUR |

ECB President Lagarde Speaks |

| Tuesday, Oct. 7 | 4:00 PM |  CAD CAD |

Ivey PMI |

| Wednesday, Oct. 8 | 3:00 AM |  NZD NZD |

Official Cash Rate |

| 8:00 PM |  USD USD |

FOMC Meeting Minutes | |

| Thursday, Oct. 9 | 2:30 PM |  USD USD |

Fed Chair Powell Speaks |

| Friday, Oct. 10 | 2:30 PM |  USD USD |

Average Hourly Earnings |

USD USD |

Unemployment Rate | ||

USD USD |

Nonfarm Payrolls | ||

CAD CAD |

Employment Change | ||

| 4:00 PM |  USD USD |

Prelim UoM Consumer, Inflation Expectations |

*All times in the table are in GMT+2

Technical Analysis with FVG Strategy

This trading strategy uses the EMA 20 and 50 to assess market trends and the Fair Value Gap (FVG) to identify areas of price imbalance. These imbalances, caused by rapid price movements, often indicate high-probability entry and exit points. This approach can be applied to currency pairs such as EURUSD and GBPJPY, as well as US30 and XAUUSD, and provides a review of recent price action and potential trading opportunities.

Weekly Market Outlook

EURUSD

Market Context: EURUSD is currently trading between strong resistance and a previously tested support zone. Price has reacted to both levels, but momentum remains uncertain following a lack of directional conviction.

Bearish Scenario (Preferred): A break below the support, which has already been tested multiple times, could open the path toward the next downside liquidity area. The recent rejection from resistance adds weight to the bearish case.

Bullish Scenario (Alternative): A bounce from support may lead to a short-term rally toward resistance. However, buying interest remains weak, and the upside may be limited without stronger confirmation.

FVG Setup: No new FVG has formed this week. Last week’s bearish FVG setup was stopped out due to indecisive price action and lack of follow-through from sellers.

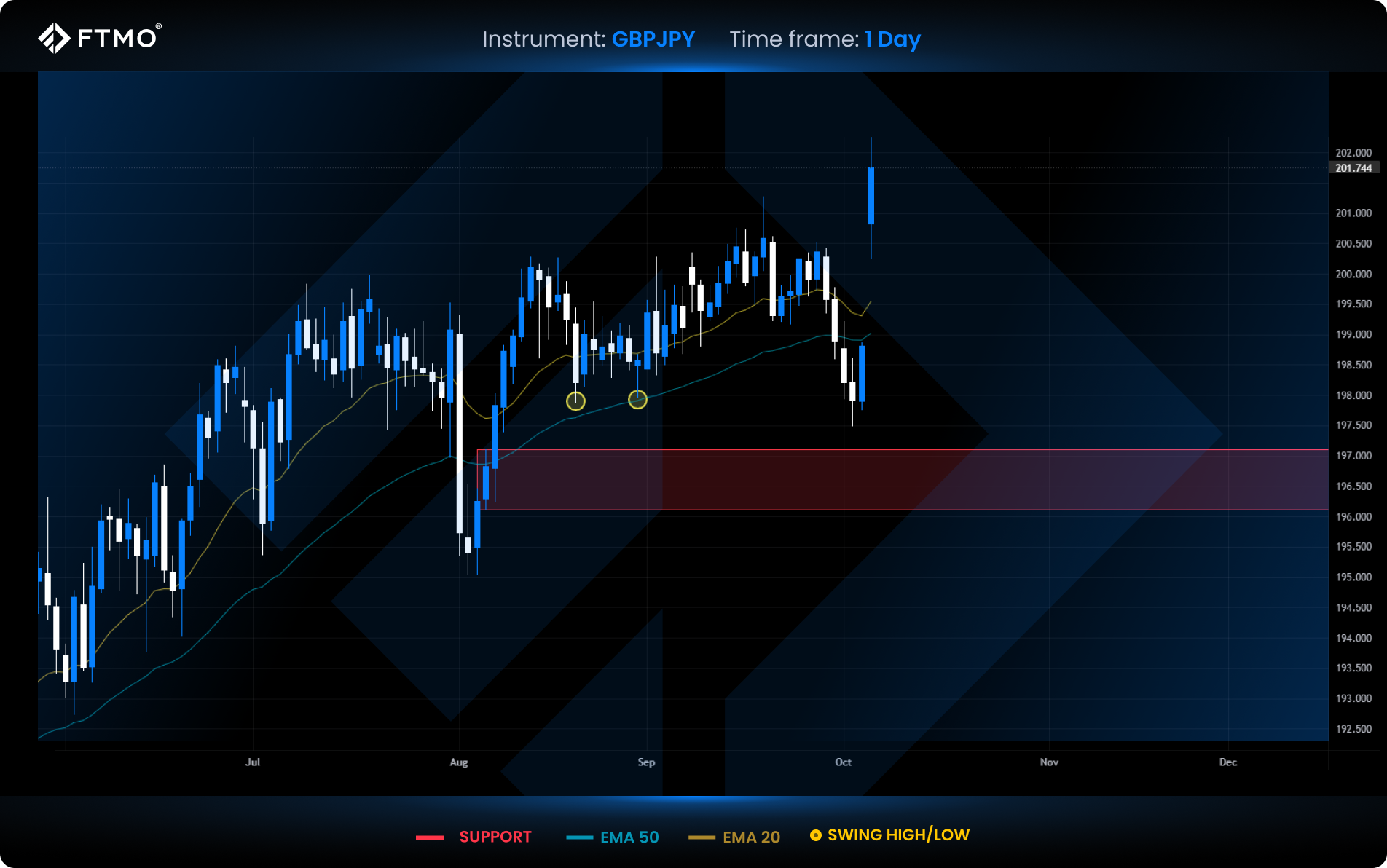

GBPJPY

Market Context: After a sharp drop that cleared two swing lows, GBPJPY closed Friday with strong bullish momentum. Monday’s open extended that move, forming a notable overnight gap.

Bearish Scenario (Preferred): The main expectation is a retracement to fill the overnight gap. Price is overextended in the short term, and a move lower toward the gap zone would align with typical gap-closing behaviour.

Bullish Scenario (Alternative): If bullish momentum remains strong, price could continue rallying without filling the gap immediately. A sustained move higher would shift focus to the next resistance zone.

FVG Setup: No new FVG formed this week. Last week’s bearish FVG reached its 2:1 RRR target.

XAUUSD

Market Context: Gold remains in a strong uptrend as market uncertainty boosts its role as a safe-haven asset. Price continues to respect FVG levels, reinforcing bullish structure.

Bullish Scenario (Preferred): Continuation of the uptrend is expected, with potential targets at the 2:1 RRR level from the last FVG, and possibly extending toward the 4000 psychological level.

Bearish Scenario (Alternative): A short-term correction could occur as part of natural trend exhaustion. Such pullbacks often present as large candles with high volume before buyers regain control.

FVG Setup: A bullish FVG formed last Wednesday remains active and is currently in play.

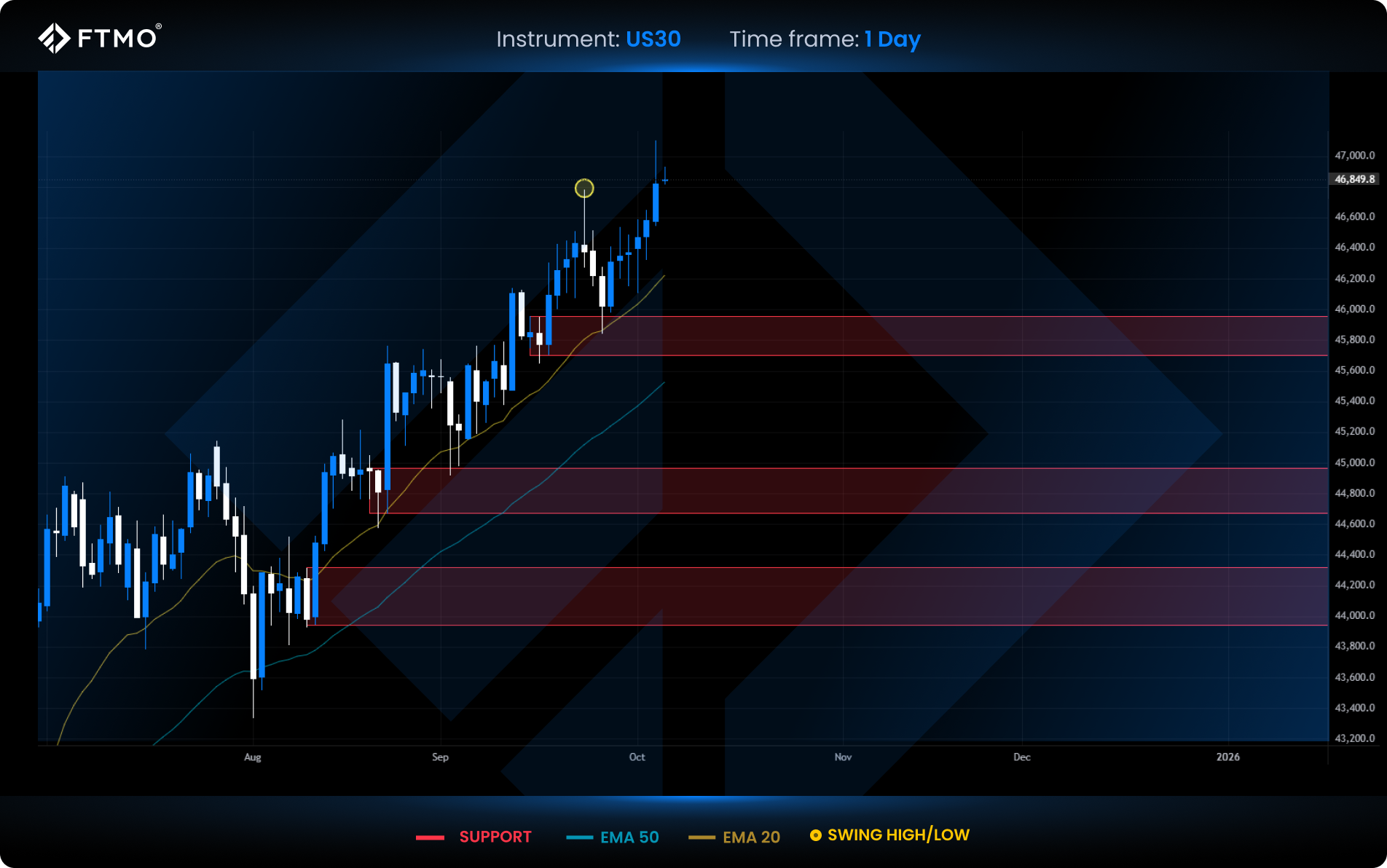

US30

Market Context: US30 took out the previous swing high from two weeks ago, paused briefly, and has now resumed its upward trend. Bullish structure remains intact.

Bullish Scenario (Preferred): The trend looks set to continue higher, potentially targeting all-time highs as long as momentum holds and price stays above recent support levels.

Bearish Scenario (Alternative): A minor pullback could develop, but current price action shows no clear signs of reversal or selling pressure.

FVG Setup: No FVG setups have formed this or last week, reflecting a market driven more by trend structure than gap imbalances.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.