Forex Pays Off: How Sticking to the Majors Delivered $23K Profit

In the next part of our Successful Trader Stories, we take a look at a trader who proved that focusing on just one or two closely related instruments can deliver strong results. By staying disciplined and trading mainly EURUSD and GBPUSD, he turned two merged FTMO Accounts ($200,000 and $100,000) into a solid payout.

A Rocky Start, Then Steady Growth

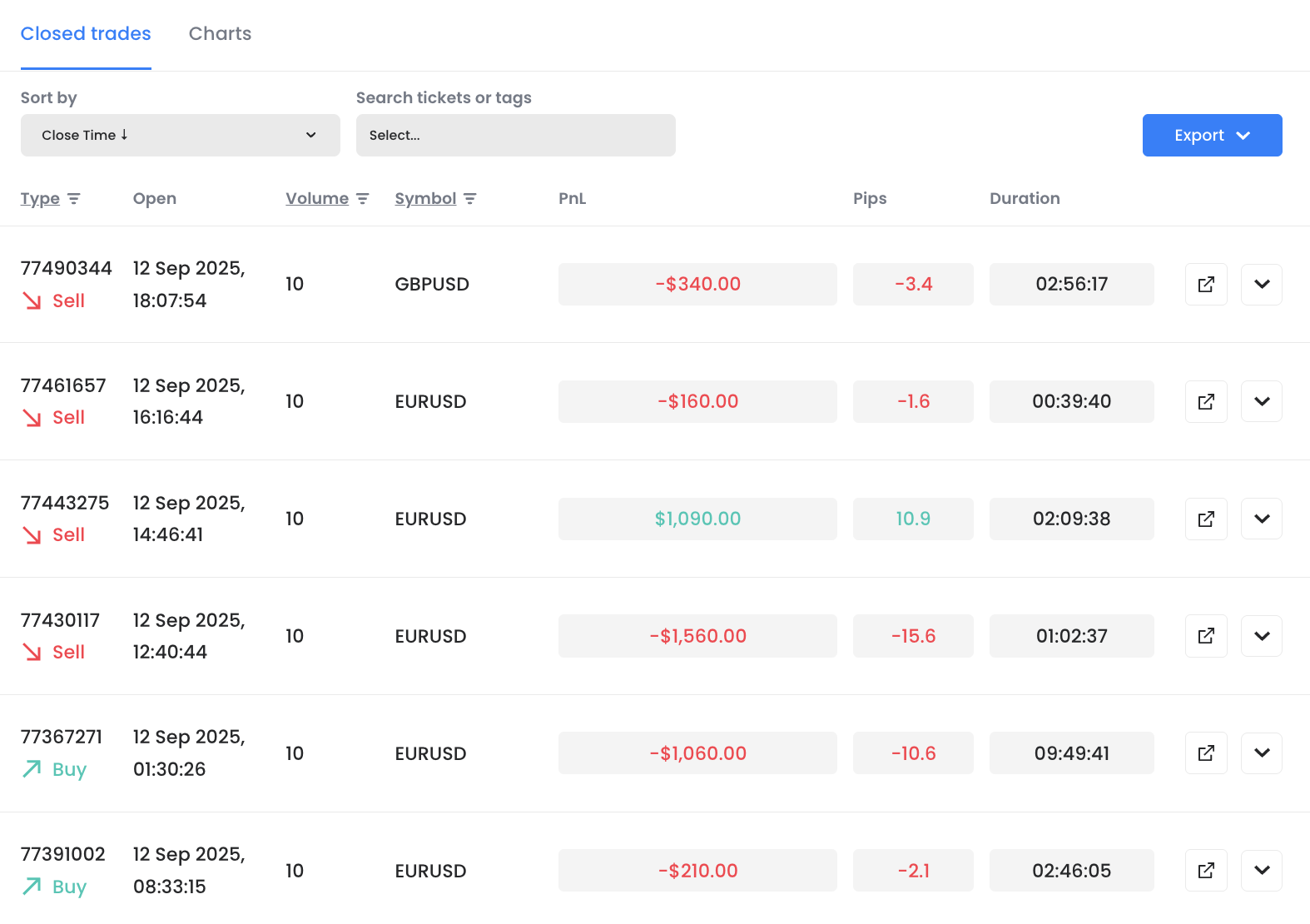

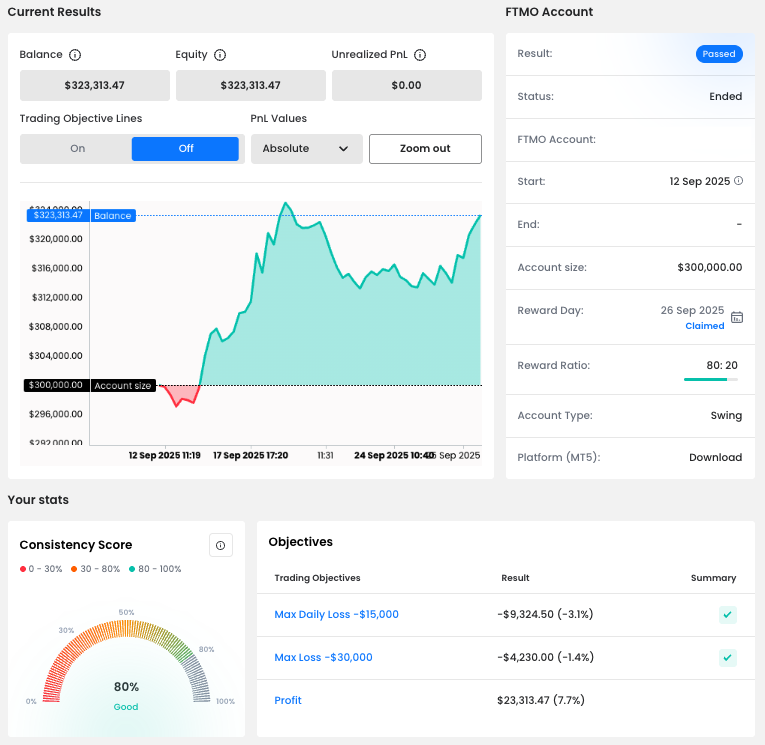

The balance curve shows it clearly – the first trading day on 12 September was far from ideal. Out of the first six trades, five ended in losses, which could easily shake the confidence of many traders. But he kept his cool, respected his Max Daily Loss, and avoided emotional revenge trading.

Three days later, on 15 September, he came back with a clear head. From that point on, the equity curve shows a consistent climb, leading to a final balance of $323,313.47. That’s a profit of $23,313.47 (7.7%) on the $300,000 combined account.

Numbers That Tell the Story

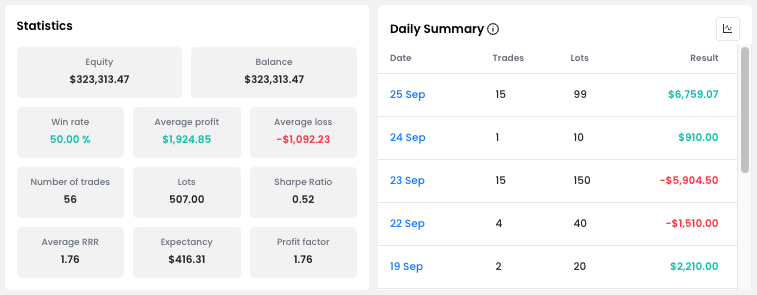

This trader proved that you don’t need to win all the time to be profitable. With a Win Rate of 50%, he won exactly half of his trades. But thanks to an average reward-to-risk ratio of 1.76, his winning trades more than compensated for the losing ones.

His average profit trade was nearly $1,925, while his average losing trade cost him about $1,092. Combined with a Profit Factor of 1.76, this shows that his edge came from proper balance – letting winners run longer than losers.

Mastering the Majors

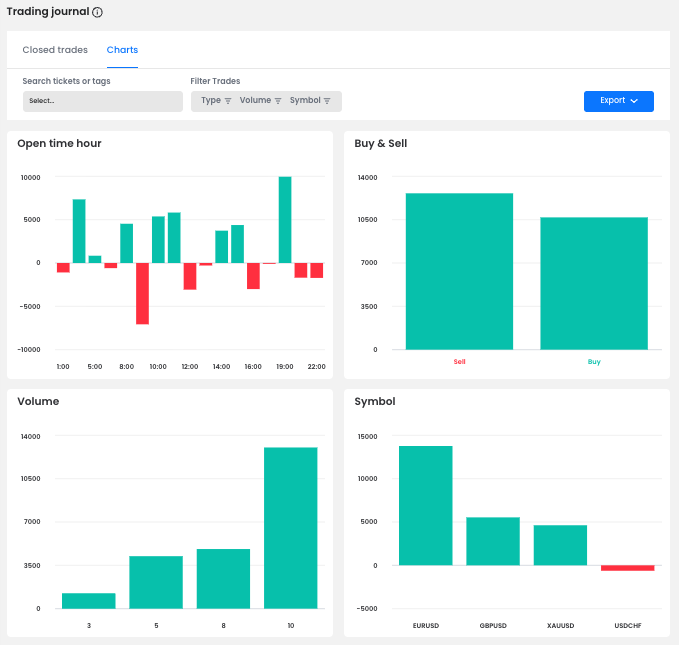

Looking at his activity, it’s clear he was a forex-focused trader. The majority of his volume came from EURUSD and GBPUSD, with some additional trades on XAUUSD. By sticking to just one or two related markets, he built deep familiarity instead of spreading himself too thin.

Interestingly, he traded both longs and shorts in nearly equal measure, showing no bias. He simply followed the setups and took opportunities in both directions.

Case Study: Long and Short on EURUSD

His best trading story played out over just two days on EURUSD. On 17 September, he entered a long position, placing a Stop Loss and holding patiently as the pair climbed. He closed with a strong profit of $6,610, exiting just before the market reversed lower.

And then came the follow-up. The very next day, 18 September, he took the opposite side – a short position on the same instrument. Again, he managed risk with a Stop Loss, timed his entry with precision, and secured a $5,450 profit within just over an hour. Remarkably, the market started rising again shortly after he exited, showing his execution was spot on.

📌 Context: These trades lined up with fundamentals. On 17 September, the Fed finally delivered the rate cut it had long signaled. Normally, such a move would be priced in, making the sharp EURUSD rally somewhat surprising. But markets can still react strongly, and in this case the surprise move worked in the trader’s favor – giving him the best possible setup. On 18 September, sentiment flipped after hawkish Fed commentary, strengthening the USD and driving EURUSD lower. This trader adapted seamlessly to both shifts.

Conclusion

This trader’s story proves that you don’t need dozens of instruments or a sky-high Win Rate to succeed. By focusing on EURUSD and GBPUSD, balancing longs and shorts, and respecting his risk limits, he turned a rocky start into a profitable payout.

What sets him apart is his ability to bounce back after early losses and his spot-on timing on EURUSD in both directions. His trades aligned not only with technical setups but also with the fundamental backdrop, showing the importance of keeping an eye on macro events that drive the markets.

It once again proves that consistency, discipline, patience – and a solid grasp of fundamentals – are the true keys to long-term trading success.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.