Consistency pays off: Sticking to the plan despite drawdowns

In the next part of our series on successful FTMO Traders, we take a look at a trader who proved that even a string of losing trades doesn’t have to ruin performance, as long as you stick to your strategy and respect the risk management rules.

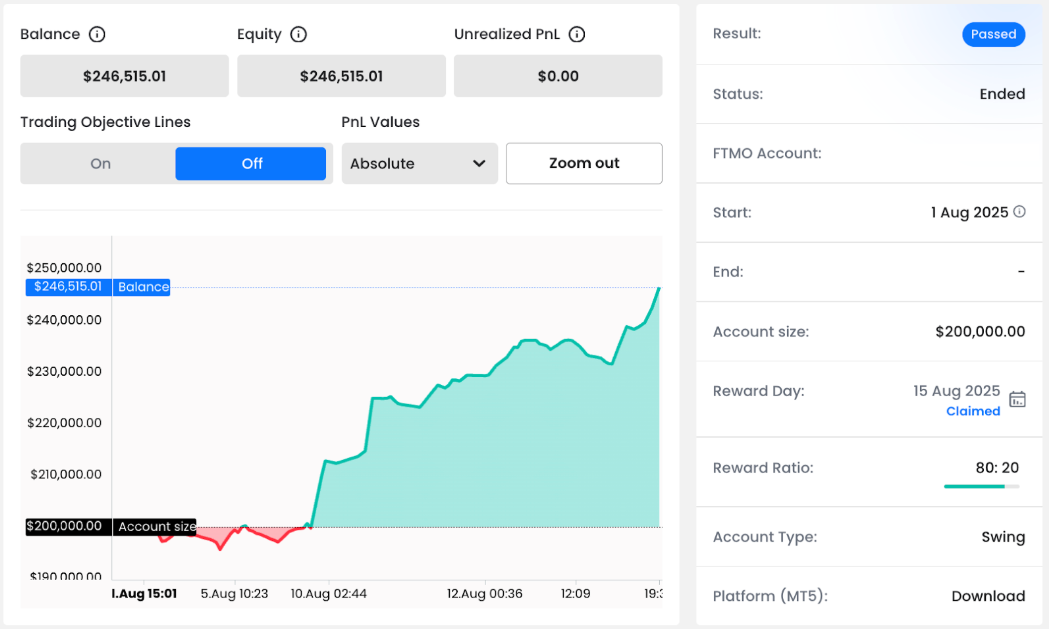

A Strong Balance Curve After a Shaky Start

The balance curve of this trader tells the story clearly. The first few days of the trading period were not easy, with equity dipping into the red.

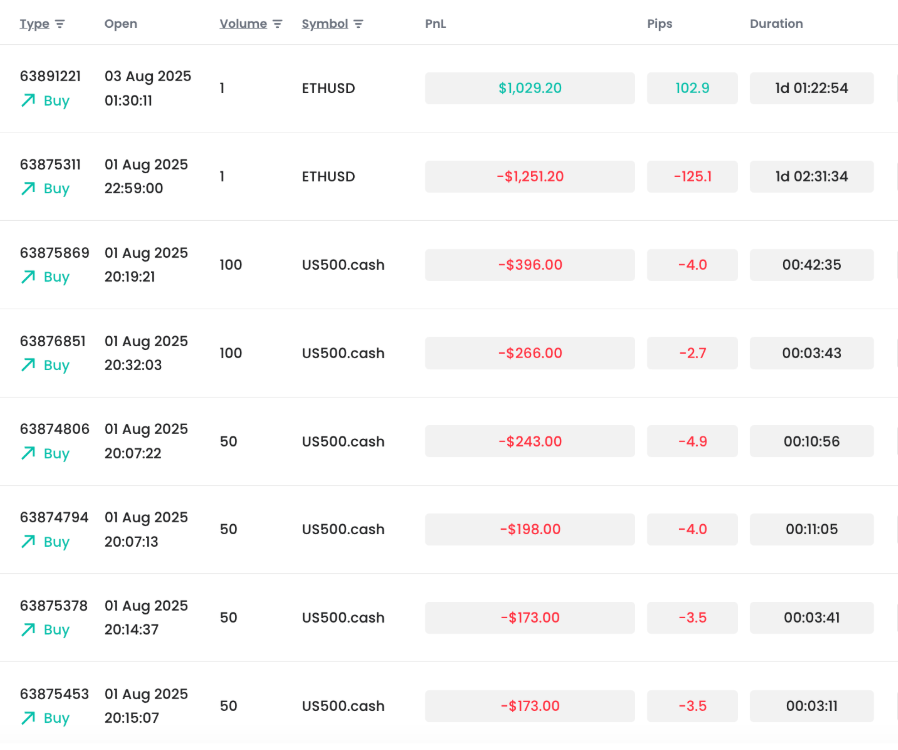

As you can see in the following picture, at one point, the trader recorded seven losing trades in a row, which can be psychologically challenging for anyone.

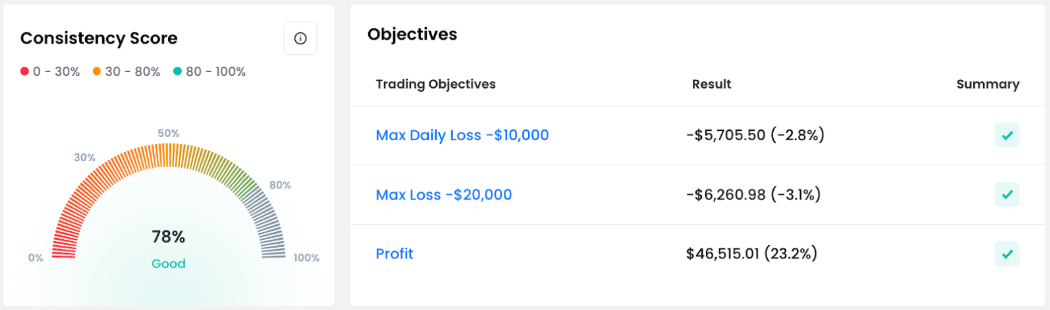

However, instead of panicking or chasing losses, the trader showed resilience. He carefully managed his position sizes and respected his Max Daily Loss limit of 5%, ensuring that no single day could endanger his account. From that point forward, the curve shows steady growth, culminating in a final profit of $46,515.01, which represents an excellent 23.2% return on a $200,000 account.

The Consistency Score of 78% is another confirmation that this was no random success, but rather the result of a structured approach.

Statistics That Support the Strategy

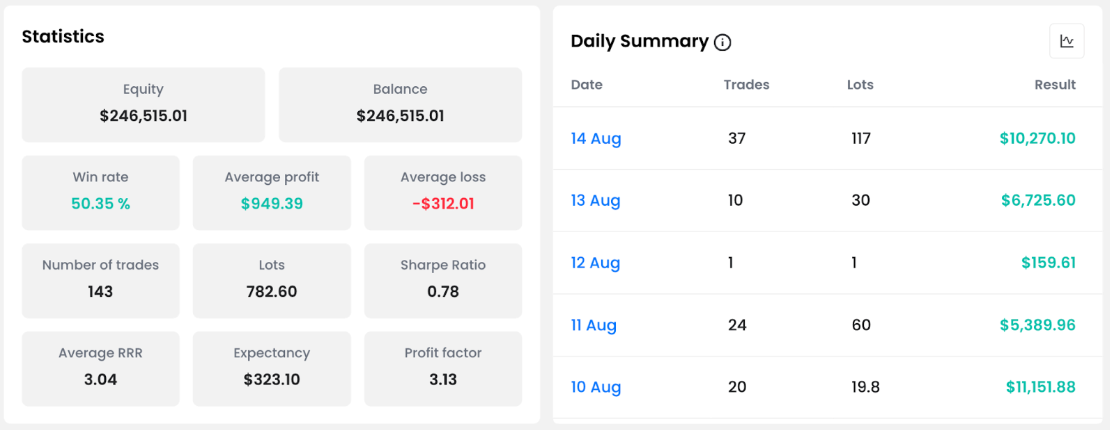

Over the course of just two weeks, the trader executed 143 trades with a total volume of 782.6 lots. This averages to just under 5.5 lots per position, though there was variance depending on the instrument.

The statistics highlight a Win rate of 50.35%. Not extraordinary on its own, but combined with an average reward-to-risk ratio (RRR) of 3.04, it forms a very profitable edge.

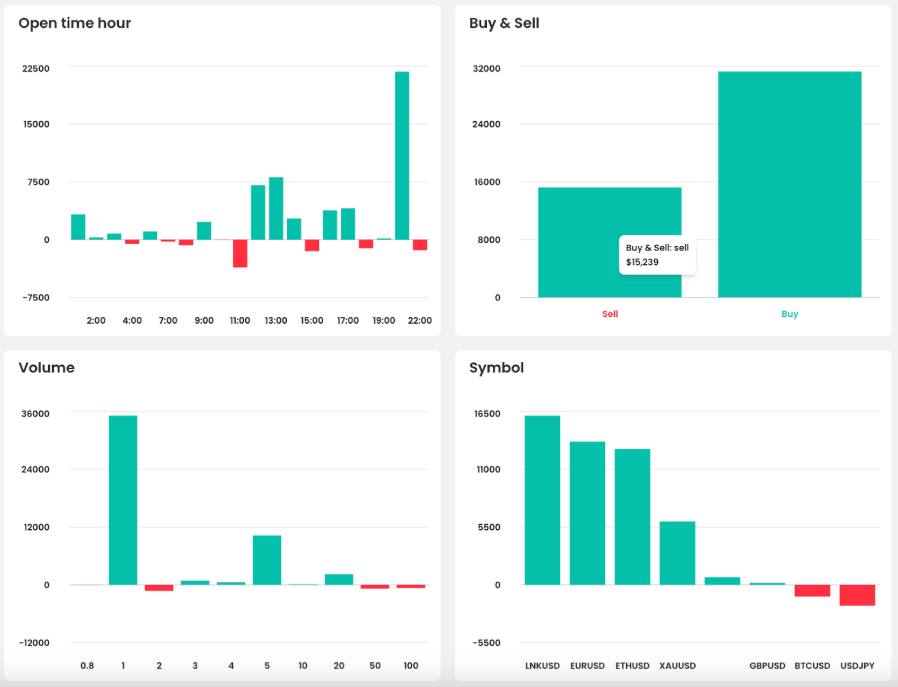

The trader kept adapting to market conditions, with trades lasting anywhere from just a few minutes to several days. That makes it difficult to place him into a single box. He wasn’t strictly a scalper, an intraday trader, or a swing trader, but rather a mix of all three depending on the opportunity.

A Playful Mix of Instruments

The trader rotated between major forex pairs (EURUSD, GBPUSD), precious metals (XAUUSD), cryptocurrencies (LNKUSD, ETHUSD, BTCUSD), and mixed them into his strategy. This flexibility allowed him to adapt to different market conditions and wait for quality setups instead of forcing trades in a single asset.

LNKUSD was clearly the most profitable instrument and delivered strong results, but the trader was able to manage profitable trades across various markets. Diversification in this case did not harm performance.

A Breakthrough on 8 August

The real turning point came on 8 August, when a series of well-timed crypto trades shifted the account out of its early drawdown and set the stage for steady growth.

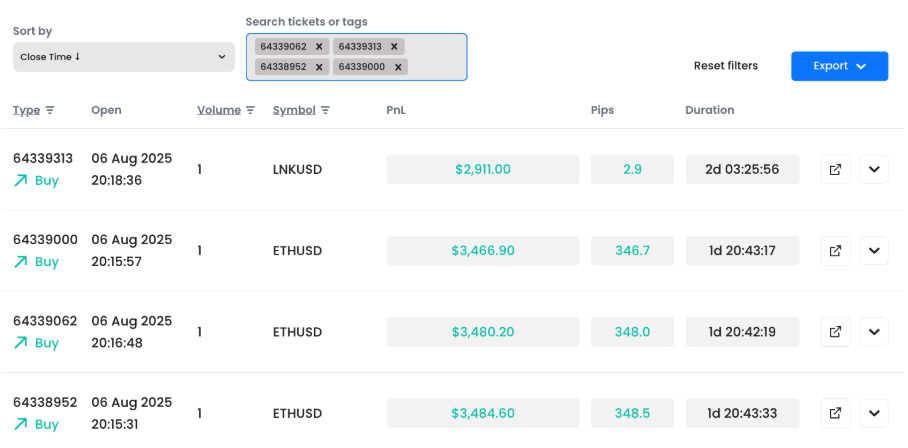

The trader executed three long positions on Ethereum (ETHUSD), each held for nearly two days. Patience paid off: the trades delivered profits of $3,466.90, $3,480.20, and $3,484.60, respectively. Alongside these, a long position on Chainlink (LNKUSD) added another $2,911.00.

Altogether, this cluster of trades generated more than $13,000 in profit, marking the first major push above breakeven. From this point forward, the trader operated with greater confidence and consistency, gradually compounding gains all the way to the payout.

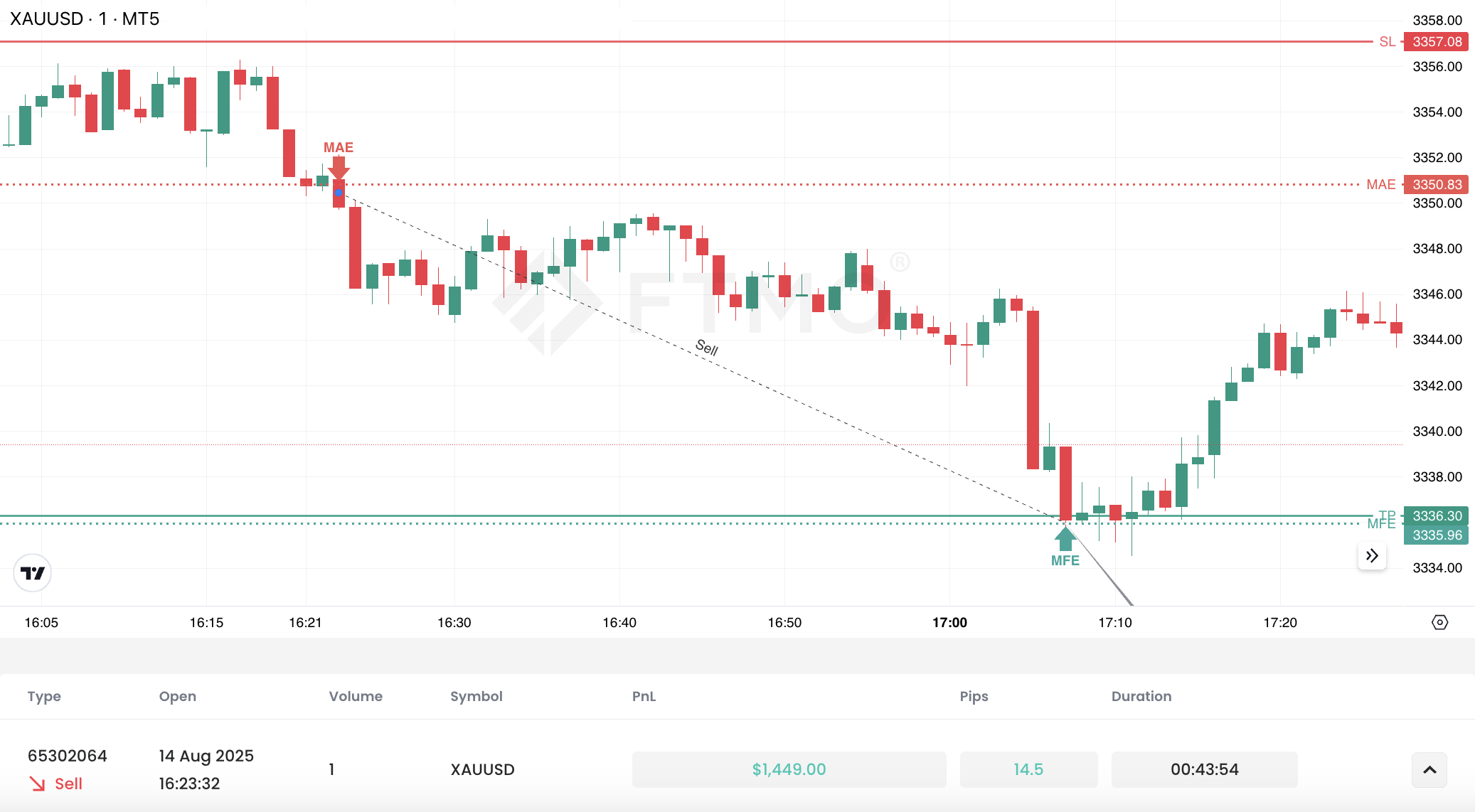

Case Study: A Golden Finish Before Payout

On 14 August, the trader demonstrated a disciplined and convincing approach on one of the most popular instruments of all time: gold. After a bounce from short-term resistance, he opened a series of four short positions within less than 2 hours.

The first two positions, both opened at 3353.60, were held for more than five hours and closed with nice profits of $1,982 and $1,990.

Later that day, the trader entered two additional shorts. This time, the holding period was much shorter (around 44 minutes), but these trades also ended in the green, with profits of $1,449 and $1,438.

In total, this sequence generated nearly $7,000 in a single day. The trading logic was straightforward: capitalize on the rejection from strong resistance and follow the continuation of the downtrend.

Importantly, the trader had his stop losses in place and managed them actively throughout the trades – something we always appreciate, as a random spike against the position can otherwise result in large losses.

In the first two gold trades, he probably adjusted his stop loss during the holding period to protect his profits while still giving the market enough room to move. In the next two trades, he placed his stop loss just above the resistance level and let the trades reach their take-profit targets.

It once again proves that consistency, patience, and respect for risk limits are the true keys to long-term success.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.