Trading Week Ahead: Will Volatility Stay High or Start to Fade?

Will the market volatility we saw last week carry over into the days ahead? Traders are gearing up for another week as fresh events come into play. The spotlight falls on the upcoming ISM Services PMI, weekly US unemployment claims, and a critical interest rate decision from the Bank of England. Each of these events has the potential to significantly reshape market expectations around monetary policy and risk appetite.

• ISM Services PMI

Tuesday’s ISM Services report is expected to show an improvement from 50.8 to 51.5, signalling modest expansion in the services sector. Following recent strength in manufacturing, traders will be watching to see if services confirm the resilience of the US economy.

• Weekly Unemployment Claims

Thursday’s unemployment claims are forecast to rise slightly from 218,000 to 221,000. While still historically low, any unexpected uptick could increase expectations for policy easing if markets interpret it as a sign of cooling labour demand. Alternatively, continued strength in job data may support a more cautious Fed and lend support to the greenback.

• Bank of England Interest Rate Decision

Markets anticipate the BoE to cut its benchmark rate from 4.25% to 4.00% this Thursday. A confirmed cut could pressure the pound and benefit the US dollar via risk-off flows, particularly if policymakers signal a dovish path ahead. However, a surprise hold or hawkish tone may catch traders off guard and fuel volatility across GBP pairs.

| Date | Time | Instrument | Event |

|---|---|---|---|

| Tuesday, Aug. 5 | 10:00 AM |  EUR EUR |

Final Services PMI |

| 10:30 AM |  GBP GBP |

Final Services PMI | |

| 4:00 PM |  USD USD |

ISM Services PMI | |

| Thursday, Aug. 7 | 5:00 AM |  NZD NZD |

Inflation Expectations |

| 1:00 PM |  GBP GBP |

Official Bank Rate | |

| 2:30 PM |  USD USD |

Unemployment Claims | |

| 4:00 PM |  CAD CAD |

Ivey PMI | |

| Friday, Aug. 8 | 2:30 PM |  CAD CAD |

Employment Change |

*All times in the table are in GMT+2

Technical Analysis with FVG Strategy

This trading strategy uses the EMA 20 and 50 to assess market trends and the Fair Value Gap (FVG) to identify areas of price imbalance. These imbalances, caused by rapid price movements, often indicate high-probability entry and exit points. This approach can be applied to currency pairs such as EURUSD and GBPJPY, as well as US30 and XAUUSD, and provides a review of recent price action and potential trading opportunities.

Last Week’s Opportunities

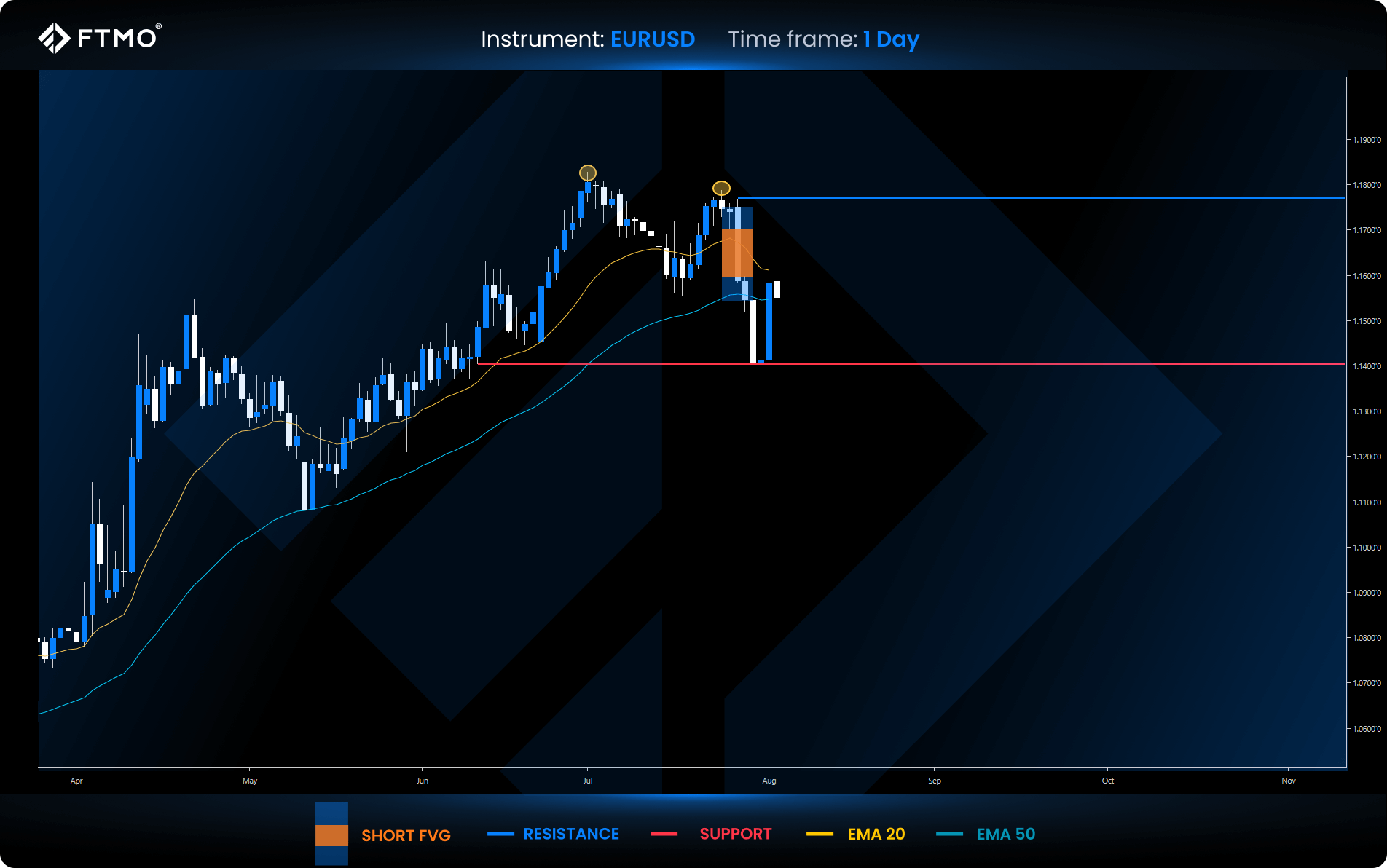

EURUSD

Market Context: After last week’s spike in volatility across major FX pairs, the euro sold off sharply and filled key liquidity zones within previous Fair Value Gaps (FVGs). The pair now trades between the 20 and 50 EMAs, which form an area of dynamic resistance.

Bearish Scenario (Preferred): A rejection from the current zone could lead to further downside, with targets near the 2:1 RRR level or the high of the smash bar candle.

Bullish Scenario (Alternative): A stronger recovery may drive price back into resistance, where sellers could return to the market.

FVG Setup: Two bearish FVGs formed last week. The first from the high remains valid and holds as resistance. The second setup was invalidated by Friday’s bullish close, although it still offers structural context.

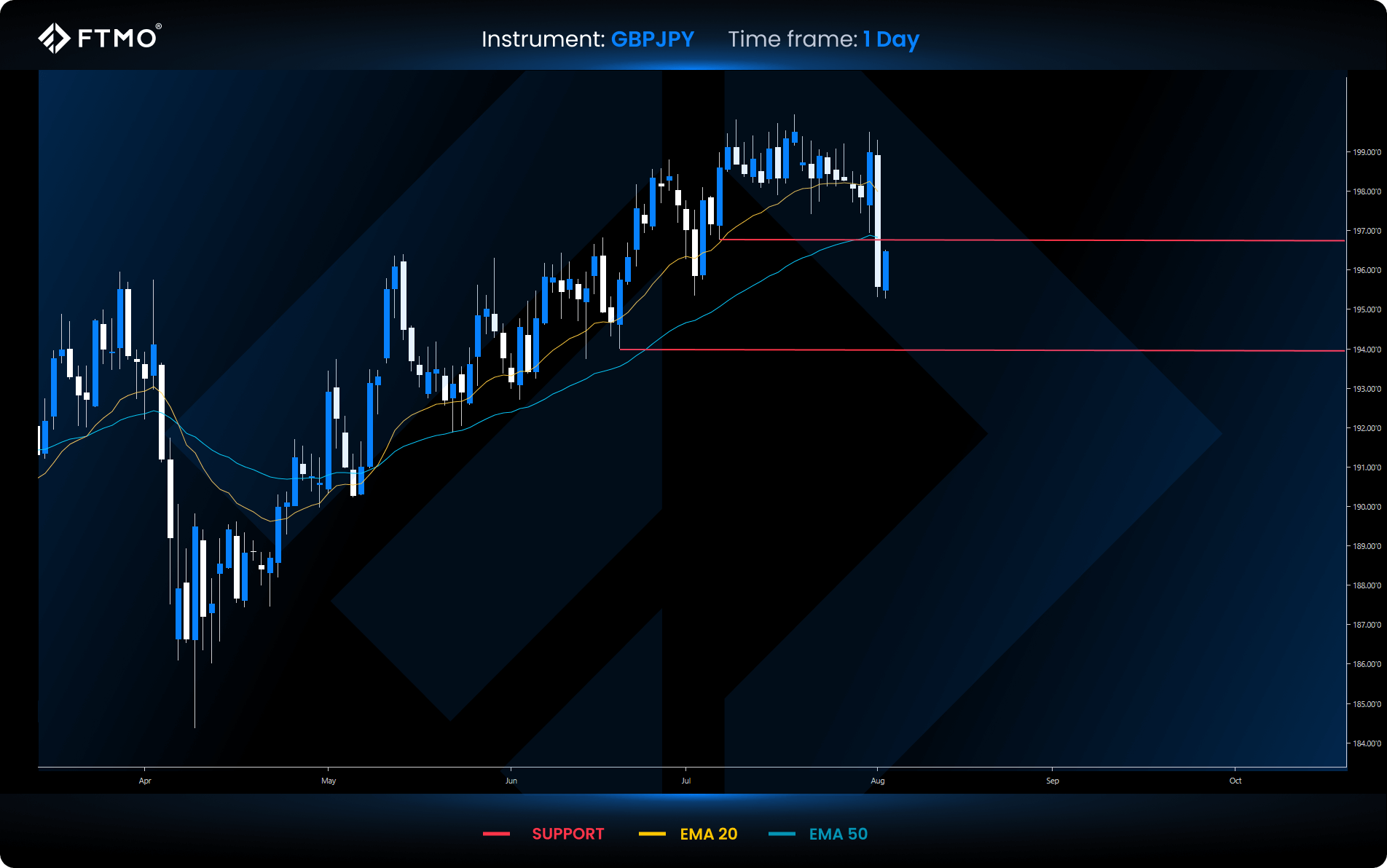

GBPJPY

Market Context: Last week’s shift in momentum turned this pair decisively bearish. Price moved below both the 20 and 50 EMAs and currently holds beneath resistance. With August seasonality historically favouring the downside, sellers may remain in control.

Bearish Scenario (Preferred): Sustained selling could push the market toward a lower support level, where buying interest may begin to build.

Bullish Scenario (Alternative): A return to the upper range could lead to a retest of resistance and provide another opportunity for short entries.

FVG Setup: No valid FVG setups have formed either this week or last.

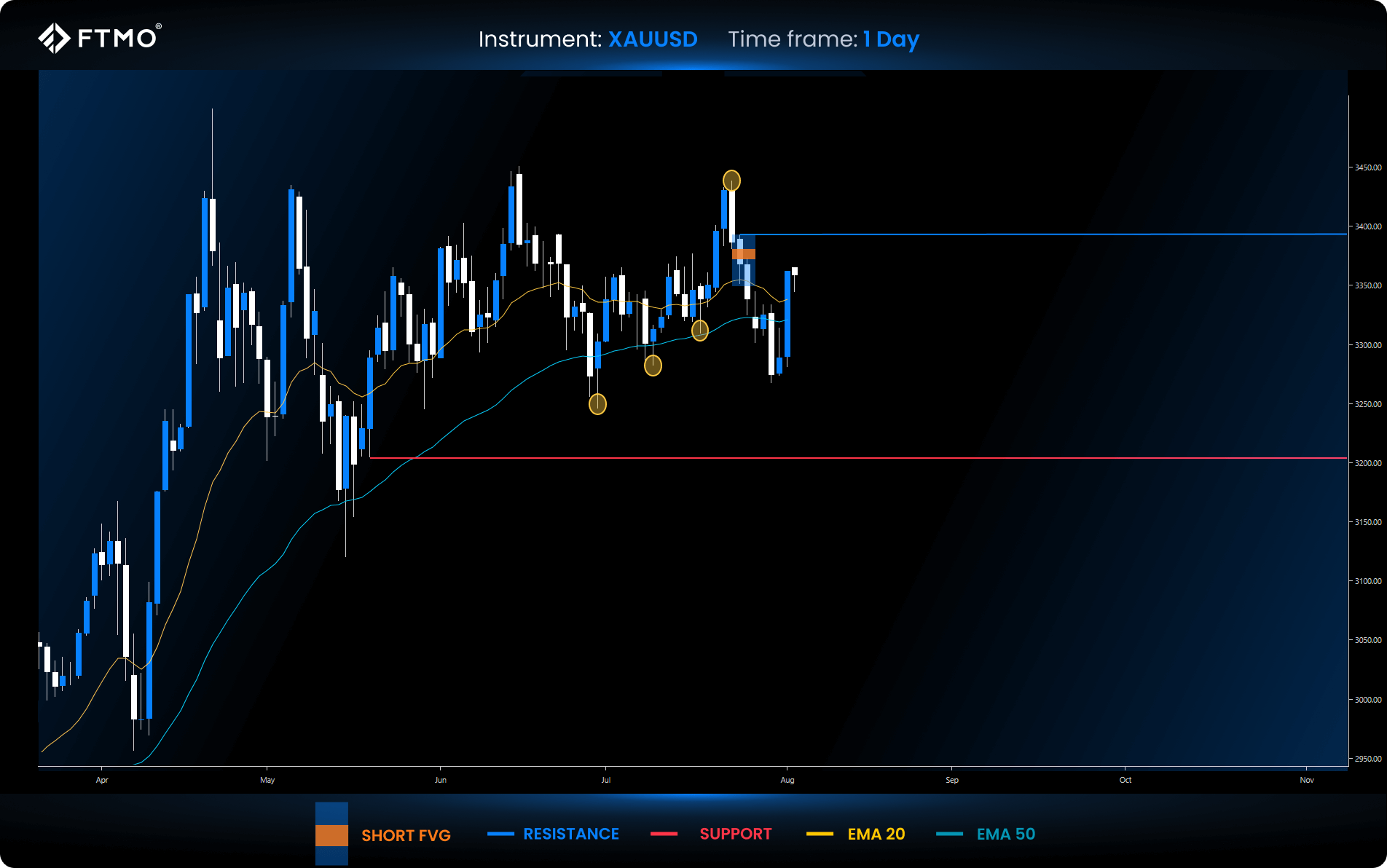

XAUUSD

Market Context: Gold cleared two swing lows last week following an aggressive sell-off that flushed liquidity from the lower range. The recovery lifted the price above the 20 and 50 EMAs, and it now approaches an unfilled FVG left behind by a previous high.

Bearish Scenario (Preferred): If price reaches the FVG and reacts lower, sellers may target the next leg of downside toward earlier liquidity levels.

Bullish Scenario (Alternative): A break above the FVG could drive price into higher resistance and sweep the prior swing high before any potential reversal.

FVG Setup: The chart has not produced a valid FVG setup this week or the one before.

Opportunities to Watch This Week

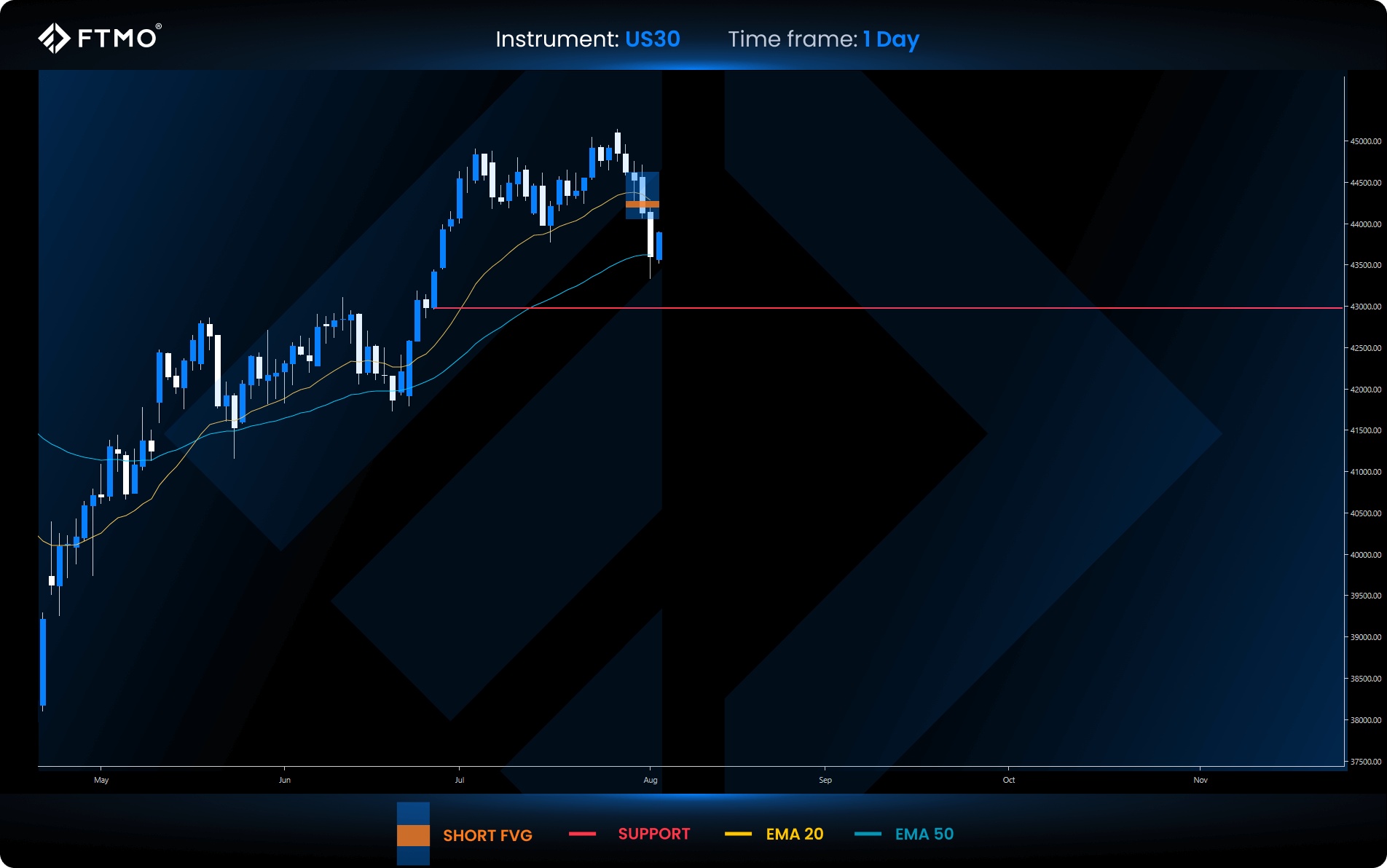

US30

Market Context: The index remains in a bearish formation while testing support at the EMA 50. Price continues to trade below the EMA 20, creating a short-term compression zone where both trend and structure will likely define the next breakout.

Bearish Scenario (Preferred): A rejection from the FVG area may resume the move lower and drive the price into previous liquidity gaps.

Bullish Scenario (Alternative): A confirmed close above the FVG could shift market bias and invite buying momentum toward the next resistance area.

FVG Setup: Last week’s bearish FVG setup remains valid and aligns with the dominant short-term trend.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis, or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.