New all-time highs in stocks may not be a barrier to further growth

In the next part of our series on successful FTMO Traders, we look at a trader who bet on the rise of the US Nasdaq 100 technology index, which is easily surpassing its all-time highs.

Traders and investors sometimes tend to be more cautious in their asset purchases and opening long positions when stocks or stock indices are approaching their all-time highs. At first glance, this may make sense as it creates a certain psychological barrier for investors. However, from a practical point of view, it makes no sense, for example because historical highs are no exception and major corrections or bear markets very rarely follow them.

Our trader today was clearly not afraid of new highs in US stocks, because he chose the Nasdaq 100 index of US technology stocks as his only investment instrument. Moreover, he belongs to a group of traders who probably have a problem with opening short positions, so all his positions were long.

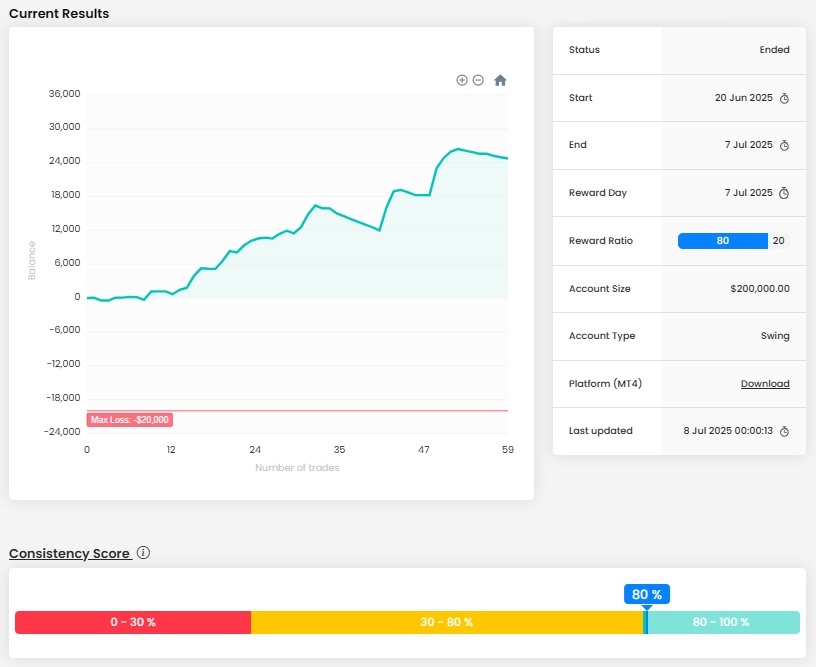

Nevertheless, he managed to record a very interesting return in the end. The proof is his balance curve, which was only in negative territory for a while at the beginning of the trading period. The trader was consistently able to take advantage of the strong uptrend in US stocks and only in the second half of the period, at the beginning of July, did he record two drawdowns, but these did not affect his overall profit significantly.

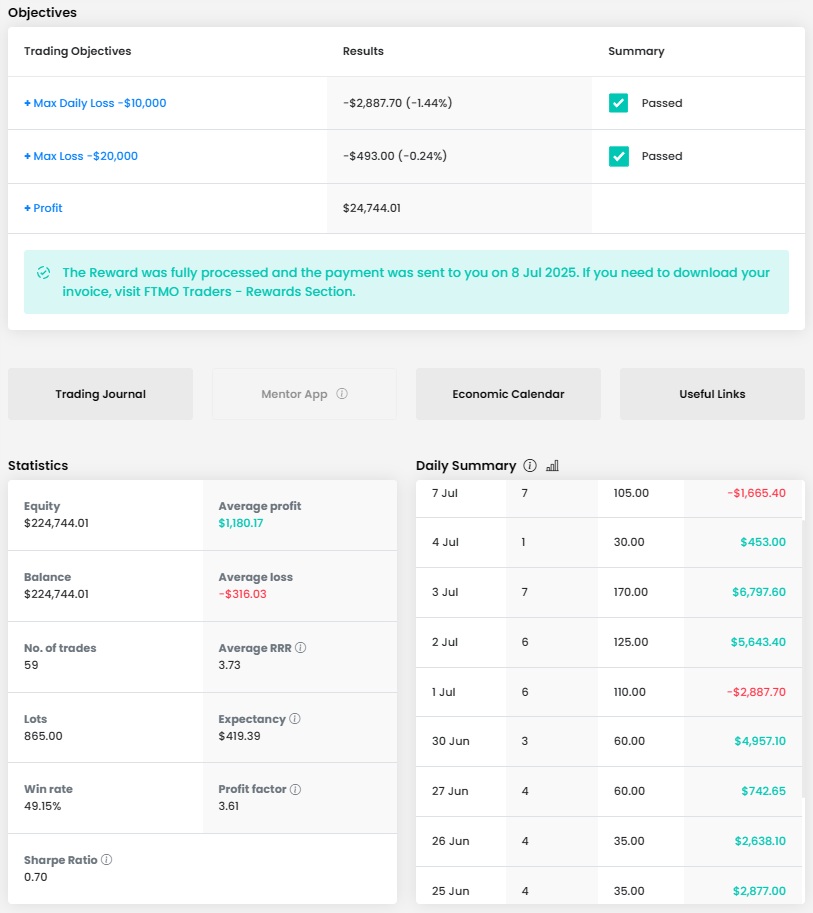

It is nearly $25,000, which is over 12% on a $200,000 account size. That averages out to over 1% per day over twelve trading days, and that is very good. The same can be said for the trader's ability to avoid large losses, which has kept him nowhere near the allowed loss limits.

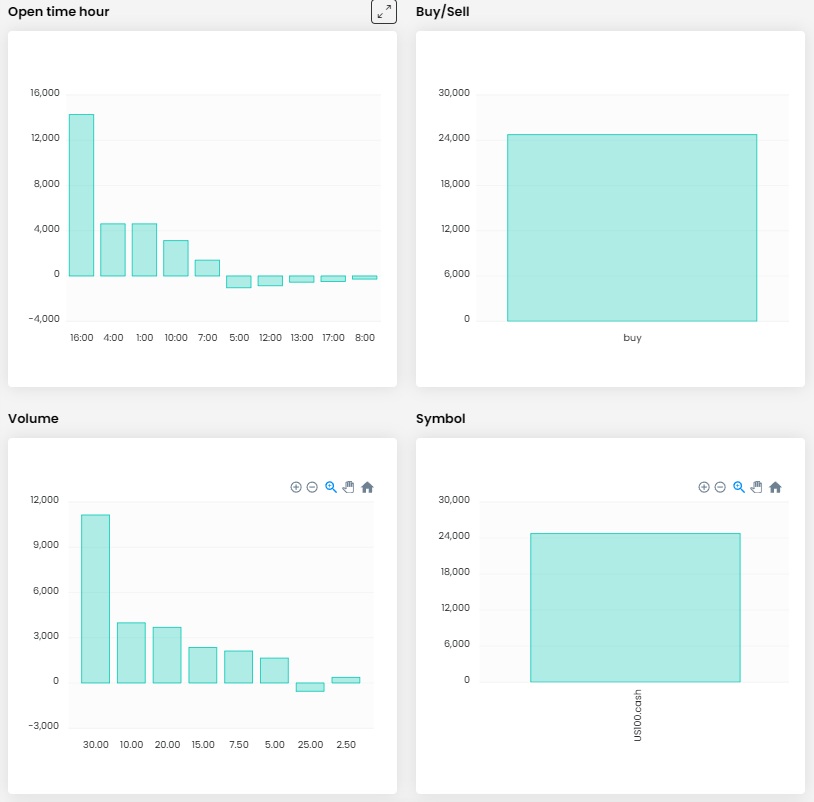

In total, the trader opened 59 positions, which means around 5 positions per day. The total volume was 865 lots, which amounts to 14.6 lots per position. This is not much for the instrument, and although the trader opened more positions per trade, it is still within the norm. The average RRR is also very good at 3.73, and the win rate of trades around half (49.15%) is not explicitly bad either.

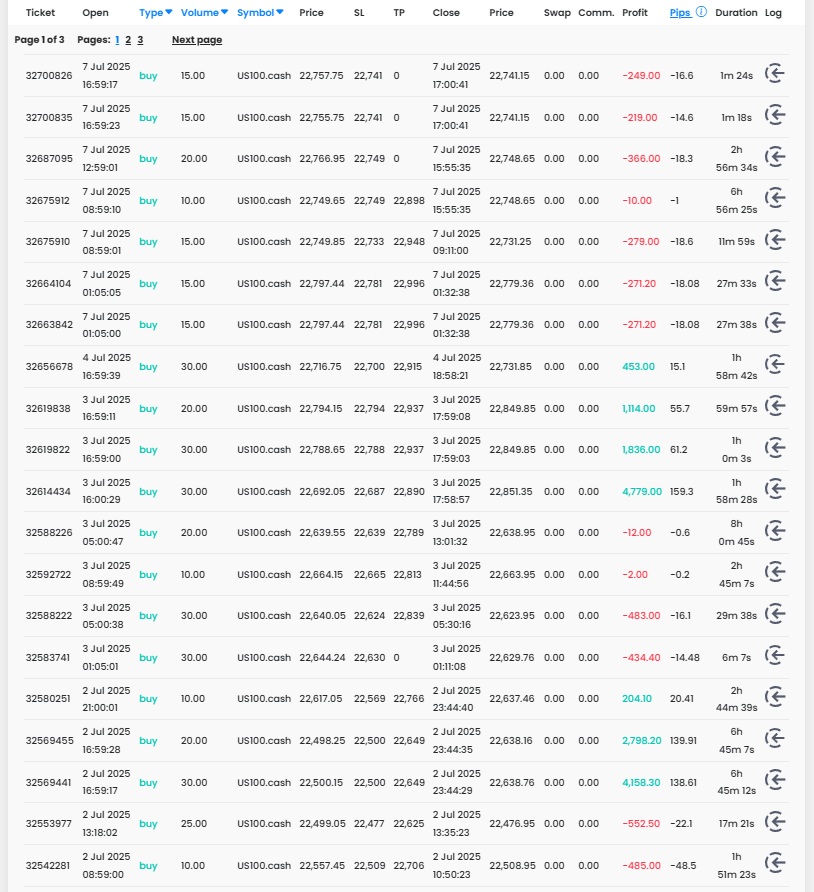

Looking at the journal, we can only see the aforementioned long positions of the trader and it is also evident that he opened multiple positions on most trades. When his position moved in the desired direction, he opened additional positions even with a relatively large time gap, thus increasing the possible profit potential. He held positions from a few dozen minutes to several hours, but never left them open overnight, thus saving on swap fees. And since FTMO did not even charge opening fees for indexes, his savings were even greater.

We positively evaluate the fact that he had a Stop Loss set for all positions, without which we definitely do not recommend trading. We also commend the fact that the trader opened smaller positions at the beginning of the trading period and increased their size only when the equity in his account grew. At the same time, he kept the losses to a minimum, so that even when opening relatively large positions at the end of the period, his total loss per trade did not reach even one percent.

For the final statistics, we can read that apart from opening only long positions on the US100.cash instrument, the trader was particularly successful at the end when he opened positions of 30 lots. At the same time, he was most successful with positions that he opened at a time when the US stock markets are opening and market volatility can be quite high.

We will also take a look at the most successful trader's move, which he made at the beginning of July. It was a day that was quite strong in terms of macro data, as US labour market data was released, including one of the most watched numbers, NFP. The relatively good labour market numbers were then supported by the services PMI data.

Trader opened the first position at 16:00 platform time when the market was already able to process the labour market data. It also took advantage of the fact that price broke the upper border of the consolidation that had formed that day while waiting for the macro data. Thus, after a short swing downwards, it opened the aforementioned first position.

After an hour, when he had already made some money on the first position, he opened two more positions. He then closed all three positions when it looked like the price might have reached its local peak. It may seem that he closed the position a bit prematurely, but further developments showed that it was a good decision after all. The profit on the first position was $4,779. The next two positions then added $1,836 and $1,114 to that profit, for a total of $7,729. Nothing to do but congratulate.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.