Gold is still worth trading

In the next part of our series on successful FTMO Traders, we will look at a trader who bet on the most popular instrument and then just one trade a day was enough to make an interesting return.

You don't need to execute dozens of trades a day to get interesting returns. At the same time, there is no need to open large positions that promise a high potential return, but when the trade does not go in the right direction, it is very difficult to mentally hold. A moderate approach, waiting for the right signal and a conservative position size can do a trader a very good service, as our trader today proves.

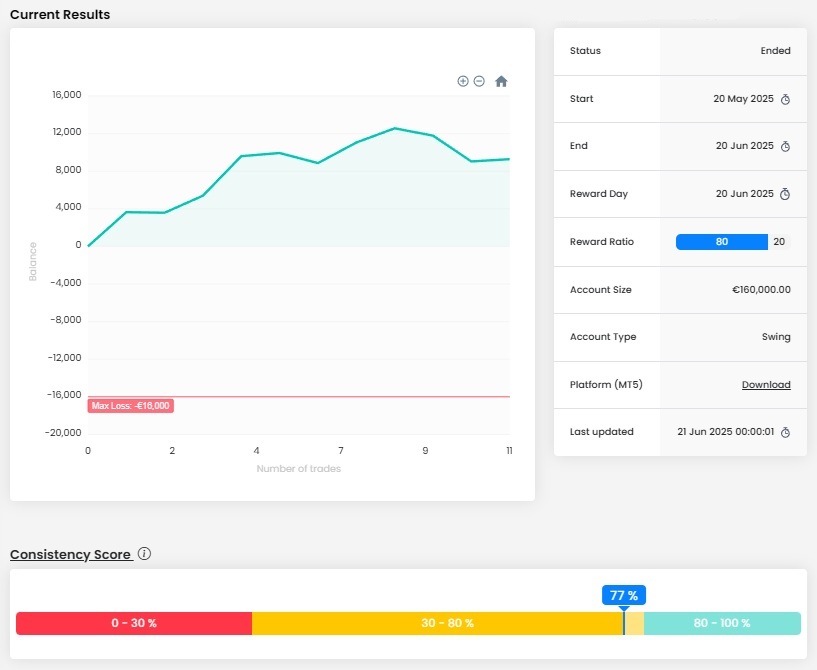

His balance curve did not fall into the red numbers during the entire trading period. Although the final return is not staggering, it was much easier for the trader psychologically to wait for the right time to enter. This allowed him to enter his positions with a clear mind. At the end of the trading period, although he realized two unsuccessful positions, he can still be very satisfied in the end.

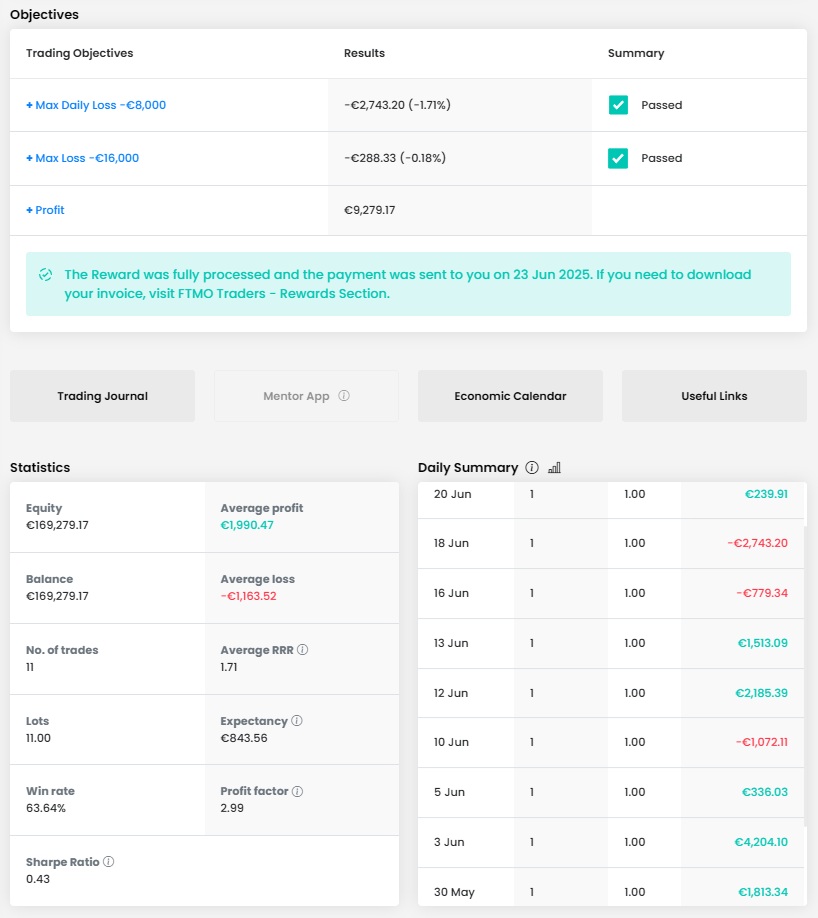

A total return of over €9,000 is not even 10% with an account size of €160,000, but earning over 10% every month is mere utopia. Let's face it, most of us would take such a return with all ten hands.

More importantly, the trader is nowhere near the loss limits and the consistency score of nearly 80% is also very good. This is also true of the trade success rate, which has surpassed 60%, which in turn, combined with the RRR of 1.71, is a very good basis for successful trading.

The trader executed 11 trades in 11 days with a total size of 11 lots. A rare match, which means that he traded only one trade of 1 lot each day, which is a truly conservative approach given the size of the account. It's a pity he didn't end up with a return of €11,000, but I guess that's too much to ask.

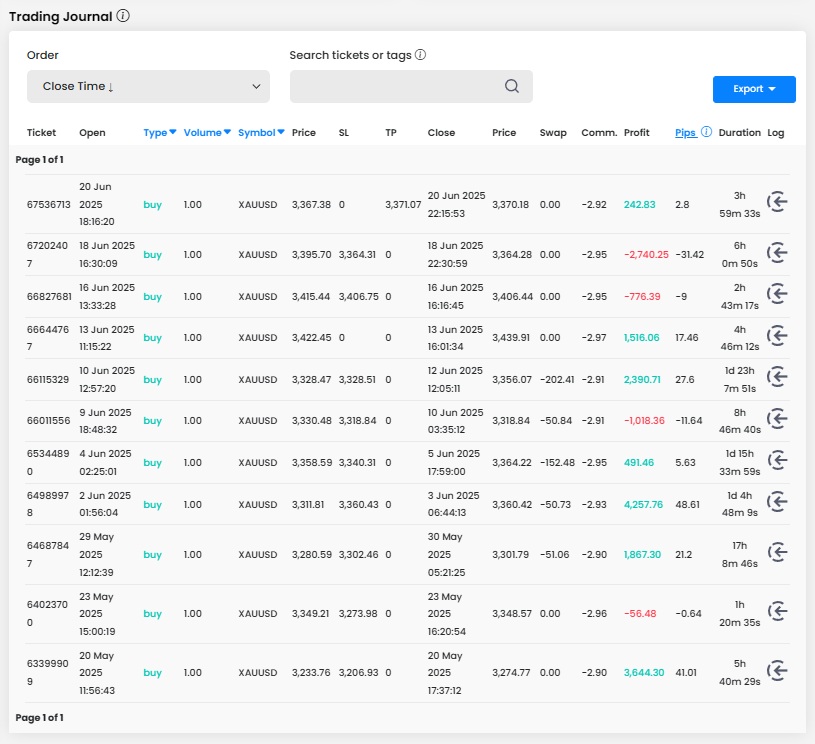

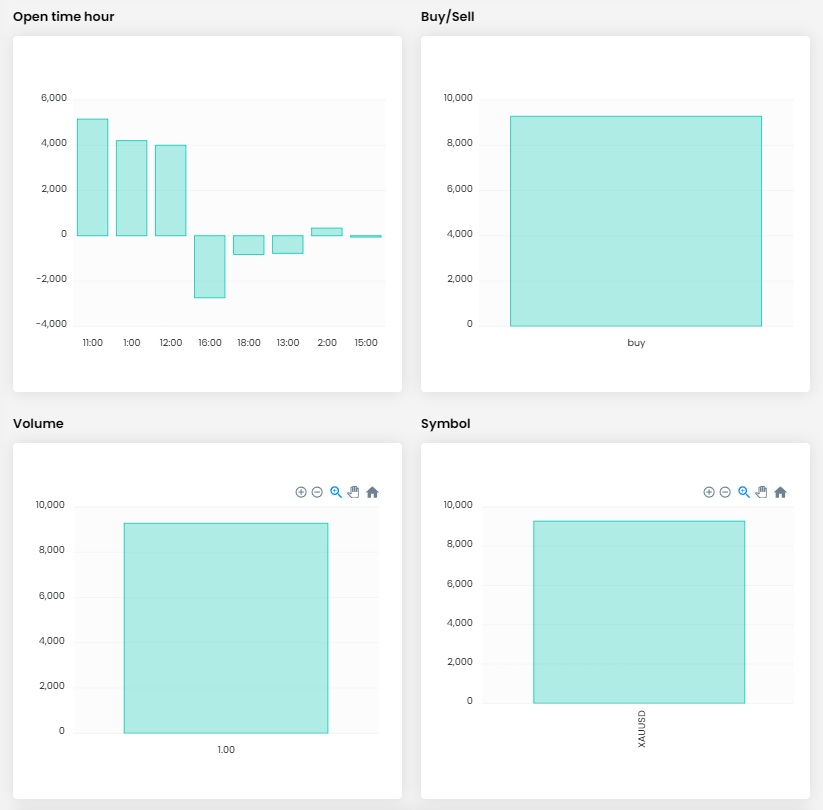

The journal only confirms what has already been written that he is an intraday trader holding his positions for several hours. In several cases he held the position overnight, and it was the longest trades that also ended with the highest profits. Some of the opening and closing times of trades may indicate the possibility of an automated trading system (Expert Advisors). The number of trades would not suggest this, though, as would the fact that the trader belongs to the group of traders who do not open short positions.

Focusing only on long positions is a bit pointless when trading forex or leveraged products, but we all have our quirks. However, we can commend the placing of Stop Losses on almost all open positions. This paid off especially in the case of one trade that ended in a loss and was closed on SL late at night when the trader did not need to be at the platform. Take Profits were not addressed by the trader, often closing positions on a shifted SL or simply manually.

We can't read much from the trade statistics, or rather we see what we have already written about. Long positions of one lot size on gold. In addition, perhaps, the trader was most successful in the outlets he opened around noon. However, even such "boring" statistics can lead to interesting returns in the end. In short, trading should not be an adrenaline rush, but should be approached as a routine.

Looking at the trader's most successful trade, the question about the possibility of using EA is again relevant. Or maybe the trader couldn't wait after the weekend and opened a long position shortly after the market opened, when the price broke the local resistance and fortunately didn't fill the resulting gap. On the other hand, it's good that the shifted SL worked and the trader certainly couldn't complain about the resulting profit of 4,257 euros.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.