How to make a profit when minimizing losses is a priority

In the next part of our series on successful FTMO Traders, we take a look at a trader who didn't chase returns at any cost but instead prioritized minimizing losses.

There are likely as many approaches to risk management as there are traders, because everyone has their own preferences. Some aim to maximize profits by targeting a high reward-to-risk ratio (RRR), others rely on the number of open positions, while some focus on minimizing losing trades - even if it means sacrificing potential profits.

The trader whose account we’ll examine today falls into the last group. He is a classic scalper, a type we've featured several times in this series. However, what makes his approach particularly interesting is that he doesn't focus on maximizing profits at any cost - instead, he aims to secure at least a minimal return on most of his positions. Once a trade reaches a certain profit level, he moves his Stop Loss, ensuring that a trend reversal won't result in a loss. While some traders "lock in" profits in increments, this trader manages the entire position in that way.

Of course, this approach may cause him to miss out on potentially more profitable trades. However, from a psychological standpoint, it’s more important for him to secure some profit, even if it means sacrificing a larger (but uncertain) return. In short: better a sparrow in the hand than a pigeon on the roof.

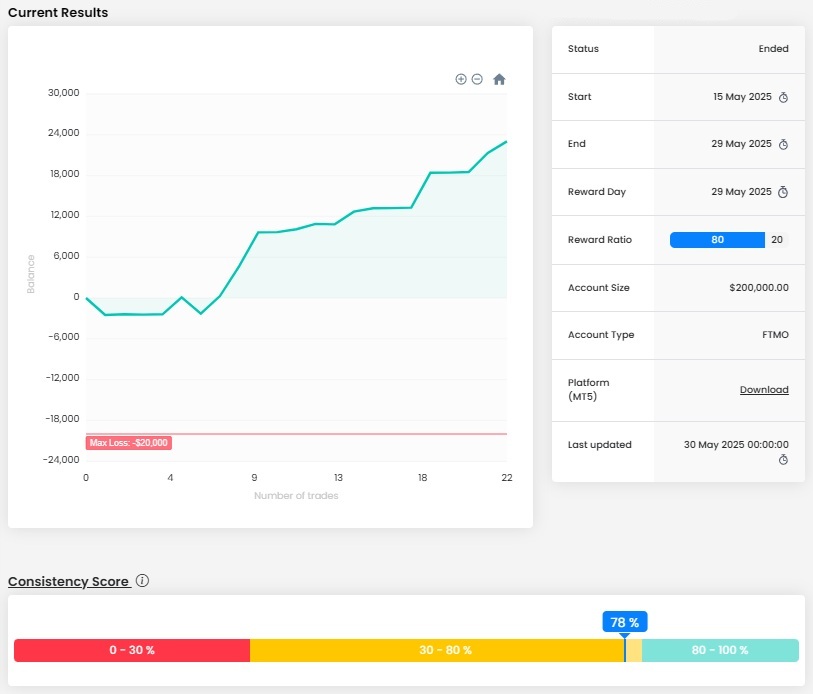

As you can see from the balance curve, the trader’s approach of moving the Stop Loss on profitable trades paid off during the trading period. The first trade was unsuccessful, but it's commendable that this didn’t push him into taking unnecessary risks. Instead, he showed patience and maintained a consistent approach in the next three positions. After a few more trades that ended alternately in profit or loss, he eventually began to achieve regular gains, and the balance curve subsequently showed a steady upward trend.

Thanks to active risk management and adjusting Stop Loss levels in profitable trades, the trader had virtually no issues with the Max Daily Loss or Max Loss limits—which is excellent. The total return was also impressive, at just over $23,000, representing more than 10% of the $200,000 account size.

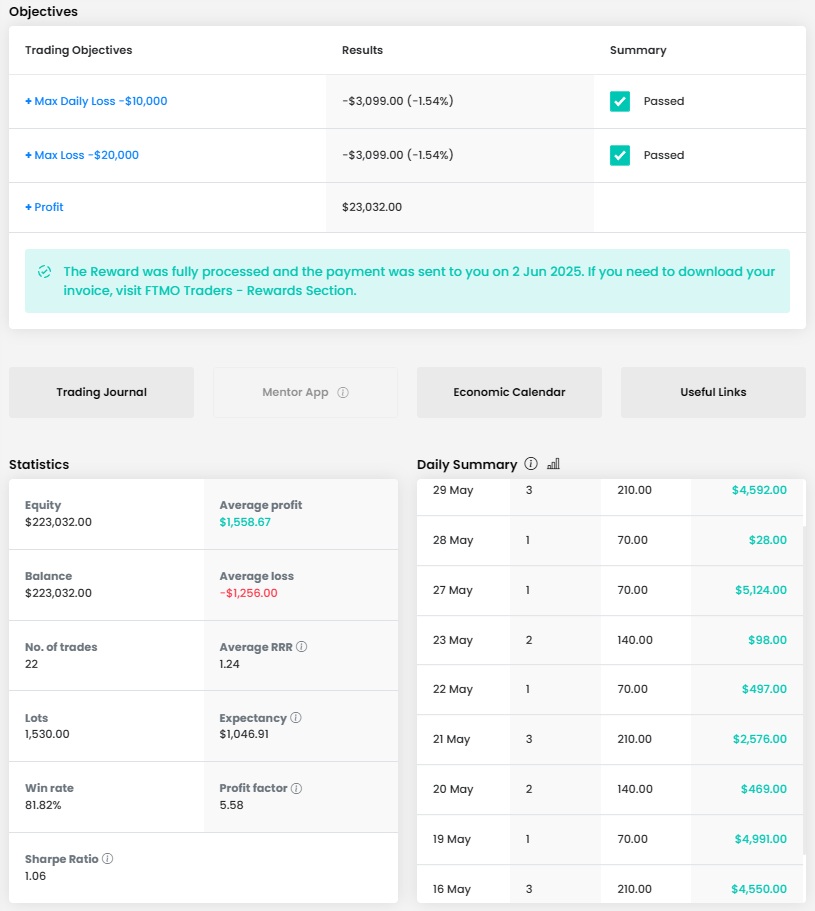

The trader didn’t need a large number of trades to achieve this; he opened just 22 positions over ten trading days. The total position size was 1,530 lots, which averages nearly 70 lots per trade. That’s quite a lot, but for the US100.cash instrument and an account size of $200,000, it’s still within a reasonable range. Once again, it ultimately depends on how the trader manages the Stop Loss size.

The average RRR was 1.24, which is not bad. Considering the trader’s approach, the win rate is definitely more important - and it reached 81.82%, which is very good.

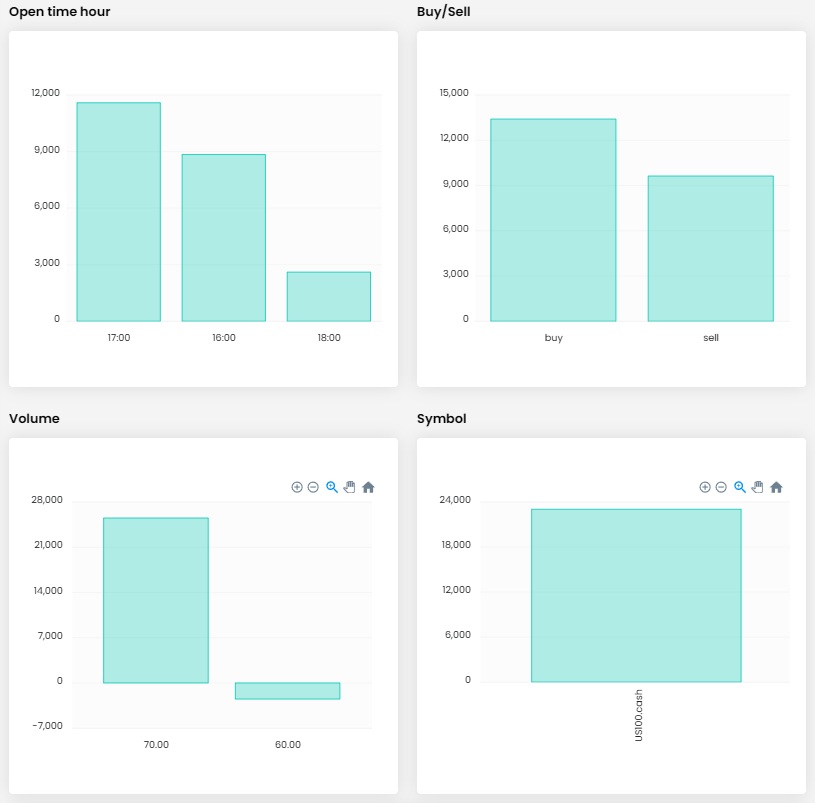

As we’ve already mentioned, this is a classic scalper, which is also evident in the journal. The trader held his positions for only a few minutes and never exceeded 30 minutes between opening and closing a trade. We can also see that he kept the position size practically constant at 70 lots, with the exception of the first trade, which was 60 lots.

Despite many profitable positions, some of them ended with very low profits. This is a consequence of the mentioned approach, where the trader moves the Stop Loss on profitable positions slightly above break-even to secure at least a minimal profit in case of a short-term trend reversal. This is also the reason why the average RRR is relatively low, despite the high number of winning trades. In any case, we appreciate the use of both SL and TP for every position - something that is not entirely common among scalpers.

Being a scalper, it is not surprising that he traded both long and short positions—and was successful in both cases. Again, this aligns with his "locking in returns" approach. The trader focused on a single instrument: the Nasdaq 100 stock index (US100.cash), as indicated by the timing of his position openings. These occurred during the first hours of the New York session, a period when market volatility is relatively high and thus well-suited for scalping.

As usual, we also take a look at a few trades made by the successful trader. He opened his first position half an hour after the U.S. stock market opened. The price was in an uptrend, and after a brief consolidation, the trader bet on the continuation of the trend. In the end, he was fortunate that the price continued to rise shortly after entry. Given the post-open optimism, he benefited from a significant upward move. The realized profit of $4,991 is excellent.

The second trade we’ll look at had a similar opening time and followed a similar pattern. The trader took advantage of the price rise after the market opened and entered a long position following a brief consolidation and the formation of a higher low. The price moved in the expected direction, and the trader closed the position at take profit after a few minutes, securing a solid $5,124 profit.

This example shows that even scalping—often considered the most challenging form of trading—can be approached relatively conservatively, with an emphasis on minimizing losses. As illustrated in the charts above, a bit of luck certainly helps, but in the long run, discipline and the ability to sometimes sacrifice potentially larger returns for the sake of safety are key. The rest is about waiting for the right opportunities and making the most of them. Trade safely!

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.