“It may take longer than expected to pass your account”

Patience and discipline. Over and over again, concepts that every trader should be aware of, but many traders forget about in the Evaluation Process. For many traders, the prospect of quick profits is both more powerful and their worst enemy. How did our new FTMO Traders deal with this?

Trader Salman Ali Ibrahim: “Focus on your own journey, not on other people.”

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, my plan is to be max allocated in funding with FTMO one day.

What was easier than expected during the FTMO Challenge or Verification?

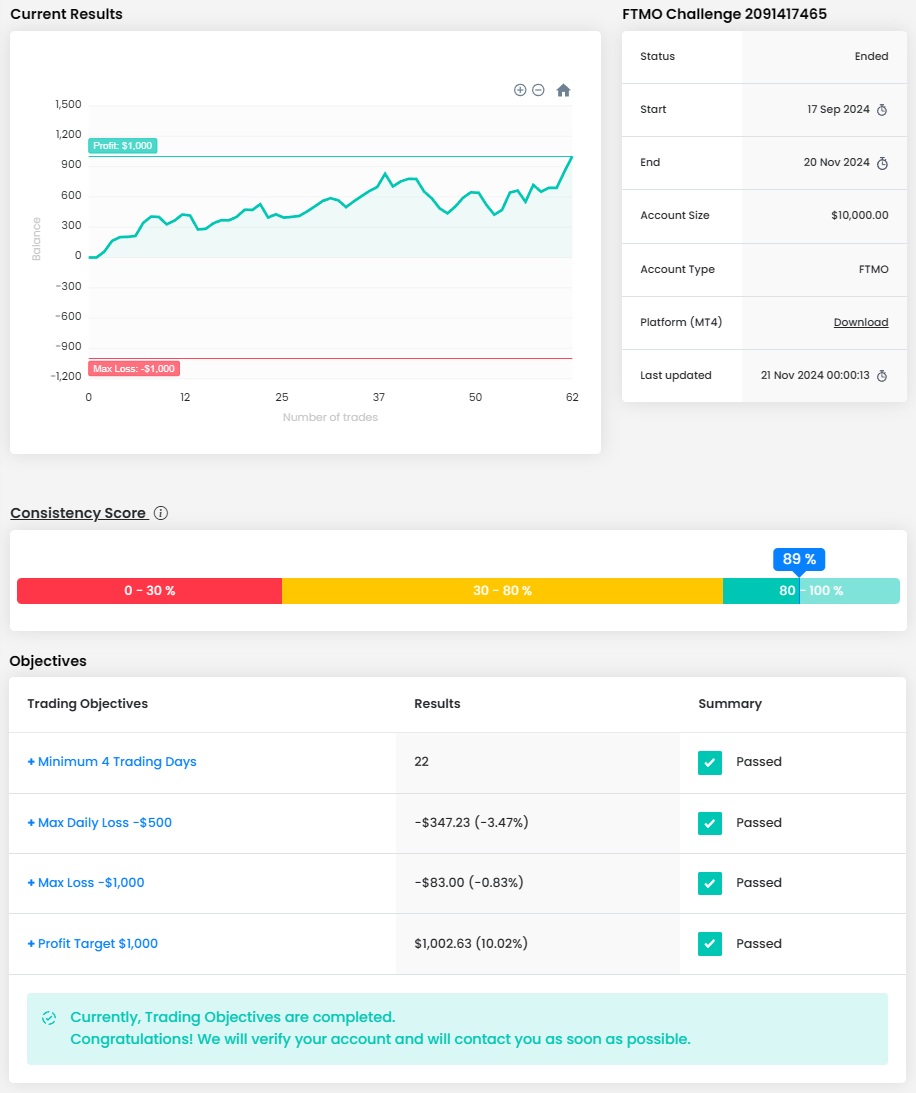

The FTMO Challenge was easier than expected in my circumstances even though the profit target was 10% which is 5% higher than the verification target. This is because from my first trade I took, I was always in profit and never went into drawdown on account overall, which gave me confidence to reach the profit percentage as it helped my mental psychology that it was achievable even though I was a bit more conserved due to it being my first challenge. In contrast the Verification was harder than expected since I did go into drawdown. This did give me thoughts on whether I would pass or not even though the profit target was 5% and I thought I could reach it quicker than the Challenge it did, in fact take me longer to pass.

What does your risk management plan look like?

I have several different rules which I follow for my strategy which is only risk one percent per trade, take 2 trades maximum a day if there is an opportunity and also mainly take trades in the London session as well as set my trades to breakeven to be risk free at a liquidity level in which price may reverse. This prevented a lot of loss happening in one day, potentially losing my account which allowed me to reach the profit goal.

How would you rate your experience with FTMO?

Overall, my experience with FTMO was brilliant. FTMO is the most reliable prop firm out there and has been for several years. The trading rules are well structured such as the daily drawdown limit and profit targets which allowed me to become more of a disciplined trader.

What inspires you to pursue trading?

I want one day pursue trading as a full time career due to the freedom it can give. I have seen how other people like me who were in the situation as I am in right now develop the skill for several years and be financially free but most importantly it gives you the freedom which is my biggest motivator.

What would you like to say to other traders that are attempting the FTMO Challenge?

Having one strategy and trading 1 pair and being patient are the main key advice I would give. There are some days on which there will be no setups due to the markets being impacted by economic news in which I advise staying away from waiting for clear higher time direction to trade alongside with to execute trades as this improved my win rate. One other key piece of advice I would give is to stay disciplined and be wary, it may take longer than expected to pass your account and focus on your own journey not on other peoples.

Trader Jacob Washington: “Stay determined and focused, don’t get revenge on trade.”

How has passing the FTMO Challenge and Verification changed your life?

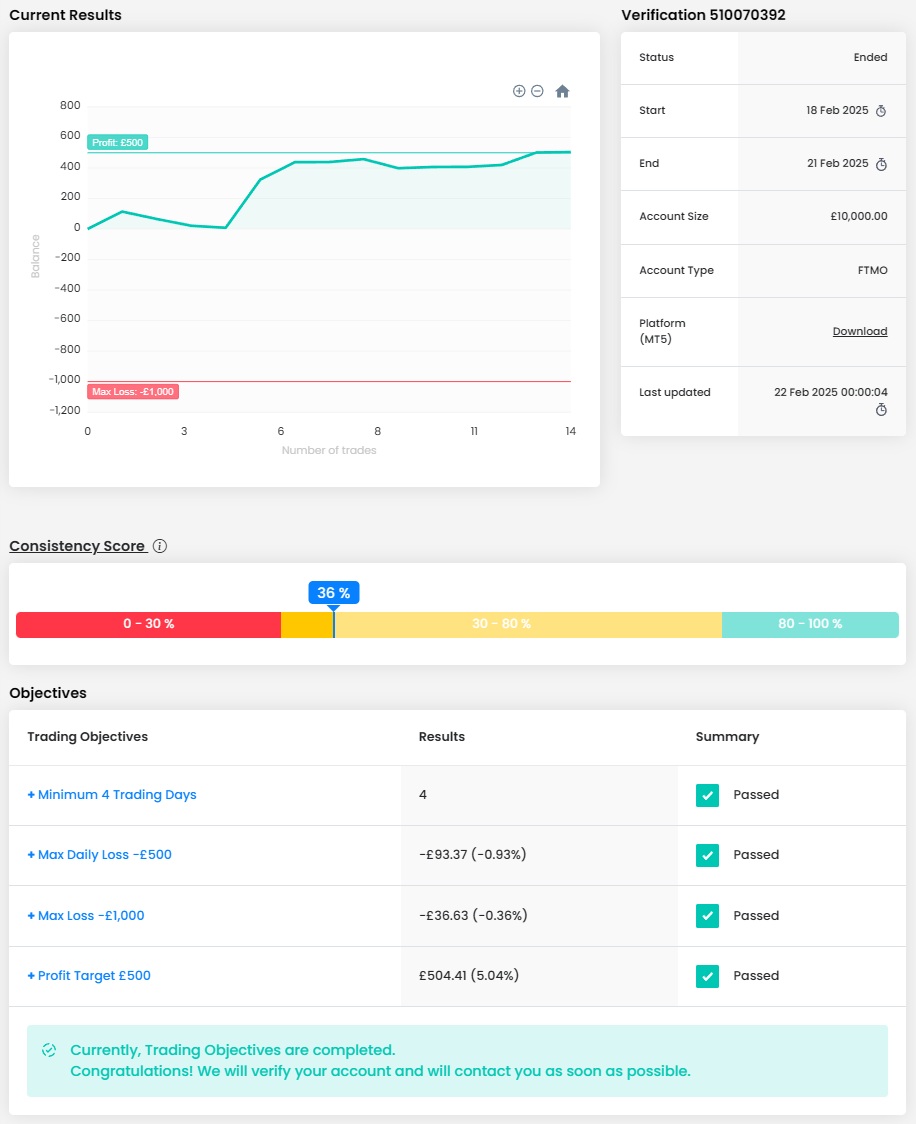

Passing the Challenge and Verification has changed my life as it will enable me to focus on what I love doing, which is trading. Now being a funded trade, I can scale my way up and hopefully make this my number 1 source of income moving forward.

What does your risk management plan look like?

I will only risk 0.5%-1% of account size per trade. If my trade is doing well and I’m in profit I will automatically bring my Stop Loss to above break even to make the trade risk free.

How did loss limits affect your trading style?

It didn’t affect my trading at all really. It made me wearier of my losses and it enabled me to use proper risk management and not overleverage on any of my positions.

How did you manage your emotions when you were in a losing trade?

I would let the trade play out and trust my analysis. If the trade hits my stop loss I would review my analysis to see what mistake I made and journal this to ensure I wouldn’t make the same mistake

Has your psychology ever affected your trading plan?

No. My psychology is you can’t always be right, so even if I do take a loss and I am stuck to my analysis and personal rules then in my eyes that is still a good trade.

One piece of advice for people starting the FTMO Challenge now.

Don’t give up. Stay determined and focused, don’t get revenge on trade and remember no trade = no loss and sometimes that is better than entering positions half-heartedly, as more than likely these positions will hit your stop loss.

Trader Bramwell: “Emotions kill accounts.”

What inspires you to pursue trading?

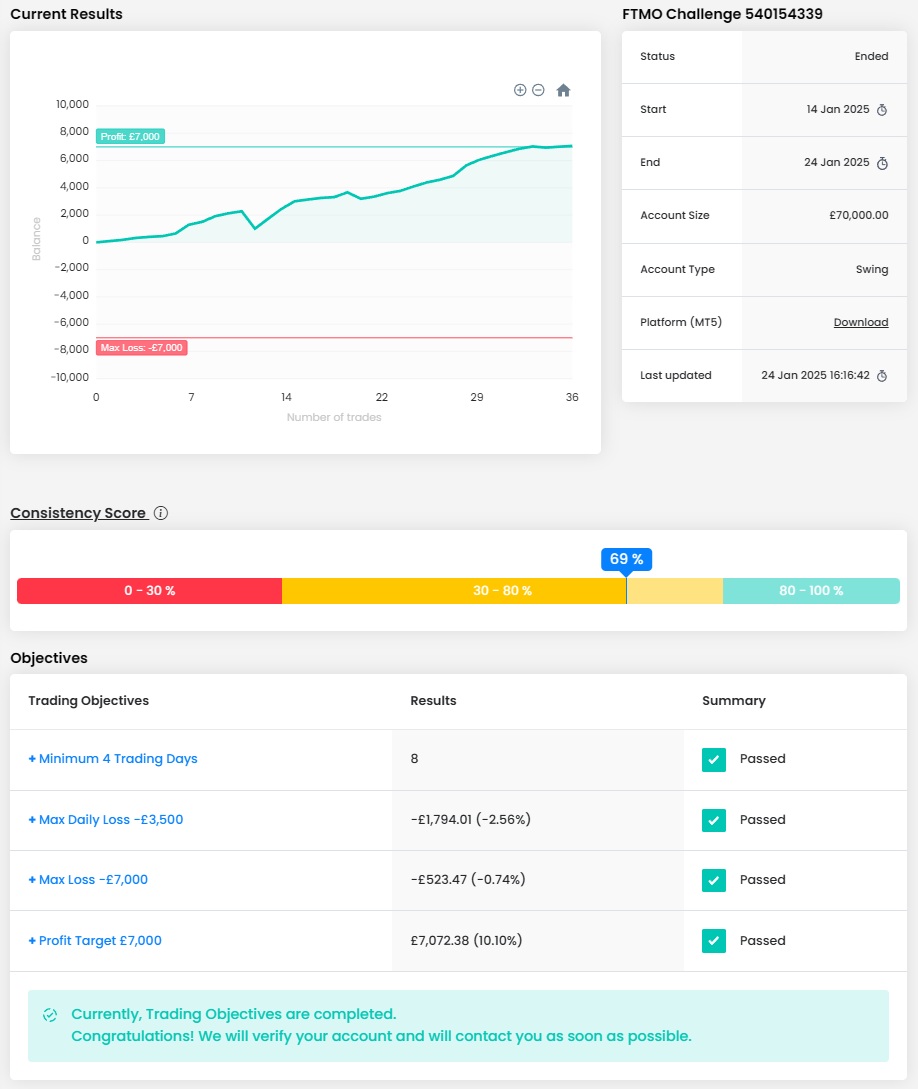

I value independence, financial growth, and building something solid for my future and trading inspires me because it offers the potential for financial freedom, a challenge that keeps my mind sharp, and a way to be in control of my income.

Has your psychology ever affected your trading plan?

Sometimes it does. For instance, I leave trades too early and in fear of losing floating profits.

What do you think is the most important characteristic/attribute to becoming a profitable trader?

For me it's discipline. Discipline helps me stick to my trading plan, manage risk, and control emotions like fear and greed.

How would you rate your experience with FTMO?

Reputation & Trust - It's one of the most established and respected prop firms. Strong Support & Technology - It has great customer service and a reliable trading environment.

How did you eliminate the factor of luck in your trading?

I stick to my strategy and highly embrace risk management.

One piece of advice for people starting the FTMO Challenge now.

Treat the FTMO challenge like a real funded account from day one. Many traders fail because they take excessive risks, thinking they can be aggressive since it’s just a challenge. Instead, stick to your trading plan, trade as if your real money is on the line. Focus on risk management, keep losses small (max 1-2% risk per trade). Don’t rush – you have enough time. Avoid overtrading, stay disciplined. Emotions kill accounts. Stay patient and follow your edge.

Trader Cristian: “In the Forex market, luck doesn’t exist, just as you shouldn’t be driven by emotions.”

What was more difficult than expected during your FTMO Challenge or Verification?

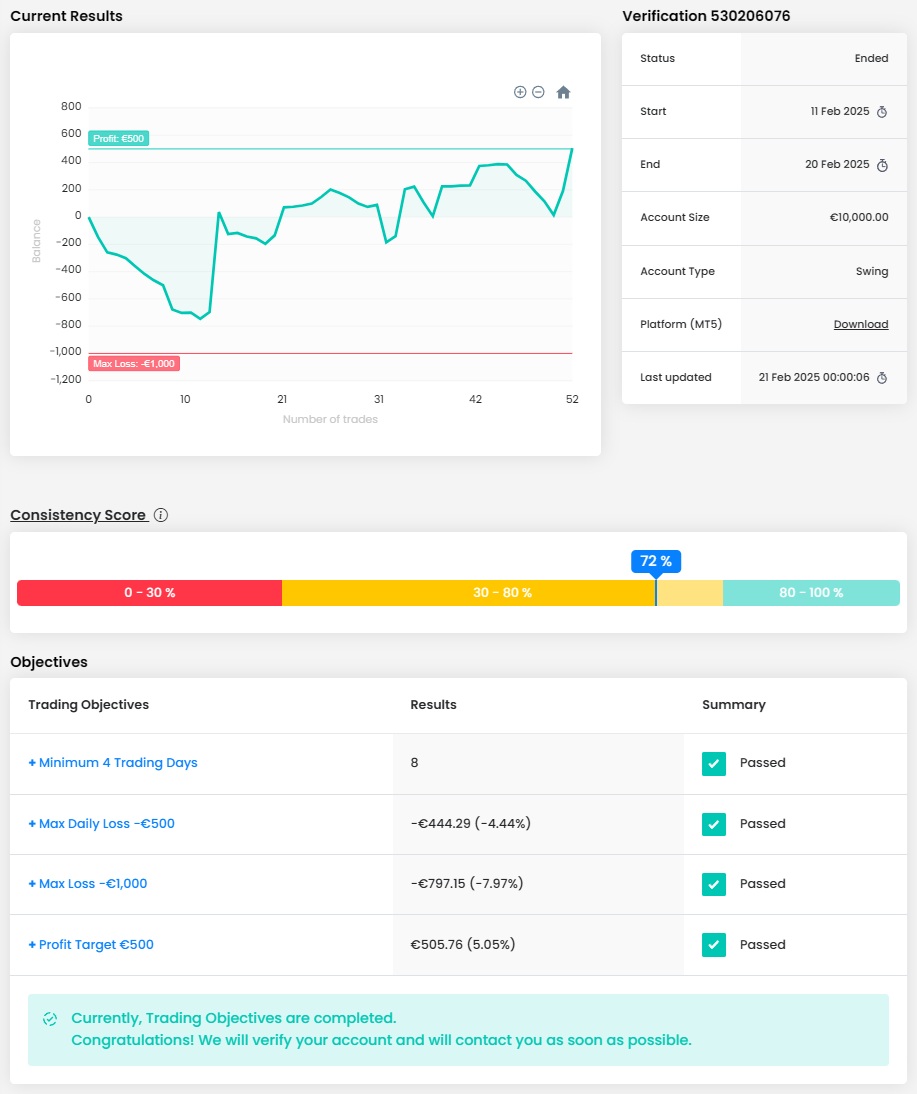

I didn’t find the evaluation period difficult because good money management and a solid strategy at the end of the week can bring you profit.

Describe your best trade.

To me, all trades seem good because my strategy is designed to generate profit. A successful trade involves meeting clear criteria, such as rejection from Fibonacci levels, filling chart gaps, breaking the trend, and retesting the 8 EMA.

How did you manage your emotions when you were in a losing trade?

I don’t experience emotions when trading because I have a solid money management plan and a well-structured strategy that allows me to take losses. The first trade that hits Take Profit then covers the previous losses.

How has passing the FTMO Challenge and Verification changed your life?

Getting access to a real FTMO account positively changes my life, giving me more self-confidence. It is the result of a long period of losses and a lot of hard work, showing that, with perseverance, you can become a successful person over time.

How did you eliminate the factor of luck in your trading?

In the Forex market, luck doesn’t exist, just as you shouldn’t be driven by emotions. You need to trade strictly based on your strategy and maintain a well-structured money management plan. Once you truly understand trading, you realize that success is not about luck, it’s solely about hard work and discipline.

What would you like to say to other traders that are attempting the FTMO Challenge?

Always trade strictly according to your strategy and maintain a well-structured money management plan. Don’t let emotions guide you and never trade without a Stop Loss and Take Profit in place. Don’t rush through the stages, as you have plenty of time to progress at the right pace.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.