Afraid to short? It doesn't have to be a big deal

In today's part of the series on successful FTMO Traders, we will have a look at a trader who has a problem with opening short positions, but even this did not prevent him from achieving a very good return.

There is a sizable group of traders who, for whatever reason, have a problem opening short positions. The reasons for this restriction can be varied. It may be a trader who is/was involved in long term investing in, for example, stocks and has simply become used to the fact that shorting stocks is generally not recommended. It could also be a trader who has some psychological problem with opening short positions and prefers to simply avoid them, but ultimately there could be many more reasons.

In CFD and forex trading, the ability to short unlimitedly is considered one of the biggest advantages. In forex itself, it is not even a classic shorting, because by opening a position on a currency pair, you are speculating on the strengthening of one currency and the weakening of the other.

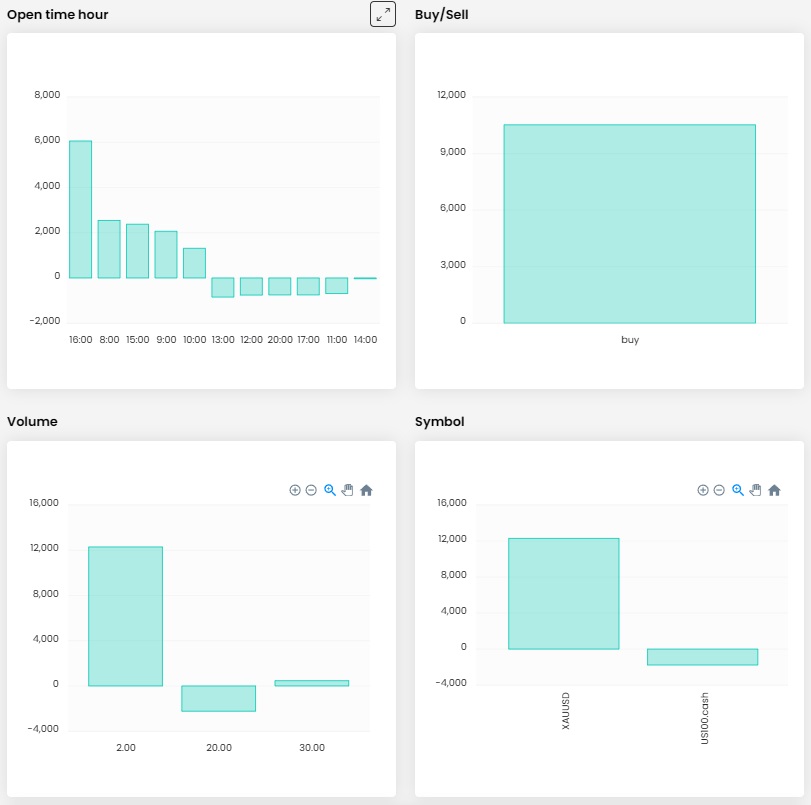

Our trader primarily trades the Nasdaq 100 stock index (US100.cash) and gold (XAUUSD), so what applies here is not the same as with currency pairs and is clearly a classic aversion to opening short positions.

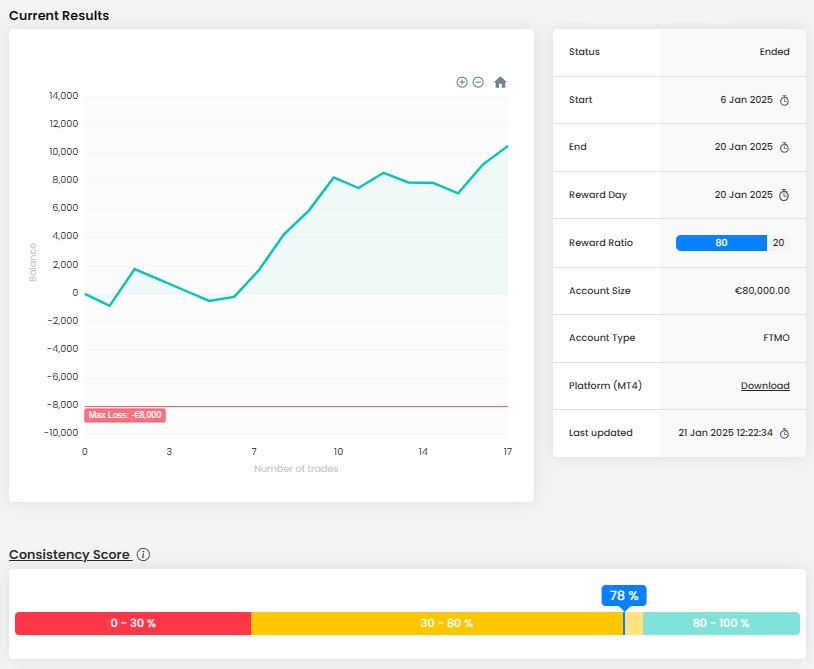

However, despite this "shortcoming", he has managed to post a very good return over the selected trading period and his balance curve looks very good. He did have a few losing trades initially, but in the end he handled this challenging period very well, which may be due to his high consistency score.

As a result, he had no problem with the loss limits, as overall he got to a maximum loss of 1.9% and lost a maximum of 1.19% over the course of a day. The total profit of over €10,500 is also very good for an account size of €80,000.

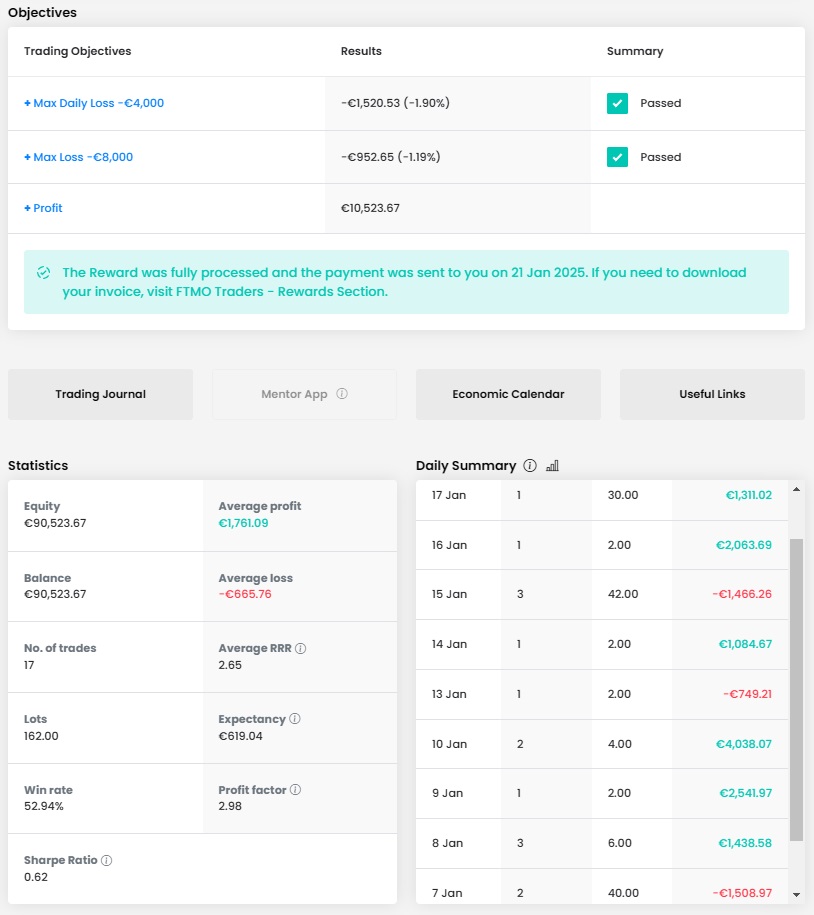

Over the course of ten trading days, the trader executed 17 trades totalling 162 lots, which is something around 9.5 lots. Considering that he traded two different instruments, for which it is possible to open diametrically different positions in lots, this is not very representative. So he mostly opened 2 lots on gold and 20 to 30 lots on the Nasdaq 100 index, which is fine given the Stop Losses he set. The average RRR was 2.65 and most trades ended in profit (52.94% win rate) and out of ten trading days, seven ended in the green.

The journal shows that he is, as in most other cases, an intraday trader who does not keep trades open overnight, so he does not lose money on swaps unnecessarily. An interesting feature is the aforementioned opening of long positions only, which at first glance might seem like a limitation. However, when a trader chooses the right combination of instruments that will offer enough trading opportunities even with a given style, this doesn't have to be a problem.

In the case of our trader, gold in particular was in a long-term trend during his trading period and the price of the Nasdaq 100 index was also rising most of the time. We are positive about the entry of Stop Loss and Take Profit on every open position and we must equally appreciate that losses on failed trades did not exceed one percent of the total account balance.

As already mentioned, the trader concentrated on only two instruments and opened only long positions, while the size of the positions also did not change much. He did much better on gold due to his style and the fact that it was in an uptrend throughout his trading period.

The times he opened his positions were spread out over virtually the entire trading day, with the trades he opened at the beginning and end of the European session doing the best.

We'll also have a look at a couple of trades that went well for the trader. In the first case, he opened a position after a bounce off the trend line at the market open in Europe. The price of gold shot up and the trader realised a very nice profit of over €2,500 on his Take Profit, which he set probably at an RRR of 1:3 (depending on the other trades and how the losing trades turned out). We have to appreciate that the trader was consistent in this direction and did not interfere with the TP, but moved the SL into profit as the trade progressed.

In the second picture we see a similar situation. However, in this case, the trader entered the position a little late and set the TP much further than usual. However, he eventually exited after reaching a similar amount of pips as the other trades, which seems like a good move as the price did not reach his original TP and the trend changed for a while. He managed to make a profit on this trade as well, so he deserves praise.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.