Profit from rising and falling markets

In the next part of the series on successful FTMO Traders, we will look at a trader who made very good use of the opportunity to open short and long positions on FTMO index instruments. He was thus able to realise interesting profits even in markets that are in a consolidation phase, and it is difficult to identify a clear trend.

One of the biggest advantages of trading forex and CFD instruments is that, apart from the possibility to use leverage, you can also open positions in both directions, i.e. long and short, without any restrictions. Thus, traders can hold their positions for short periods of time as leverage increases the return potential (but there is also a higher risk to think about) and can speculate on the rise and fall of the instrument at their discretion.

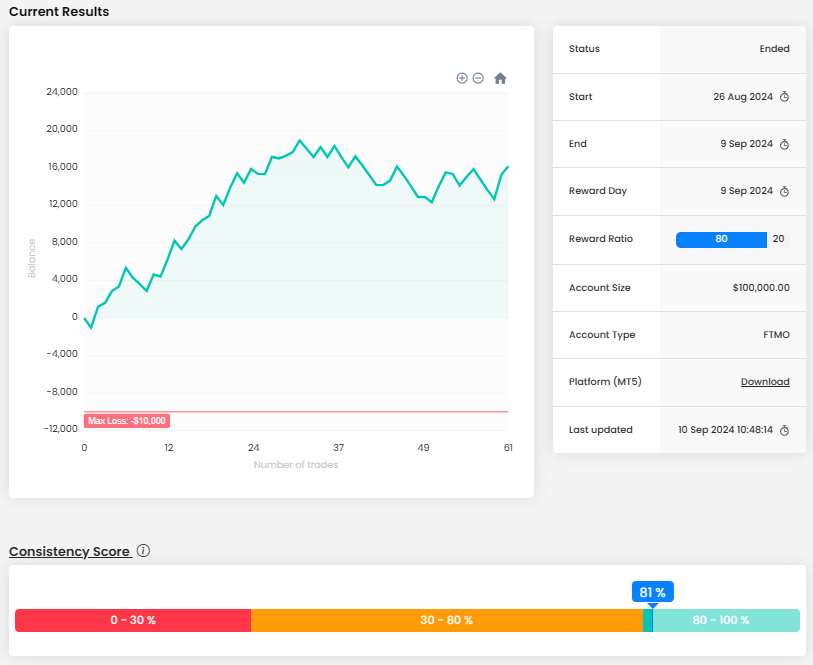

Even though the stock markets hit their all-time highs at the end of August and the beginning of September, which meant that the uptrend stopped, our trader managed to realise a very interesting profit. From the balance curve, it even looked like a really above-average return at the beginning, but in the middle of the trading period the trader's losing trades started to prevail and the curve "straightened" a bit. However, thanks to a consistent approach (consistency score of 81%), the trader was able to hold on to his gains in the end.

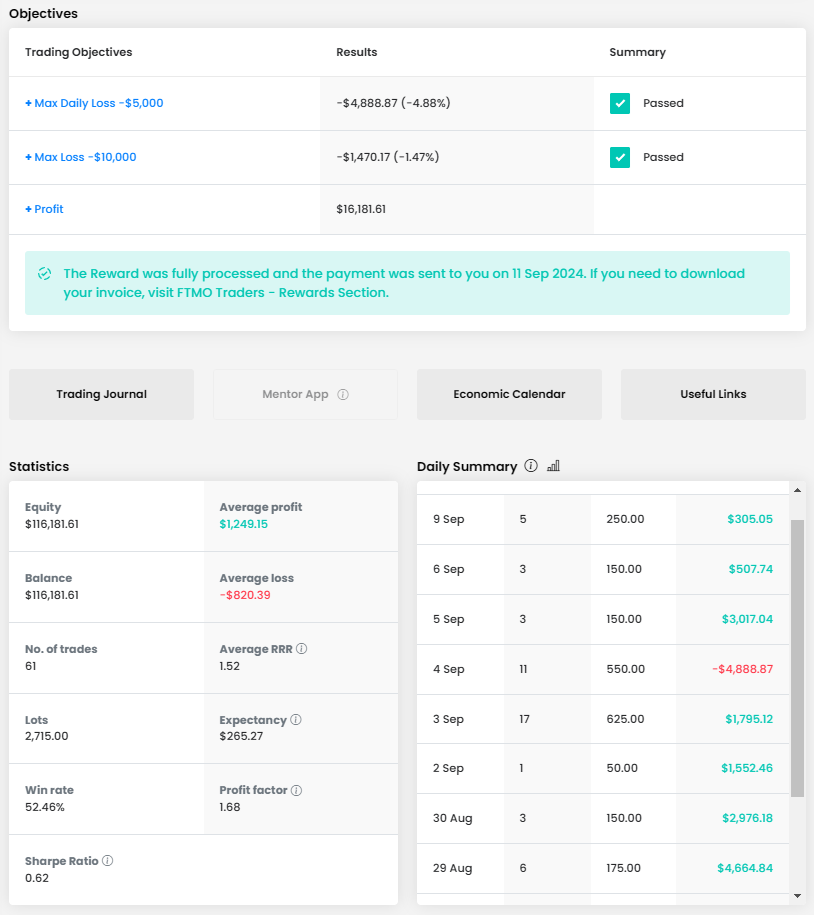

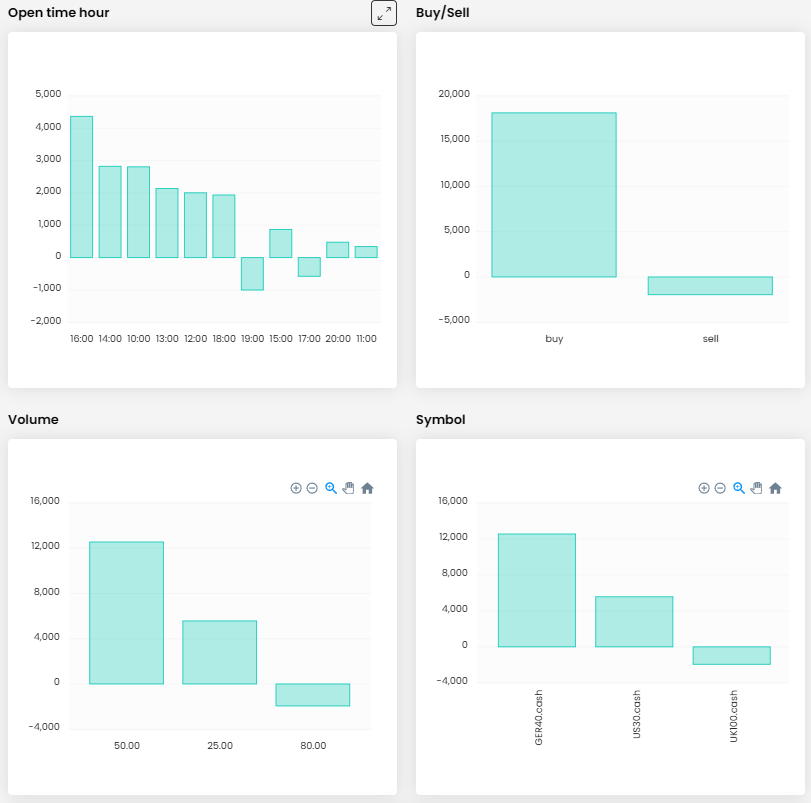

Once he was in danger of breaking the maximum daily loss rule (-4.88%), but in the end it was his only losing day, the other trading days ended in the green. During the eleven trading days, the trader executed 61 trades with a total size of 2,715 lots, which means an average of 44.5 lots per trade. For index instruments, this size is not such a big problem, especially when the trader adjusted the size of positions according to the instrument he was opening.

The average RRR per trade of 1.52 is not bad, and the win rate of around half of the trades (52.46%) is also average. Together, however, it makes for a combination that can yield interesting returns, as in this case.

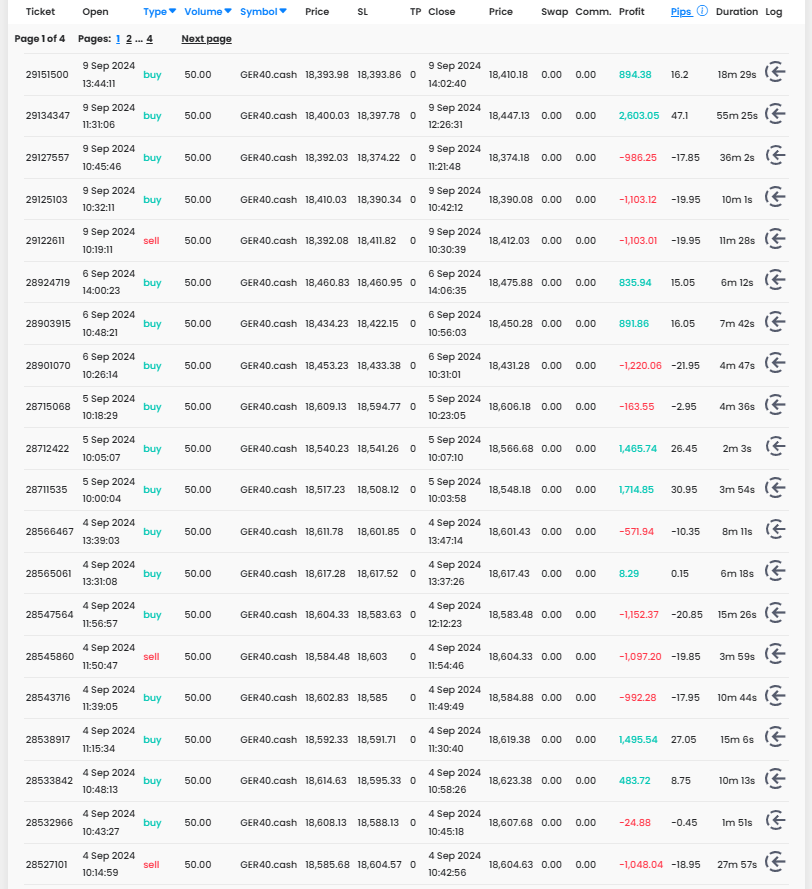

The log clearly shows that in this case it is a scalper holding his positions for a few minutes to a few tens of minutes. The trader has held his trades for more than an hour on only four occasions. We must commend the placing of Stop Loss orders on all trades, which is certainly reasonable in the case of such large positions, and without it, we would certainly not recommend trading in this style to anyone. The trader, due to his trading style, set Take Profits only in exceptional cases.

Interestingly, despite the fact that the trader did not trade in explicitly growth markets, the comparison of the success of long and short positions is clear. It would seem that the trader was still speculating on rising markets and therefore losing money after the trend reversal, but the opposite is true. Just the day after the biggest sell-off, the client started speculating on a decline in the DAX 40 index (GER40.cash), which unfortunately did not pay off, and this is one of the reasons why the trader's results in short positions are negative. Up to half of all short positions were executed by the trader at that time.

In addition to the German stock index (GER40.cash), the trader speculated on the movements of the most famous stock index DJIA (US30.cash) and tried the British index FTSE 100 (UK100.cash), but did not do well on it and all trades on this instrument ended in losses.

Finally, let's have a look at a few of the client's trades on his favourite instrument GER40.cash, which show how he was able to take advantage of the volatility in the markets regardless of whether the markets were rising or falling. In the first case, the trader was speculating on a decline after the price hit an all-time high from mid-May this year at the end of August. A bit of a risky trade, but the trader "hit" this high almost exactly.

Being a scalper, he didn't hold the position for too long and only used the local swing, which turned out to be a good idea, because that evening a new all-time high was finally made on GER40.cash. It was only his second short on this account, but a profit of $2,000 (which is 2% of the account). If the trader had set his stop loss just above said high, his RRR could have been around 3.5 to 4, which is very good.

After the market corrected after making the mentioned new high, it bounced off the newly formed support (which was local support a few days before). The trader took the opportunity to enter a long position and after the formation of a new higher low, executed another profitable trade, with a profit of over $2,100.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.