“There is no exact perfect trading strategy out there”

The perfect strategy or holy grail that beginner traders in particular want to find does not really exist in forex. We each have to find what suits our personality and our style. For some traders, this may be an uncomfortable discovery, but our new FTMO Traders Ndecham, Charlie, France Anne and Parag are certainly already clear on this.

Trader Ndecham: “Trade with the direction of the market.”

How did you eliminate the factor of luck in your trading?

Trade with the direction of the market (market structure) not against the market.

Has your psychology ever affected your trading plan?

Yes. But I learned that never move your stop loss thinking the market is going to come back and bounce back up.

Describe your best trade.

My best trade was with US30, it was the perfect set up like everything on my trading plan was right in place, so I took the trade, and it hit my TP.

What was the most difficult during your FTMO Challenge or Verification, and how did you overcome it?

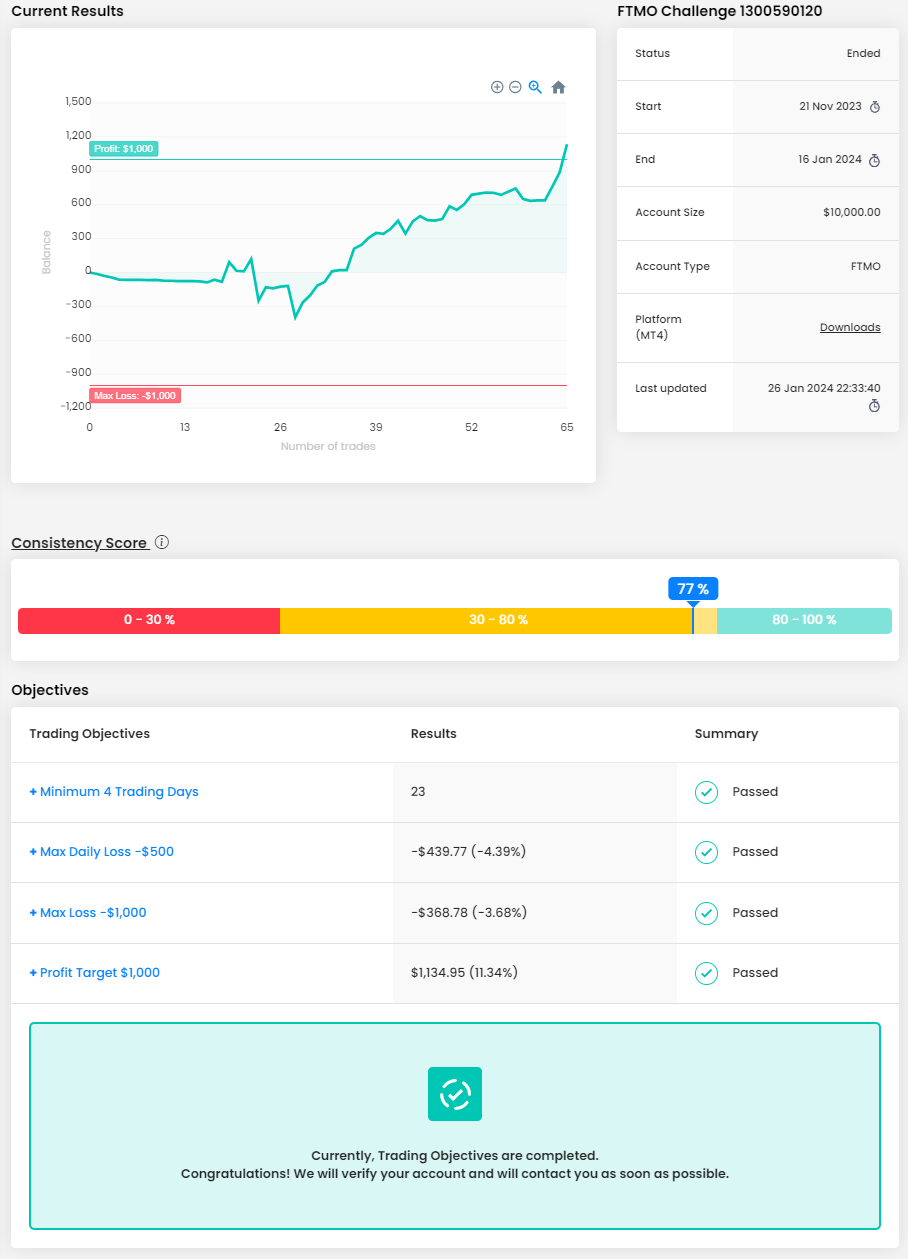

The most difficult about the challenges was the number of days you have to trade because I remember on my Verification stage, I took a trade the same day I took my account, and it was up $600, so I had to figure out a way to close the trade with less than $500 the first day. So, I took a trade against the market, took a lost, and it went down to $400. I then closed the trade and traded the remaining $100 in the next three days.

What inspires you to pursue trading?

I guess discipline because I used to have a friend, he was trading. He told me trading comes with discipline. If you’re not disciplined enough, I don’t think you can make it, so that’s what I really like about it.

What is the number one advice you would give to a new trader?

There is no exact perfect trading strategy out there. I used to watch hundreds of strategies on YouTube, and nothing worked. The only thing that’s gonna work for you is your own. You have to figure out what is going to work for you. There is no perfect strategy, you make your own strategy.

Trader Charlie: “Set realistic expectations of yourself at the start of journey”

What was more difficult than expected during your FTMO Challenge or Verification?

Verification definitely, I've been trying to pass for about a year and after finally finishing 3 trials over 2 months I really flew through the Challenge phase. But with getting to phase 2 for the first time, some nerves kicked in, and I almost slipped into an old bad habit.

What was the hardest obstacle on your trading journey?

Emotional stability. Meaning, once the trade is active my heart used to pound hard, and I would make emotional, irrational decisions from that state of mind only to later analyse the move and see what I should have done. Working hard on myself for a solid year, reading trading psychology books and listening to the right people has now finally allowed me to trade worry and stress-free. But it was a rocky journey.

How did you manage your emotions when you were in a losing trade?

Practise, practise, practise. For 2 years I didn't do it very well until I got an excellent mentor who not only taught me a brilliant strategy but also how to manage your trade and your emotions. So now if I ever feel nauseous, I work on breath, I listen to classical music and If I'm being honest smoke. All these things help me build a calming environment to trade emotionlessly.

What was easier than expected during the FTMO Challenge or Verification?

The first 10+ challenges felt impossible, going from drawdown to profit, never really getting anywhere. This time I didn’t start the Challenge until I passed 3 trials and that gave a solid confidence boost in my abilities. I can't say it was easy because it's 3 years work compressed into a couple of days of good results, but I traded with ease for sure.

What do you think is the key for long term success in trading?

Set realistic expectations of yourself at the start of the journey, or even if you’re a few years in. Allow yourself time to make mistakes and document these mistakes. Don't do what I and many other traders do and spend your last money on this dream to believe that "now I understand this, this is easy, I'm going to get rich". It will backfire and hurt a lot.

What is the number one advice you would give to a new trader?

Really take your time, use a low risk to start off, learn from everyone and most importantly from yourself. Another thing is to understand that your ego will try and trick you into thinking you understand the markets because you had a good win streak. The market is ruthless, and you never need to know what will happen next in order for you to make money. Backtest, backtest, backtest is a very underrated feature that needs to be leveraged more by traders, especially new ones, as it’s risk-free evidence of your start working or not.

Trader Frances Anne: “Discipline really is the key.”

How did you eliminate the factor of luck in your trading?

This time around, I really tried to stick to my system and only take trades if/when I get my trigger. This way, I keep it all objective.

Has your psychology ever affected your trading plan?

Yes, many times in the past. It really is the greatest struggle to master your mind above everything.

What was easier than expected during the FTMO Challenge or Verification?

To stick to the rules. It can be very intimidating but after learning so many lessons, discipline really is the key. If you have that and not over trade, not breaking the rules (especially the daily limits) is easy.

How would you rate your experience with FTMO?

The best! I only ever invested time and money here with FTMO because I know they are reliable. FTMO is leader of the pack.

What was more difficult than expected during your FTMO Challenge or Verification?

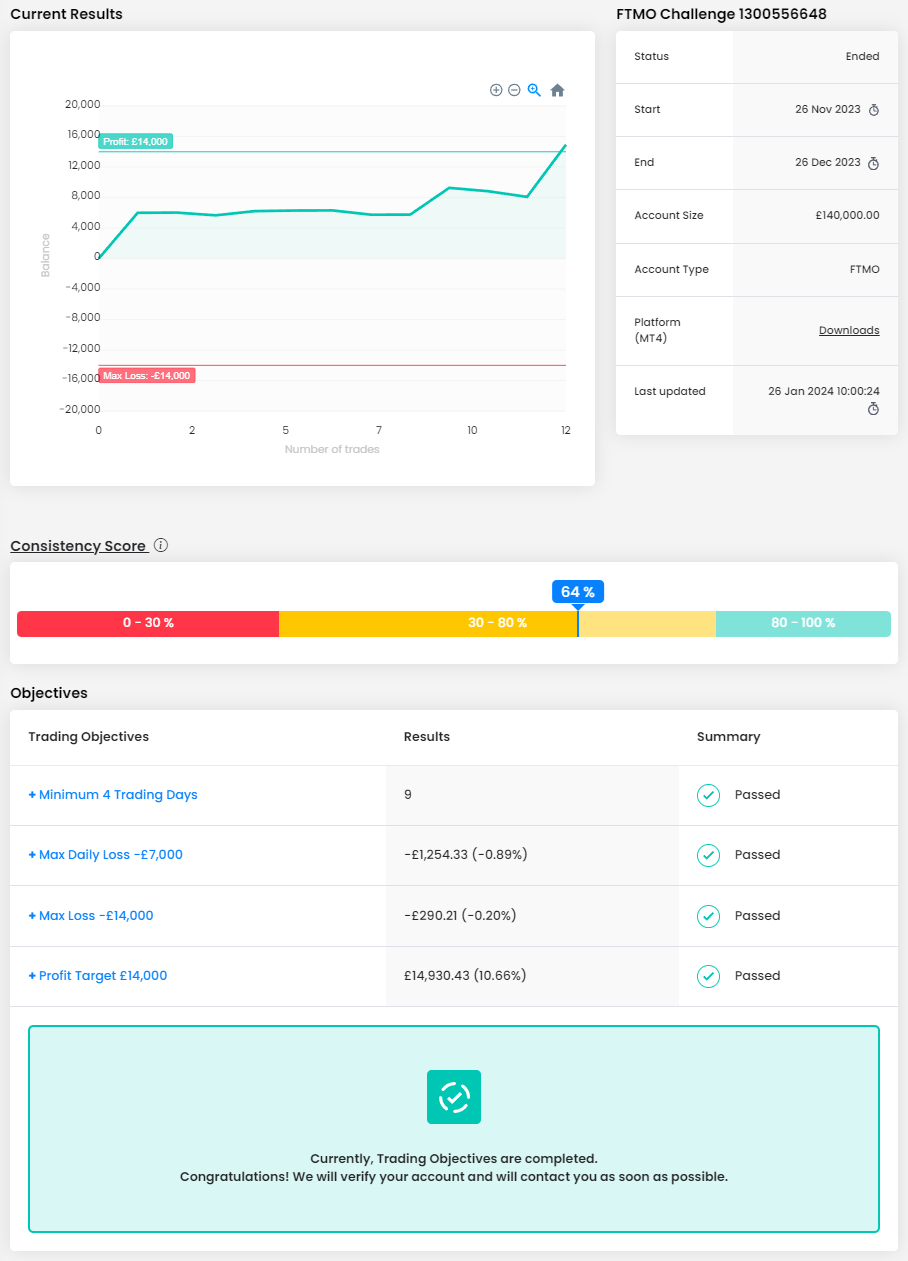

I wouldn't say difficult but especially in my Verification phase, I had one loss over £700 and after that, I have only taken trades based on my triggers/system religiously. Hence, took lesser trades. Every system isn’t perfect, and it doesn’t always work, as the market will do what it wants to do. So, for following trades after the +£700 loss, I would realise that my trade was not ideal or was wrong and therefore would abort - I exit at breakeven or in whatever little green I can muster. This meant that my wins following the loss were less than the first initial loss. It affected my RRR negatively, even though the win rate looked great. This was on oversight from my end. Although I ended up in profit, I have to be careful in the long run as ideally, RRR and win rate along with profit factor should ideally always reflect profitability.

What is the number one advice you would give to a new trader?

Discipline. Do not FOMO. Follow your system religiously.

Trader Parag: “Entry and exit criteria should be clear cut”

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes.

What was the hardest obstacle on your trading journey?

Risk management. Once we identify an entry trigger based on one of the various tested strategies, managing the risk is crucial and that is where, back testing, forward testing, years of experience watching and trading the strategies comes in handy.

What do you think is the most important characteristic/attribute to become a profitable trader?

Keep things simple and do not over-complicate the charts and decision-making process. Entry and exit criteria should be clear cut. Discipline to be consistent and sticking to the plan and exit when relevant is really important, whether it is profit taking or a stop loss exit.

What inspires you to pursue trading?

Ability to control my day, my time and be able to work from anywhere.

Describe your best trade.

My best trades are the ones where I had a high-level game plan ready by carefully understanding the context of the overall market and the particular instrument, I'm trading. Then I enter the trade where I expect a minimum 1:3 return, which means my Stop Loss is very low vs my expected return and in case I have to take the Stop Loss, I don't lose much.

What would you like to say to other traders that are attempting the FTMO Challenge?

Be a clean trader and know your game. Start from the basics, understand your "why". Practice (backtest and forward test) and have a set of strategies ready for execution on a few trading symbols. Know how those symbols behave during various different times and how their margin and risk calculations work for each lot.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.