“When things aren’t going your way, accept it and make adjustments”

Things don't always go our way. In Forex, such periods sometimes occur more often than we would like, but that is something every trader has to deal with. You can read about how our new FTMO Traders Abdullah, Daniël, Martha and Kwong Cheung handled such situations in our next article.

Trader Abdullah: “If you notice anything unusual in your trading style, I recommend you do a top-down analysis or everything regarding it.”

Describe your best trade.

The best trade I have ever had so far was my last trade on the Verification account. Once I was able to identify the opportunity (US100), I got in and loaded the trade up, and exited a few minutes later because the market did a double tap (1:1.5 RRR). Once the market created a new high, I jumped in again and this time with bigger lots and a calculated Stop Loss, and managed to close on a 1:3.75 RRR. I closed it because I thought the market will dip due to it slowing down in momentum, but the moment the market gained momentum again I hopped in a third time and loaded up all the way until I hit the target (1:5.5 RRR)

How did you manage your emotions when you were in a losing trade?

I usually distracted myself with playing chess or continuing to read a book until the Stop Loss was hit. Monitoring the trade would not be a bad option but you are more prone to moving your Stop Loss if you do so.

How did you eliminate the factor of luck in your trading?

By setting up a gameplan and knowing where and when to enter, and where the market trend is headed overall. I followed the basic price action to identify my opportunities luck-free.

What does your risk management plan look like?

Risk per trade is around 0.3% to 0.9% and on rare occasions 1%. Once the trade gets profitable I would stack another one if the market continues in the desired action with the same amount of risk, but this time I would be at break-even if it fails because the first trade's Stop Loss is now at breakeven and the new trade's Stop Loss is with it.

What do you think is the key for long-term success in trading?

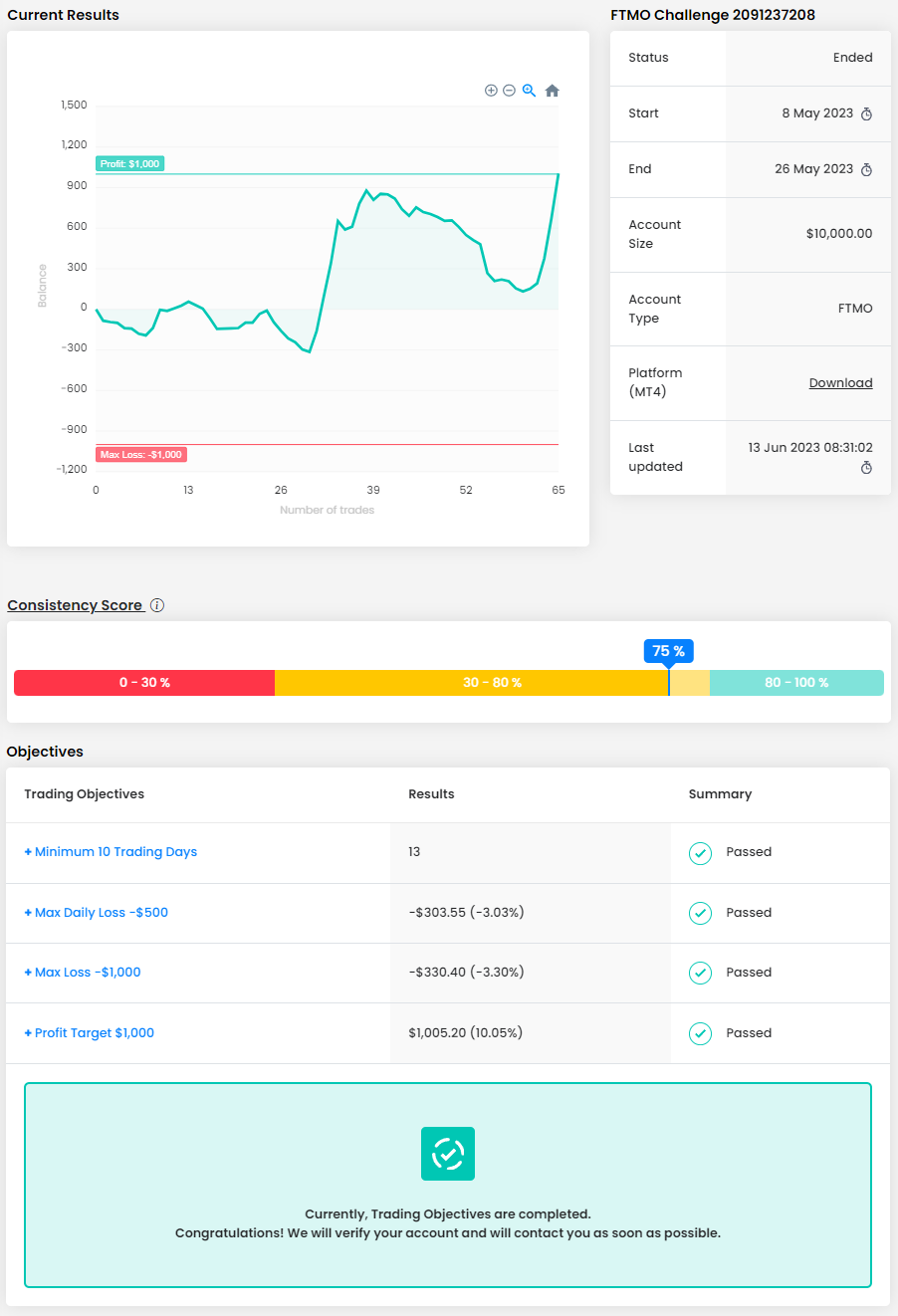

Discipline and self-control, identifying areas for improvement in your trades, and having an eye that can see the overall market direction ASAP. My first FTMO Challenge failed so hard because I did not realize how long my trades took (which was around two weeks for just one trade with 1% risk and 1:1.5 RRR and a TERRIBLE win rate). So basically, if you notice anything unusual in your trading style, I recommend you do a top-down analysis of everything regarding it.

One piece of advice for people starting an FTMO Challenge now.

Just know that if you work extremely hard at whatever you got going on and you stick to it, your whole life will change. It does not take a lot of effort to make it to the top but rather discipline is what it takes. Stay blessed and Goodluck to y’all.

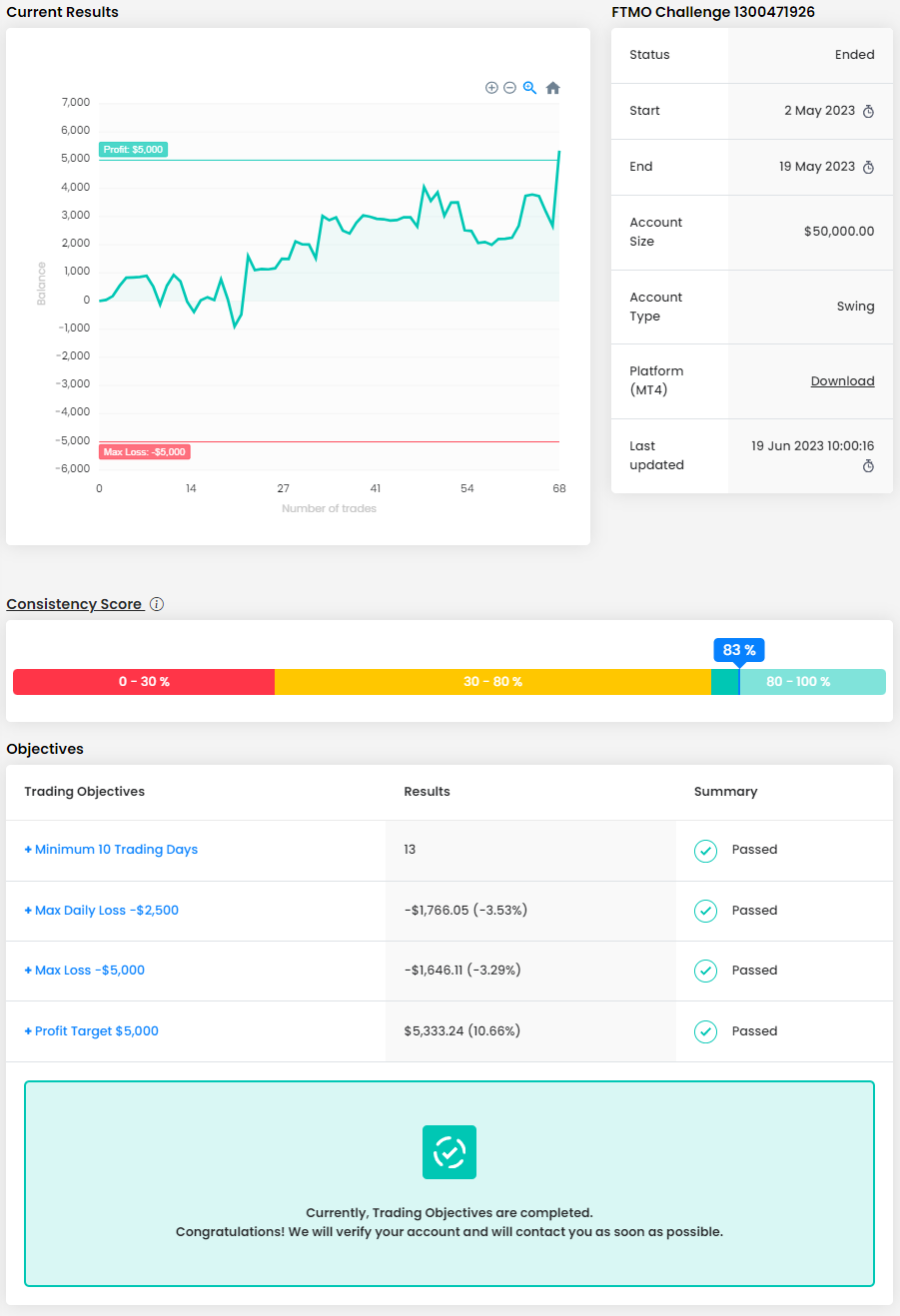

Trader Martha: “I know how important it is to be consistent.”

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

I am relatively new to trading. I started learning about trading last year at the end of July, so the psychology of trading is very complex, controlling your emotions, I think, is the hardest part, I burned my first FTMO Challenge account because of this. But I learned from this and opened a second one which is the one I just passed.

How did passing the FTMO Challenge and Verification change your life?

It will give me freedom in terms of time and, financially speaking, if I maintain the account with consistency and grow the account.

Describe your best trade.

My last trade was supposed to hit TP at a fractal, but I would need another trade to pass the second phase since I would be missing $15, so I decided to let the trade go (since the previous fractal went above $25) and try to hit it or loss part of the profit. So, the trade hit the profit that I needed and I liked this trade because it was giving me all the win conditions and I made the choice that paid off but if the trade didn't reach the target and go back and hit the SL I would also be fine with that.

Do you have a trading plan in place, and do you follow it strictly?

Yes! I have a strategy for entry management, exit management, and account management. I know how important it is to be consistent and to do this you need to follow a plan.

Has your psychology ever affected your trading plan?

Sure, I burned the first account I opened with FTMO.

What would you like to say to other traders that are attempting an FTMO Challenge?

Believe in yourself, follow your strategy, and focus especially on the management part.

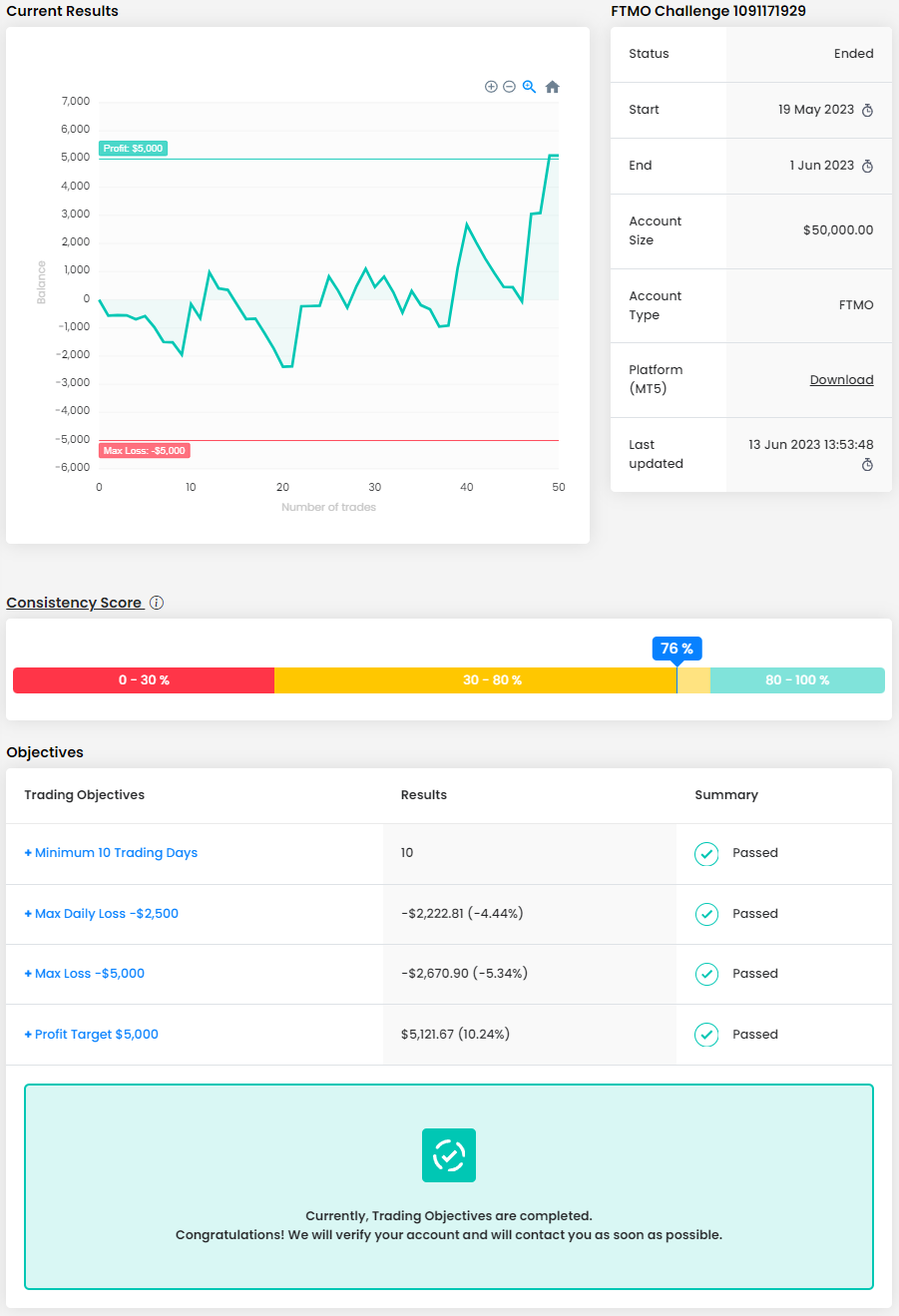

Trader Daniël: “Time and practice were the only factors needed to overcome the obstacle of becoming a consistently profitable trader.”

Where have you learned about FTMO?

Through YouTube.

Describe your best trade.

My best trade was a 1:10 trade on USOIL. I waited for the price to reach a certain point on which I had all statistical probability confluence together with my trading strategy. I went in for a buy and it skyrocketed (this wasn't a news event). I kept trailing my Stop Loss and when I was confident that the max extension had been reached, I closed the trade.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

Most difficult was to keep to my trading strategy. In the past, I began trading with less than 1% risk whenever I was in a drawdown. Also, my win rate was lower than 40% at the time. It caused my results to diminish slowly until the point of reaching Max Loss. Also, not overtrading was really hard, keeping your Max Daily Loss at a 2% maximum. So, in short, being disciplined and not giving in to emotion was and is the most difficult.

What was the hardest obstacle on your trading journey?

To finally keep my calm and stick to my trading strategy. I can't really turn off my emotion, but I can handle it differently. I think that was the hardest thing to do.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I do. I follow a combination of statistical strategies taught at DR Academy and my own mix of price action and support & resistance.

What would you like to say to other traders that are attempting an FTMO Challenge?

Simply don't give up. When you have obtained an edge and you understand your technique, it mostly is a mind game. For me, time and practice were the only factors needed to overcome the obstacle of becoming a consistently profitable trader.

Trader Kwong Cheung: “Adjusting lot size makes you feel better even if you lose the trade.”

What does your risk management plan look like?

Adjusting the lot size according to trades that I’m entering. Sometimes you could doubt yourself, and it causes anxiety. Adjusting lot size makes you feel better even if you lose the trade, as there is less mental burden.

What do you think is the key to long-term success in trading?

Be sure what you’re about to do is evidence-based. On the other side, FOMO could cause you to enter a trade you weren’t supposed to. Psychology is key, and you have to remind yourself what kind of situation you’re in and stay alert.

What do you think is the most important characteristic/attribute required to become a profitable trader?

Tough mentality, I’ll say. Be flexible. Be like water. When things aren’t going your way, accept it and make adjustments. Sometimes people are too mindful of “I must at least get xx% in a trade”, and most of the time the results are not what they want.

How did you manage your emotions when you were in a losing trade?

Chill. I’ve set a certain amount that I’ll be willing to risk, so if things turn out that way, I’ll accept, although it’s painful sometimes. Every day is an opportunity, so no rush, gather yourself the next day, not the next trade. In that way, you could get a refreshed mentality.

Describe your best trade.

News trade. Some news gives a huge amount of volume, and prior to the news release, I’ve done my work and research. Just accept what the market gives you, and your work is done beforehand.

One piece of advice for people starting an FTMO Challenge now.

Don’t get hot-headed. If you lose a trade, evaluate your emotion. If you feel pain, stop trading for the day and back on it the next day. Every day is an opportunity, just relax. There is no rush.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.