Lucros Sólidos Apesar de uma Baixa Taxa de Sucesso: A Paciência Compensa

In the next part of our Successful Trader Stories, we take a look at a trader who proved that you don’t need a high win rate to achieve strong results. What made the difference was his outstanding Reward-to-Risk Ratio of 3.44 and his ability to stay calm during losing streaks. This approach isn’t for everyone though. It requires nerves of steel and the patience to let winners run while cutting losses effectively.

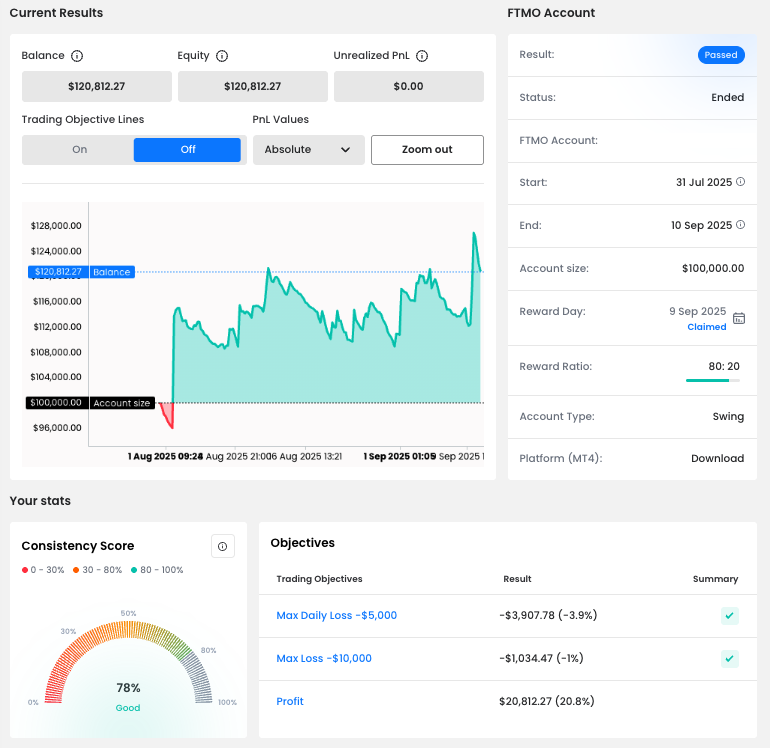

A Balance Curve With Steady Resilience

The equity curve tells the story of determination. Starting with a $100,000 FTMO Account, the trader grew his balance to $120,812.27, achieving a 20.8% profit in just over a month. The path wasn’t smooth: after early gains came several pullbacks, but he managed to recover and finish the cycle strongly in profit.

This performance highlights his discipline – no reckless revenge trading, just consistent execution of his plan.

Numbers That Prove the Edge

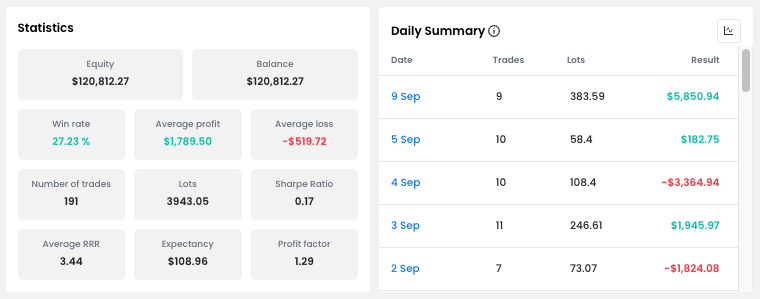

At first glance, his Win Rate of just 27.23% may look discouraging. But the power of his system lay elsewhere. His average winning trade brought nearly $1,800, while his average loss was contained to about $520. That’s more than a 3:1 reward-to-risk ratio, which gave him the edge needed to stay profitable despite frequent small losses.

The result? A profit factor of 1.29 and proof that trading success doesn’t require being right most of the time – it requires making more on your winners than you give back on your losers.

A Nerve-Testing Day: 6 August

The most difficult moment came on 6 August, when the trader experienced a Daily Loss of –$3,907.78 and strung together nine losing trades in a row.

For many traders, this would be the point where emotions take over and the account spirals out of control. But here, discipline made the difference. He respected his Max Daily Loss, stopped trading before breaking limits, and returned the next days with renewed focus.

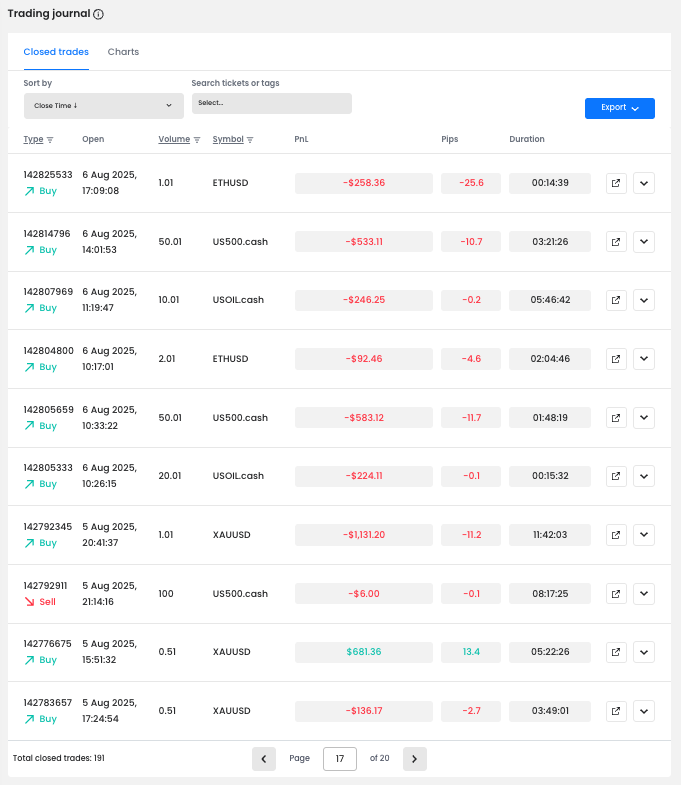

Focused but Flexible Approach to Instruments

Looking deeper into his trading activity, we can see a diverse mix of instruments: gold (XAUUSD), indices like US500.cash, and even cryptocurrencies such as ETHUSD and XRPUSD. Despite this variety, one thing stands out – the trader remained consistent in his approach.

While he occasionally took short trades, the clear majority of his positions were longs. This shows he was confident in reading bullish momentum, yet he still demonstrated flexibility when market conditions called for it. Always with risk control in mind.

Case Study: A Golden Patience Play

Among all his trades, one stands out clearly: a long position on gold (XAUUSD) opened on 5 September and held for over four days.

In this trade, the setup was clean: gold was trending higher, and he positioned himself early, with a clearly defined Stop Loss in place. Instead of taking quick profits, he showed patience and trusted the move. The market eventually rallied strongly, and he closed the trade with an impressive $8,922.34 profit – his single best trade of the cycle.

What adds some context: during that period, gold was repeatedly reaching new all-time highs. For example, on 9 September 2025, it surged to a record high of $3,673.95 per ounce, driven by expectations of U.S. rate cuts and geopolitical uncertainty.

This trade highlights the combination of risk control, technical awareness, and patience that defined his success. It wasn’t about catching every move, but about being positioned correctly when the big opportunity arrived.

Conclusion

While his Win Rate was below 30%, the trader’s disciplined use of reward-to-risk dynamics and mental resilience allowed him to turn a difficult stretch into a strong payout. Holding steady through a string of nine losses and bouncing back with patience shows what separates serious traders from the rest.

It once again proves that patience and respect for risk limits are the true keys to long-term success.

Nota: Uma vez que não podemos definir claramente a estratégia exacta do trader a partir do gráfico, esta é apenas a opinião privada do autor deste artigo. Os FTMO Traders são livres de escolher a sua estratégia e, desde que não violem explicitamente os nossos Termos e Condições e sigam as nossas regras de gestão de risco, a escolha da estratégia e a execução de posições individuais são da sua responsabilidade.

Sobre FTMO

A FTMO desenvolveu um processo de avaliação de duas etapas para encontrar talentos de trading. Após concluir com sucesso, pode obter uma FTMO Account com um saldo inicial de até $200,000. Como funciona?