Economic Calendar - Consumer confidence tells a lot about the economy

Consumer confidence and sentiment data are not based on hard and accurate figures. Nevertherless, they can provide economists and investors with very valuable insights into the state of an economy.

GDP, inflation, or labour market figures give economists a clear picture of the state of a country's or region's economy at a glance. However, they often come out with a large lag or are subject to significant revisions.

People's opinions as a guide for future development

The data on consumer and household sentiment, on the other hand, do not represent exact figures as they are based on a survey of the population. For economists, however, they are a very interesting indicator of how consumer behaviour may evolve and change in the future. When people's incomes rise at relatively stable prices, they can afford to spend more and their confidence in a "better tomorrow" grows. On the contrary, in times of crisis, high inflation, and unemployment, consumer confidence in the economy tends to decline. And since, for example, in the US, household consumption accounts for up to 70% of the country's GDP, it is a very important indicator of the direction the economy will take.

CB Consumer Confidence Index

One of the most closely watched data on consumer sentiment is the US Consumer Confidence Index (CCI) published by the Conference Board. This is a non-profit organisation that was founded in 1916 in New York (called the National Industrial Conference Board, NICB) against the backdrop of the economic situation that was poor at that time, several tragic events, and growing tensions between large companies and employees. The organisation, whose original aim was to ease tensions between employers and their employees, now comprises more than 1 000 public and private companies and operates in 60 countries.

As part of the data collection for the index, the company is surveying 3,000 households of different age and income groups every month (by mail until May 2021, currently online). The survey consists of 50 questions covering five areas, namely current business conditions, business conditions for the next 6 months, current employment conditions, employment conditions for the next 6 months, and total family income for the next 6 months.

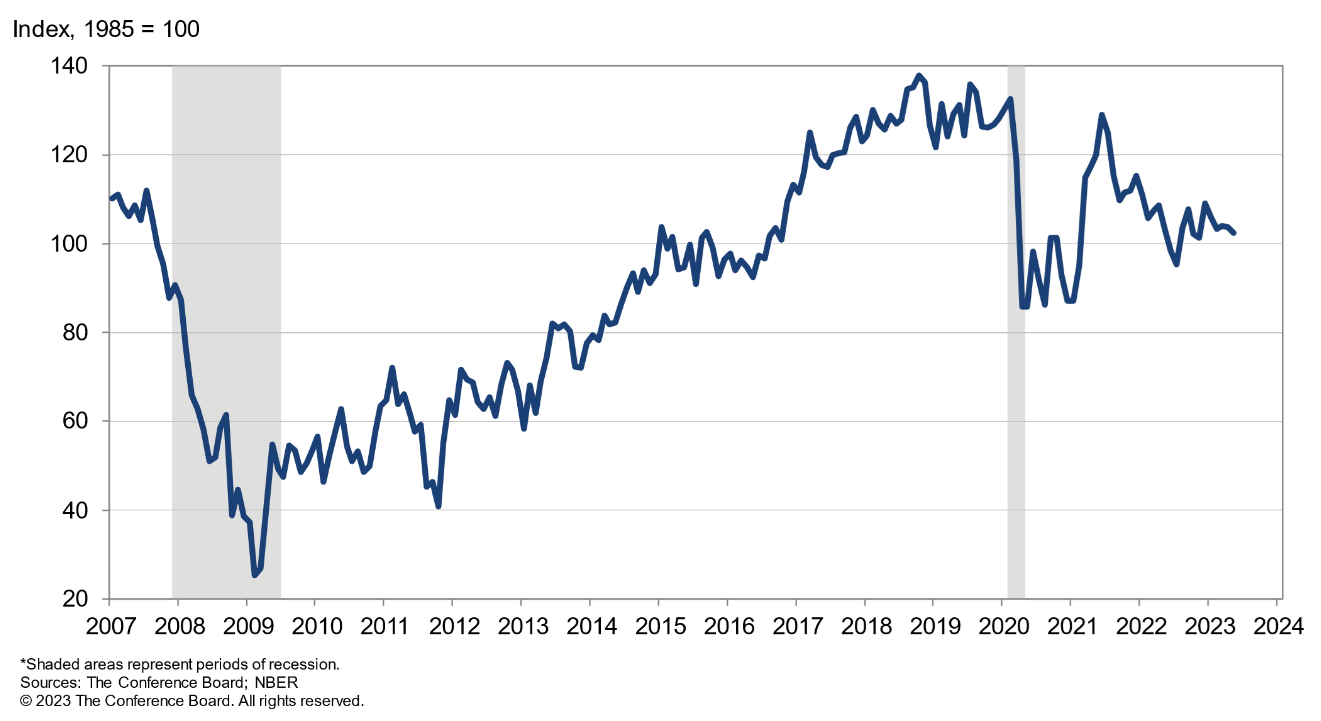

The index is published on the last Tuesday of the month and shows how consumers perceive the current situation and what their plans are for the future. A comparison of current and past values can thus give companies and institutions a picture of how consumer confidence is changing and what trends to expect in the economy. Generally, a value above 100 is interpreted as optimism, and a value below 100 as growing pessimism among consumers. During the recession of 2008-2009, the index reached historic lows of around 25 points, whereas before 2000 the index had reached a high of around 140 points.

University of Michigan Consumer Sentiment Index

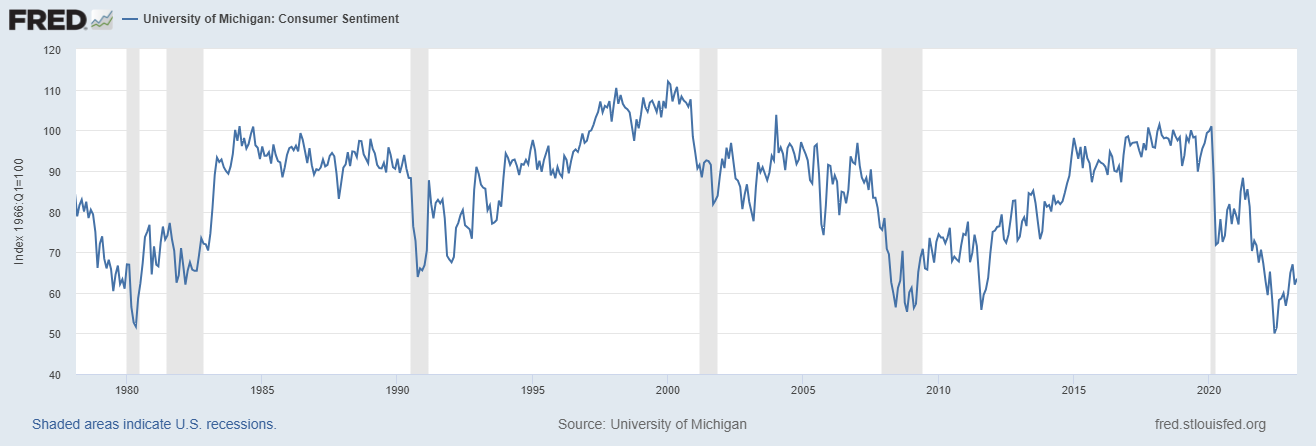

Another index tracking consumer sentiment in the US is the University of Michigan Consumer Sentiment Index (UMCSI). Just like the CCI, this index is survey-based, in this case it is based on a telephone survey. It is conducted by the University of Michigan and consists of approximately 50 questions. It covers seven areas, three of which relate to current conditions (economic situation, personal finances, and durable goods buying conditions) and four of which relate to expectations (economic situation, personal finance expectations, economic conditions in 1 year, and economic conditions in 5 years).

Unlike the CCI, the UMCSI is published twice a month, with a preliminary figure published on the second Friday of the month and the final index value published on the fourth Friday of the month. In the preliminary survey, 420 subjects are interviewed and in the final survey, 600 subjects are interviewed. The CCI is then subject to revisions, unlike the UMSCI.

Although both indices relate to the household sentiment, the results may differ. The UMSCI addresses a smaller number of respondents but has more specific questions. In addition, both surveys are conducted at different times of the month, so any short-term significant movements in the markets may lead to slightly different results.

In addition to the widely recognised and monitored consumer confidence indices mentioned above, there are several of other indicators of consumer and household sentiment published by individual countries. In Europe, the GfK indices on household economic sentiment in Germany and the UK are relatively well known.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.