From a Bad Start to 40% Profit: Discipline Flipped the Script

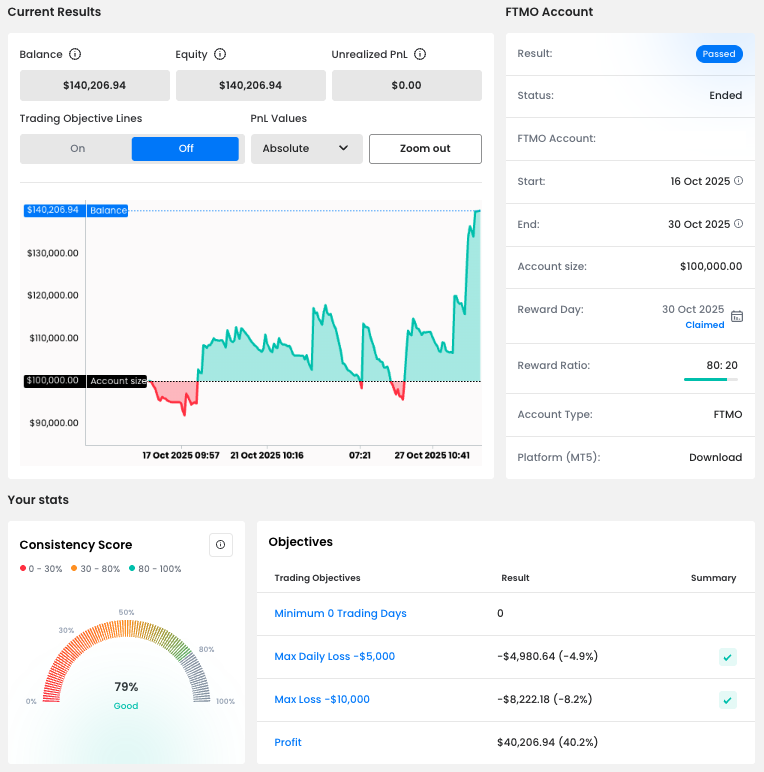

In this edition of Successful Trader Stories, we spotlight a trader who started cold – losing 19 of the first 20 trades – yet never broke the FTMO Trading Objectives. Fourteen days later, he closed at $140,206.94 on a $100,000 FTMO Account for a +40.2% result, powered by tight risk control, solid RRR, and decisive execution on gold.

Early Turbulence, Then Lift-Off

The Balance curve shows a choppy first stretch below the entry line before momentum flipped hard to the upside into the final sessions, ending near the highs at $140,206.94 with a Consistency Score of 79%. He respected Max Daily Loss ($5,000) and Max Loss ($10,000) throughout, which kept him in the game long enough for the recovery to play out.

When RRR Does the Heavy Lifting

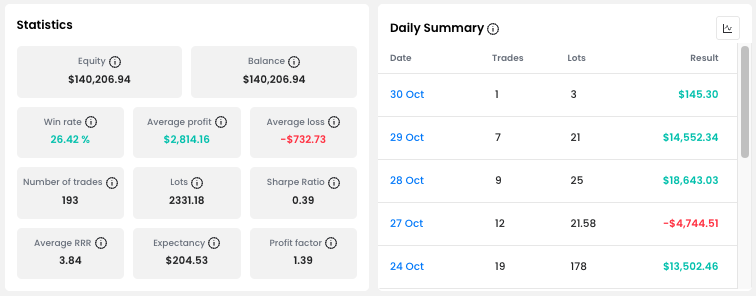

He traded intensively yet with structure, executing 193 trades over just two weeks.

A Win rate of 26.42% means roughly one in four trades closed green. But the Average RRR of 3.84 and Profit factor 1.39 tell the real story. Average winners of $2,814.16 outpaced average losses of –$732.73 by nearly 4×, so the math favored patience and strict exits more than “being right” often.

Reading Two Markets, Executing One Plan

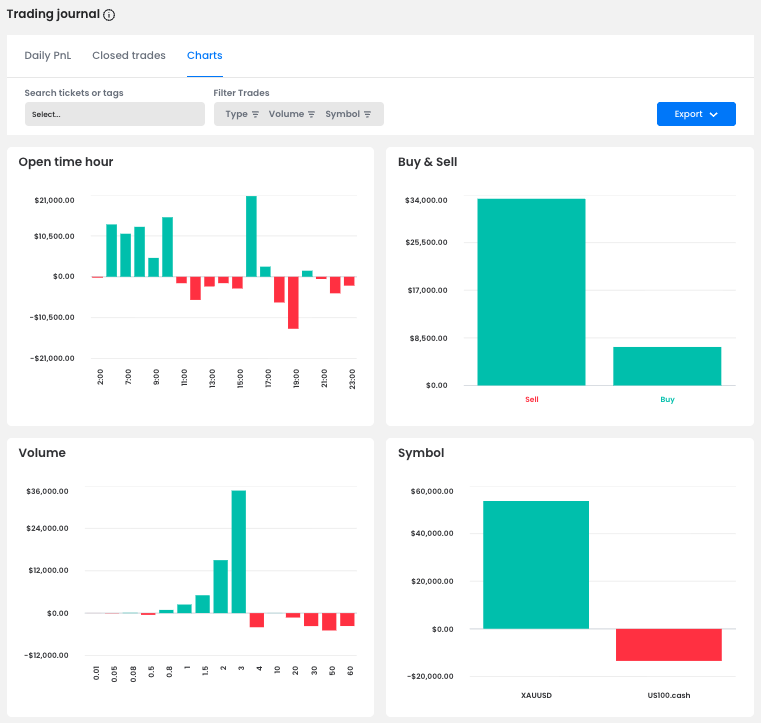

The trader concentrated mainly on XAUUSD (Gold) and US100.cash (NASDAQ-100) – two distinct markets that require different strategies and timing. Although his overall bias leaned toward short positions, his most profitable trade came from a long on XAUUSD, demonstrating the flexibility to adapt when market momentum shifted. (We’ll take a closer look at that trade in the next section.)

The Open time hour data also shows how he capitalized on morning and late-afternoon volatility – the periods when gold typically sees its most dynamic movements and offers the best opportunities for precise entries and exits.

Case Study: 9-Hour Gold Long Nets $15,201.74

On 23 October, he bought XAUUSD (3 lots) and held ~9 hours (09:04:32) for $15,201.74. The structure: early push higher, a mid-session reset, then a second up-leg that delivered the bulk of the move. He used a clearly placed Stop Loss and managed it actively. Notably, the exit came just under the Take Profit, locking gains before momentum faded — a prudent read, as price began to stall and rotate afterward.

Conclusion

This two-week run is a clean example of process over outcome. He traded 193 times, won only ~26%, yet turned a $100,000 FTMO Account into $140,206.94 (+40.2%) by keeping losses capped, pressing high-quality upside, and staying adaptable (short bias overall, but taking the gold long when it mattered). Respecting FTMO Trading Objectives made the comeback possible; RRR and timing made it profitable.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.